You trust the contractor fixing your roof to do an honest, complete job. Unfortunately, with the rise of roofing insurance scams nationwide, this doesn't always happen. That's why you must know the signs of these crimes so you can protect yourself.

A Florida independent insurance agent can also help you protect your roof with the right homeowners insurance policy. But first, make sure to take some time to familiarize yourself with common red flags that indicate a roofer scam. Check out this guide to get started.

What Is a Roofer Scam?

Known as either a roofer scam or roofing insurance scam, this is a crime that targets vulnerable homeowners and convinces them to pay someone posing as a contractor that isn't really legitimate. The scammer might get your money and then disappear off the face of the Earth, they may ask you for more money partway through the project, or they may even damage your roof on purpose. whatever the tactic, you lose out big time.

How to Identify a Legitimate Roofing Contractor

It's critical to take enough time to determine that someone who offers to fix your roof is honest and intends to actually complete the job as described. Failure to ask the right questions before letting someone begin working on your roof can cost you in terms of money, time, and stress.

Always ask your contractor for the following up front:

- A list of past completed projects on roofs

- A list of references

- A roofing warranty to look for gray areas in the contract

- A written proposal with the project's specs and estimated timeline for completion

- Their business's contact information including its address, tax ID number, and phone number

- Their supervisor's name and contact information

- Proof of their business's license or bond

- Proof of insurance like contractors liability insurance and workers' comp

If you're still hesitating to hire a certain individual to take on a home project for you, take your investigative research one step further and hit the internet. A quick search on the Better Business Bureau's website can show you if a company has positive reviews or a landslide of complaints.

Know the Signs of Roofing Insurance Scams in Florida

Now that you know the signs of a legitimate roofing contractor, you can also learn the signs of a legitimate roof repair project proposal vs. a scam. You'll know a roof repair project is likely to be an insurance scam if the following red flags pop up:

- Asking for more money: Scammers love to halt their projects before they're finished, bringing you claims of newly discovered additional damage or a need for extra materials. They'll refuse to complete their work unless you fork over more cash.

- Asking for your insurance check: Scammers want to convince you that their work requires zero out-of-pocket money on your end, the catch is they want you to sign over your homeowners insurance check to them. Don't fall for this.

- Demanding a huge deposit: While a regular deposit can be a common business practice with legitimate roofing contractors, scammers, on the other hand, will ask for a ridiculous amount of money before they start working. Do some research before agreeing to hire someone to learn what an acceptable deposit request looks like.

- Appearing right after a storm: Scammers who magically appear on your doorstep right after a storm has hit your town, potentially causing property damage, are known as "storm chasers." After insisting your roof is in bad shape and needs repairs right away, they'll either take your money and run, or do a poor job not worthy of your payment.

Once you get the signs of a faulty contractor and roofing insurance scam down, you'll be much less likely to ever fall victim to these terrible crimes.

Avoid Falling Victim to Roofing Insurance Scams in Florida

It's critical to avoid roofing insurance scams in order to save yourself potentially thousands of dollars that could otherwise be lost. It's also important to protect your home by ensuring that anyone hired to work on your roof is legit and licensed. Since scammers are known to intentionally cause damage to homes to get more money, it's critical you don't let this happen to you.

Take control of your home projects by initiating repairs on your terms. Contact your Florida independent insurance agent if you feel like your roof is in need of repairs. They can get in touch with your insurance company for you to schedule a real roof inspection, and the two of you can proceed from there.

Common Natural Disasters in Florida that Cause Roof Damage

While Florida is known for its pleasant sunny weather, it's also notorious for its many storms. In fact, Florida is the state most prone to hurricanes, which can cause extensive roof damage.

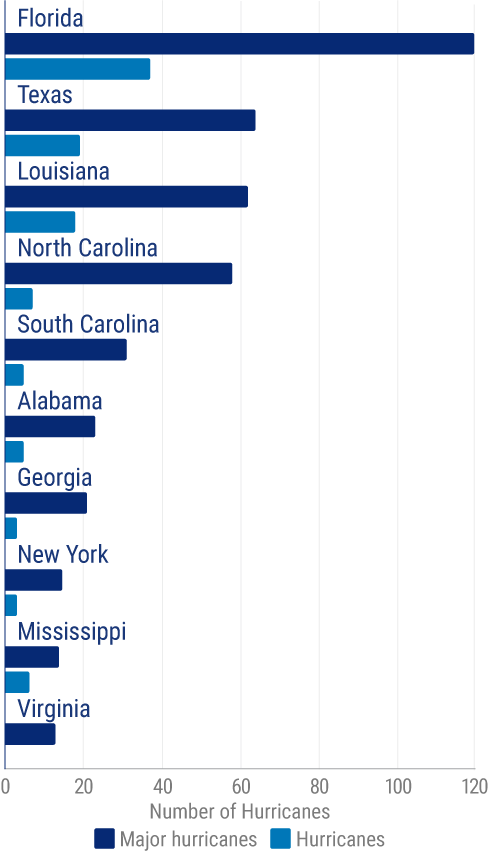

Number of hurricanes that made landfall in the US, by state

As you can see, of all the states nationwide, Florida has been hit by far the most often by both major hurricanes and regular hurricanes. Since 1851, 120 hurricanes have made landfall in Florida, and 37 major hurricanes have hit the state. Texas comes in a distant second place, with a reported 64 hurricanes and 19 major hurricanes making landfall during the observed period.

Fortunately for residents in Florida, homeowners insurance does cover roofs damaged by wind and hail that accompanies hurricanes. Make sure to ask your Florida independent insurance agent about all the ways your homeowners insurance can reimburse you for roof repairs from covered disasters.

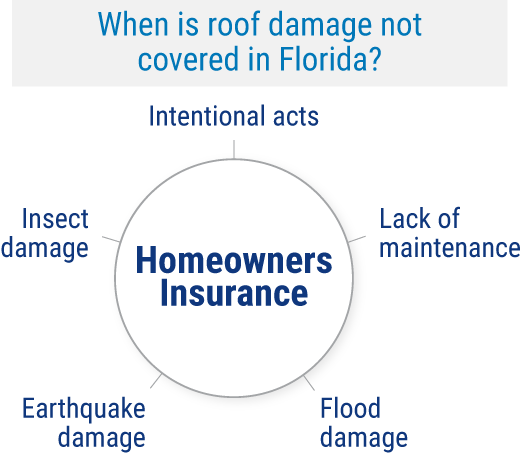

When Isn't Roof Damage Covered in Florida?

Though homeowners insurance covers many causes of roof damage in Florida, there are several excluded disasters as well. These are:

- Intentional acts

- Lack of maintenance

- Flood damage

- Earthquake damage

- Insect damage

Since Florida is prone to frequent hurricanes that bring a lot of natural flooding, it's critical to ask your Florida independent insurance agent about adding a flood insurance policy to protect your home. Natural floodwaters aren't covered by standard homeowners insurance.

Why Choose a Florida Independent Insurance Agent?

Florida independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Florida independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/1269483/number-of-hurricanes-that-made-landfall-in-the-us-state/

fox4now.com/news/local-news/contractors-promising-a-new-roof-taking-your-rights-and-money-instead

forbes.com/advisor/homeowners-insurance/roof-repair-scams/

© 2024, Consumer Agent Portal, LLC. All rights reserved.