Twenty-five percent of flood claims come from low to moderate-risk areas, which means that most Florida homeowners can benefit from flood insurance.

Whether you're in a low, medium, or high-risk flood area, a Florida independent insurance agent can help you find flood insurance. Here's how to determine whether you need this coverage.

Is Flood Insurance Required in Florida?

If your home is located in a high-risk flood zone and your mortgage is from a federally regulated bank, then you are required to have flood insurance for your home in Florida.

If you own your home outright, then you are not required to purchase flood insurance. However, it is still recommended because of the risks to Florida homeowners.

4 reasons you should consider flood insurance in Florida

- Florida holds one-third of all policies nationwide through the National Flood Insurance Program (NFIP)

- More than $974 million in premiums have been paid by Florida policyholders

- Florida has received $3.6 billion in payouts over the years

- 1 in 4 properties facing major flood risk in the US are located in Florida

Do Florida Business Owners Need Flood Insurance?

Most Florida businesses can benefit from purchasing flood insurance because commercial property insurance will not cover any damage from flooding.

Considering that flooding is one of the most common hazards in Florida, business owners should consider this important coverage.

Fortunately, a Florida independent insurance agent will know the risks of flood damage that your business faces. They can look up whether you're in a flood zone and help you purchase flood insurance from the National Flood Insurance Program (NFIP).

What Are the Top Flood Zones in Florida?

With its coastal cities and abundance of flat terrain, Florida is full of areas at high risk of flooding.

Top 4 cities at risk of property flooding in Florida

- Cape Coral: 90,000 properties

- Tampa: 43,000 properties

- Jacksonville: 29,000 properties

- Lehigh Acres: 26,000 properties

The easiest way to see if you're in a flood zone is to use the Flood Map Service provided by FEMA. Through this tool, you can enter your home or business address and see if you're located in a flood zone.

Do Homeowners Need Flood Insurance in Florida?

Yes, some homeowners will be required to have this insurance in order to have a mortgage. Whether it's required or not, most homeowners need flood insurance because flood damage is not covered in a typical Florida homeowners insurance policy.

Flooding can occur from more than a tropical storm as well. Hurricanes, broken levees, outdated or clogged drainage systems, and rapid accumulation of rainfall can all be causes of flooding.

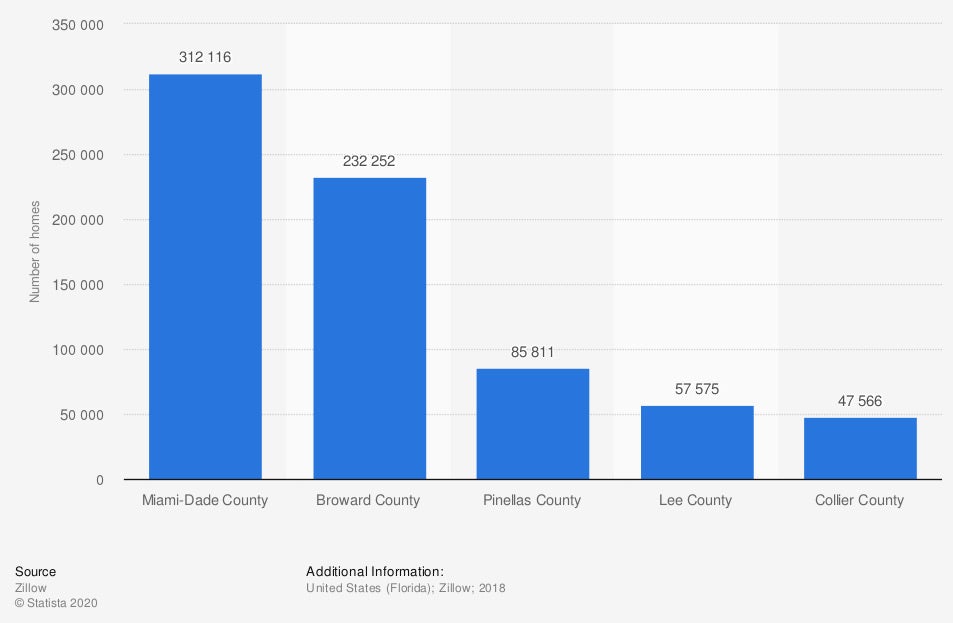

Number of homes at risk of annual coastal flooding in Florida, by county

Hundreds of thousands of homes are at risk of flooding across the state of Florida.

What If a Florida Homeowner or Business Doesn't Have Flood Insurance?

Should a flood event impact your home or business and you do not have insurance, you'll be required to pay for all damage out of pocket.

Fortunately, flood insurance can be purchased at any time of year, but that doesn't mean you can wait until the last minute to purchase it.

"If a hurricane is expected to hit the state in a few days and you try to purchase flood insurance, it'll be denied," explained insurance expert Paul Martin. "Typically your policy has to be in place 30 days before it can be used for a claim."

It's best to have an insurance plan in place long before an event occurs so you don't run the risk of not being protected.

How a Florida Independent Insurance Agent Can Help You

Florida residents and business owners are at risk of flood damage to their properties every year. A Florida independent insurance agent can find you the protection that you need in the event of a catastrophic weather pattern.

Independent insurance agents will talk to you, free of charge, about your insurance needs. In addition, they are familiar with purchasing policies through the National Flood Insurance Program. They'll do the hard work for you and will even provide guidance should you need to file a claim.

Author | Sara East

Article Reviewed by | Paul Martin

https://msc.fema.gov/portal/home

https://www.flooddefenders.org/news/florida-city-tops-list-of-riskiest-flood-neighborhoods

https://www.iii.org/fact-statistic/facts-statistics-flood-insurance

https://www.fl-counties.com/national-flood-insurance-program-nfip

https://www.tampabay.com/hurricane/2021/03/14/study-finds-that-floridans-are-underpaying-for-flood-insurance/

© 2024, Consumer Agent Portal, LLC. All rights reserved.