Florida homes are at risk of smoke and fire damage from wildfires and residential fires. Thirty-two percent of home losses are related to fire and lightning, so you need a Florida homeowners insurance policy that has adequate protection.

Depending on the location of your home, some Florida residents will need a more robust homeowners policy than others. That's why it's best to work with a Florida independent insurance agent who knows the state's landscape when it comes to fire risk and affordable insurance.

Does Florida Homeowners Insurance Cover Fire?

Yes, Florida homeowners insurance combines liability and property coverage to pay for any damage that is caused by a covered loss, including fire.

The combination of policies that make up your standard home insurance package will provide the following coverages in the event of a fire.

- Dwelling coverage: Will pay to rebuild or repair any structural damage to your home, including detached structures.

- Personal property coverage: Will provide replacement cost for any personal belongings that are damaged by a fire.

Your home insurance policy will also pay for any temporary living expenses should a fire temporarily displace you from your home.

Florida residents pay an average of $1,951 annually for home insurance

When Does Florida Homeowners Insurance Cover a Fire?

Fires are considered a covered loss by insurance if they're accidental residential fires or wildfires.

Should your home be damaged by a fire, you would immediately file a claim with your home insurance carrier. Your Florida independent insurance agent can help you through that process.

Florida wildfire and residential fire stats

- 2,121 wildfires a year

- 122,500 acres burned

- 42 injuries per 1,000 residential fires

- 55% of fire deaths were related to structural fires

"Homeowners insurance will not cover fire losses due to intentional acts, neglect, acts of war, and nuclear hazard," explained insurance expert Jeffrey Green.

Are There Specific Fire Zones in Florida?

Yes, Florida’s Wildland Fire Risk Assessment (FRA) team has determined Fire Occurrence Areas (FOA) for every county in Florida. The zones were determined by previous fires that have occurred in the area.

Residents can also access the Southern Wildfire Risk Assessment Portal (SouthWRAP) to receive up-to-date wildfire risk information at any time.

Is Fire Insurance Mandatory?

Florida law does not require that homeowners have insurance. However, it can be a costly mistake to skip it.

Every year there is $37,135,000,000 in fire-related property losses in the US. The average range for repairing fire damage is between $2,500 and $32,000. Without the proper insurance, you could be paying that cost out of pocket.

In addition, Florida is highly susceptible to wildfires. If you're uncertain about purchasing home insurance, speak with a Florida independent insurance agent about your options and risks. They can help you determine if insurance is right for you.

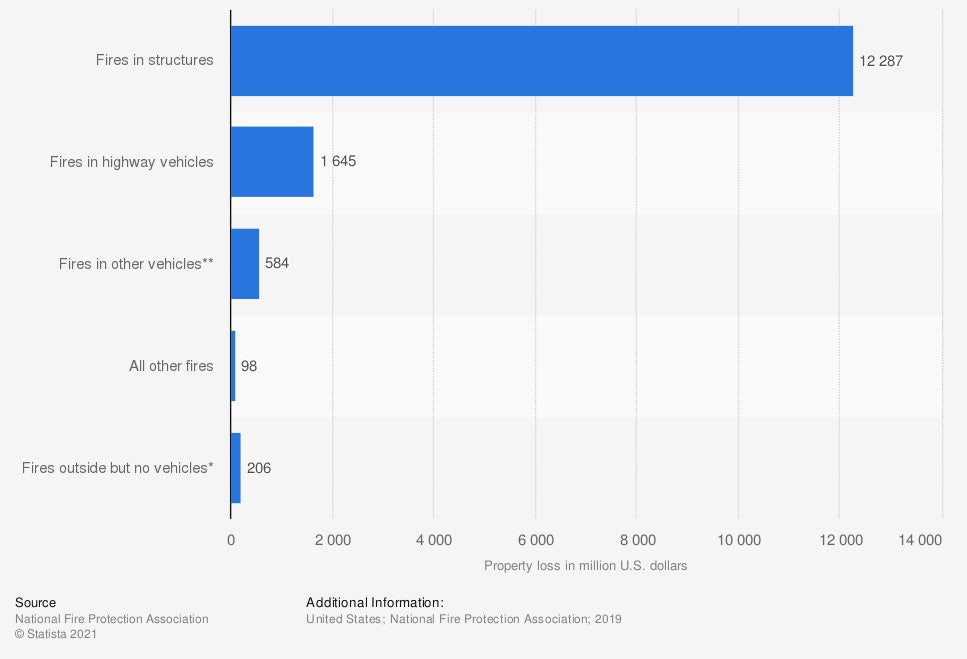

Property loss due to fires in the US

In the US, fires in structures have resulted in more than $12 billion in losses.

Does Home Insurance Cover Other Disasters?

Yes, the property damage coverages in standard homeowners policies cover the following disasters:

- Fire and smoke

- Wind and hail

- Tornados

- Hurricanes

- Theft

- Vandalism

If your home or personal belongings are damaged or destroyed by one of these events, your policy will pay to replace or repair the damage up to your insurance limits.

How Can a Florida Independent Insurance Agent Help?

Fire and smoke damage can be detrimental to your home and your wallet. No matter where you live in Florida, a high-quality homeowners insurance package is the only way to protect your property and your belongings.

With any insurance, you want your policy to be robust but affordable. A Florida independent insurance agent will speak with you, free of charge, to learn more about your wants and needs. They'll shop multiple insurance carriers for you and help you select an option that protects your home from any potential risks.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.weather.gov/pimar/FireZones

https://www.fs.fed.us/pnw/pubs/gtr802/Vol2/pnw_gtr802vol2_brenner.pdf

https://www.fdacs.gov/Forest-Wildfire/Wildland-Fire/Resources/Fire-Tools-and-Downloads/Southern-Wildfire-Risk-Assessment-Portal-SouthWRAP

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.