Over the last 170 years, Florida has been subject to more than 120 hurricanes. Hurricanes bring with them strong winds and rainfall, which can cause tremendous damage to your Florida home. That's why you need the proper hurricane insurance for your property.

To find hurricane insurance, it's easiest to work with a Florida independent insurance agent. Whether you live in the Panhandle or inland, they'll know exactly what you need to protect your home from hurricanes.

What Is Hurricane Insurance?

Hurricane insurance is tucked into your Florida homeowners insurance and is designed to help pay to repair or replace your property and possessions if they're damaged by a windstorm.

Insurance carriers write "windstorm coverage" into homeowners policies that include coverage against strong winds such as those that come from a hurricane. Some insurers in Florida require homeowners to buy additional windstorm coverage.

In addition, under Florida law, all insurers must offer a hurricane deductible of $500, 2%, 5% and 10% of the policy dwelling or structure limits.

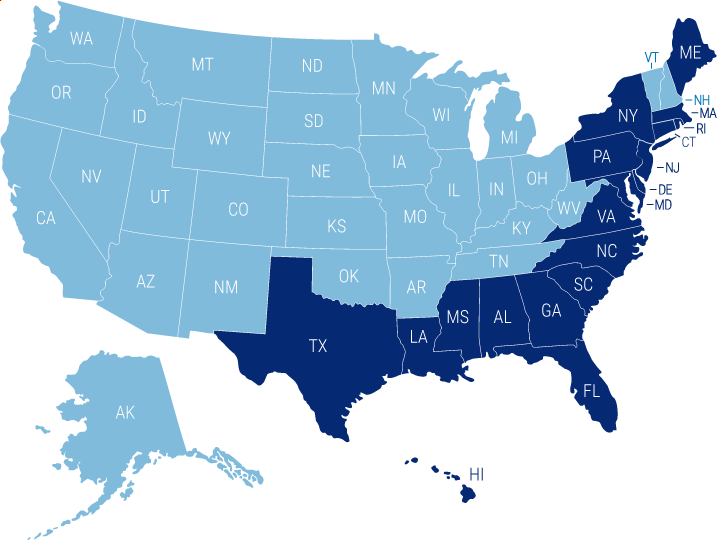

19 states that have a hurricane deductible

Alabama, Connecticut, Delaware, Florida, Georgia, Hawaii, Louisiana, Maine, Maryland, Massachusetts, Mississippi, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Texas, Virginia and Washington DC

What Does Hurricane Insurance Cover In Florida?

Hurricane insurance covers your property and your possessions if damaged by high winds. The following property and possessions are covered:

- The structure of your home

- Detached structures like sheds and garages

- Fences

- Appliances

- Furniture

- Clothing

- Jewelry

- Electronics

"Policies will have a long list of what is covered and not covered by your homeowners policy," explained insurance expert Paul Martin. "You can set individual limits for specific items, which your independent insurance agent can help with."

What Isn't Covered by Hurricane Insurance in Florida?

Hurricanes typically result in heavy floodwaters. Damage from natural waters or flooding is not covered by hurricane insurance. In order to receive this coverage, you'd need to purchase flood insurance from the National Flood Insurance Program or a private insurer.

This type of insurance also won't cover any damage from earthquakes or hurricane damage to your vehicle. A Florida independent insurance agent can help you purchase car insurance and earthquake coverage for a more thorough policy package.

Common Hurricane Claims in Florida

Hurricanes are such a common occurrence in Florida that the state keeps a close eye on the costs and claims associated with each hurricane.

Below is a sample of the amount of residence-related claims made after hurricanes that struck Florida in recent years.

Hurricane Michael

Hurricane Irma

Does Hurricane Insurance Cover My Car in Florida?

No, the windstorm coverage that is provided in your homeowners insurance will not cover any damage that your vehicle sustains from a hurricane.

According to Martin, to receive coverage for your vehicle you need to purchase a comprehensive car insurance policy. This coverage is not required by law, but it will pay for damage from any events other than a collision, such as a hurricane.

A Florida independent insurance agent can help you find a car insurance policy that protects against hurricanes.

How to File a Claim for Hurricane Damage in Florida

In the unfortunate event that your home is damaged by a hurricane, the first step is to contact your Florida independent insurance agent. They can guide you on the next steps you can take while they get in touch with your insurance company.

Before you touch or move anything in the home, take inventory of your damaged possessions alongside photos and a video if possible. The more you can document, the easier the claim process will be.

Once your agent is in touch with your insurance company, they will help you stay organized in providing your insurance company with the necessary documentation and work with you throughout the claims process.

How Can a Florida Independent Insurance Agent Help You?

Hurricanes can cause hundreds or thousands of dollars of damage to your Florida home. The worst-case scenario is dealing with damage without proper insurance. A Florida independent insurance agent is there to get you covered before you need it.

They'll talk with you, free of charge, about your home and your insurance needs. As experts in Florida hurricane Insurance, they'll find you affordable and comprehensive coverage to protect your home and personal belongings.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.tampabay.com/hurricane/2021/05/27/hurricane-2021-florida-may-not-be-spared-this-storm-season/

Hurricane Michael: https://www.floir.com/Office/HurricaneSeason/HurricaneMichaelClaimsData.aspx

Hurricane Irma: https://www.floir.com/office/hurricaneseason/hurricaneirmaclaimsdata.aspx

https://www.iii.org/article/background-on-hurricane-and-windstorm-deductibles

© 2024, Consumer Agent Portal, LLC. All rights reserved.