The safety of family members is one of the most common concerns all drivers have before hitting the road. Before you ever fasten your child’s seatbelt, it’s important to know just how far your coverage extends.

Fortunately a Florida independent insurance agent can help you find the right car insurance for you and help you review the details of your specific policy. They’ll make sure you’re covered before you ever need to file a claim. But before we jump too far ahead, here’s a deep dive into car insurance.

Is My Child Covered under My Car Insurance?

According to insurance expert Jeffery Green, if you live in a no-fault state, your child is protected under your standard Florida car insurance policy even if you cause an accident. However, if you don’t live in a no-fault state, you’d need medical payments coverage to protect your child in the event of an accident. A Florida independent insurance agent can help you determine for sure if your child is covered under your policy.

Do I Need Full Auto Coverage to Protect My Child?

“Full coverage” is actually not a standard industry term. Often, when people request full coverage auto insurance, what they really want is a combination of liability insurance and comprehensive auto insurance, which protects you against disasters like theft, windshield breakage, collisions with large animals, and more. So no, you shouldn’t need full coverage to protect your child under your car insurance.

Does My Car Insurance Cover an Injured Child in Another Vehicle?

If you’re insured with at least the basic auto insurance required, such as bodily injury liability coverage, then yes, your policy should pay for medical treatments to passengers in another vehicle. If you were to cause an accident with another car that had a child in the back seat who got injured, the bodily injury liability portion of your standard auto insurance would kick in. It’s crucial to always drive with at least bodily injury liability and property damage liability protection.

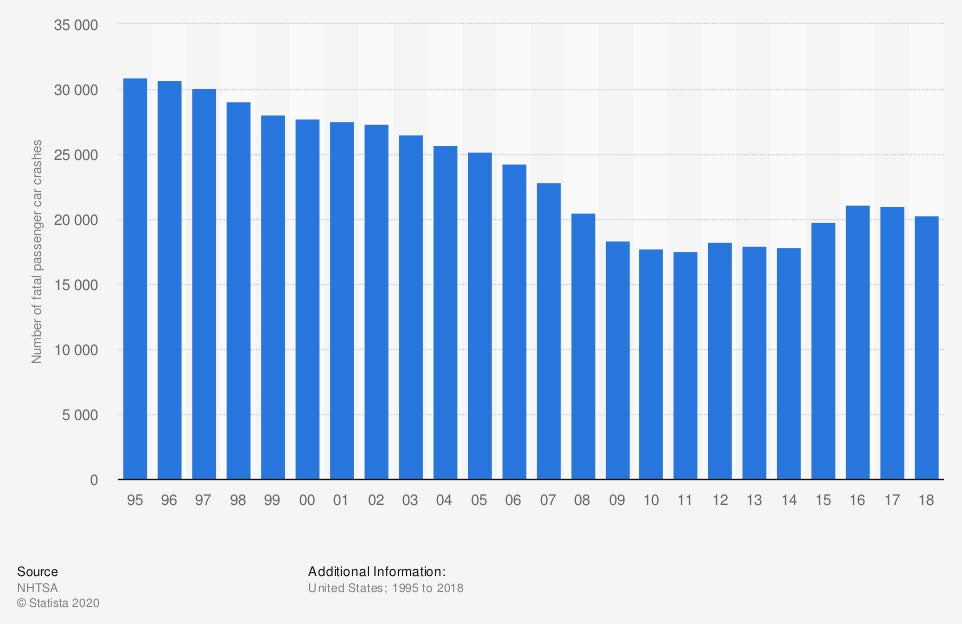

Fatal Crash Stats for the US

Though you’d like to think you’ll never have to actually use your car insurance, disasters like fatal crashes may occur more often than expected. Check out some stats below to see the true importance of having enough car insurance.

Number of passenger cars involved in fatal crashes in the United States

Nearly 31,000 fatal accidents were reported in one year in the mid-90s. Fortunately this number has fallen dramatically only a couple decades later. The number of reported fatal accidents fell by nearly a third, to 20,333 total, in recent years.

While fatal passenger accidents are declining overall in the US, they’re still a pretty common occurrence, and it’s still absolutely critical to be equipped with the proper protection just in case.

What If I Have Multiple Children in My Vehicle?

If you have medical payments or personal injury protection coverage under your auto insurance, all of your passengers should be protected in case of an accident, regardless of who was actually at fault. So, no matter how many kids you’ve got in the back seat, they’d be protected. Make sure to ask your Florida independent insurance agent about adding crucial medical payments or personal injury protection coverage to your Florida auto insurance.

What If My Child Gets Critically Injured?

To protect your child against potential critical injury, it’s important to double-check your existing coverage. Your personal health insurance policy might cover your child after a severe auto accident, but you can also use the medical payments or personal injury protection portion of your auto insurance.

If your child gets critically injured, depending on where you live, your health insurance might begin to reimburse for the medical treatments before your auto insurance does. Your Florida independent insurance agent can provide you with more information about which specific policy would cover you in this case.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in car insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

graph - https://www.statista.com/statistics/191530/fatal-passenger-car-crashes-in-the-us/

https://www.iii.org/article/homeowners-insurance-basics

https://www.iii.org/article/auto-insurance-basics-understanding-your-coverage

© 2024, Consumer Agent Portal, LLC. All rights reserved.