When your car is parked outside your Florida home, you assume it's safe from damage. But anything can happen, even an unexpected rock to the windshield from the neighbor's lawnmower. Homeowners need to be prepared for a variety of unforeseen risks. So what happens if the neighbor accidentally shatters your windshield? Who pays?

Fortunately, a Florida independent insurance agent can answer this question and help you get set up with the right car insurance. They know how important it is to have coverage in place long before you need it.

Who’s Responsible If My Neighbor Accidentally Shatters My Windshield?

Even though your neighbor is to blame for the rock flying from their lawnmower to your windshield, you would be likely to file the claim with your car insurance policy.

Vehicle damage typically goes through your car insurance rather than your neighbor's homeowners insurance. This is because homeowners insurance does not extend to third-party property damage to a vehicle. Since you would need insurance in this scenario, your Florida independent insurance agent can make sure you're set up with the right coverage.

What Does Car Insurance Cover in Florida?

Florida law requires you to carry specific insurance coverage to operate a vehicle. You must have a minimum required amount of Personal Injury Protection (PIP) and Property Damage Liability (PDL) in the state.

- Property damage liability (PDL): This coverage pays for third-party property damage that you or someone else driving your vehicle causes. Florida requires a $10,000 minimum of PDL coverage for all drivers.

- Personal injury protection (PIP): This coverage pays for medical expenses related to an accident, no matter who is at fault. PIP insurance in Florida will cover 80% of costs up to $10,000.

In addition to these required coverages, you can choose optional coverages to add to your policy.

- Collision coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled in a collision, regardless of fault.

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

- Bodily injury liability coverage: This pays medical expenses for injuries to another person that you cause with your vehicle. It will also pay legal and court fees if another driver sues you.

- Uninsured motorist coverage: Coverage reimburses you for accidents involving another driver who does not carry any/adequate car insurance.

Am I Responsible for Covering Any Damage Caused by My Neighbor?

Yes, your insurance would be responsible for any damage that your neighbor caused. For a rock to the windshield, you would start with filing the claim with your car insurance, which your comprehensive car insurance would cover. If the claim was denied or you did not have comprehensive coverage, you could choose to take legal action against your neighbor and sue them for the damage.

What If I Don’t Have Comprehensive Coverage on My Vehicle?

Comprehensive car insurance is an optional coverage in Florida, but it's the only policy that pays for damage to your vehicle that occurs outside of a collision.

While a rock from the neighbor's lawnmower may not be common, damage from hail, thunderstorms, fire, falling objects, hitting a deer, theft, and vandalism happen more frequently. Without comprehensive insurance, you'd have to pay for any of these incidents out of pocket.

With that said, if you did not have comprehensive insurance coverage, you'd be left paying for the damage from the rock on your own.

Comprehensive Car Insurance Stats

Most of the time, the cost of comprehensive insurance outweighs the potential financial consequences of not having coverage. Your agent can help you determine if comprehensive insurance is a good choice for you, but these stats paint a picture of the importance of this coverage.

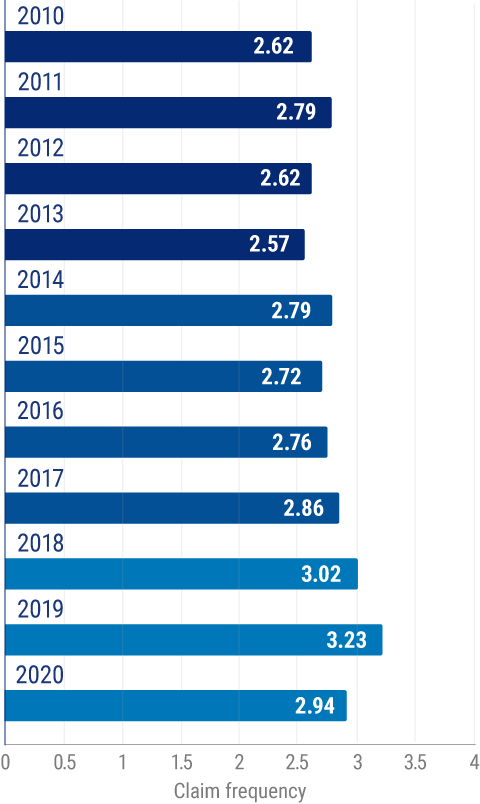

Frequency of Auto Claims

- Even though the frequency of comprehensive insurance claims fell in the last recorded year, it continually increased in frequency year over year in previous years.

- In one recent year, there were 3.23 comprehensive insurance claims filed per 100 cars.

- The following year, this number dropped to 2.94 per 100 cars.

- In that same year, the average value of private passenger auto comprehensive insurance claims for physical damage was $1,995.

How Can a Florida Independent Insurance Agent Help?

Homeowners need to be prepared for unforeseen events like a neighbor accidentally cracking your car's windshield. Having the right car insurance can help out this scenario and many others. To get the best coverage for your needs, a Florida independent insurance agent can help.

Agents work with a network of carriers to shop multiple policies and find you the right blend of coverage. Agents make sure you have the correct limits and coverages on your policy, so you're always protected.

Article reviewed by | Jeff Green

https://www.ilsos.gov/publications/pdf_publications/vsd361.pdf

https://www.iii.org/article/what-is-covered-by-collision-and-comprehensive-auto-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.