In Florida, there are 19,845,911 residents, and many of them can access the roadways at any given time. If you're a driver, there are custom coverages you'll want to include on your auto insurance policy. Florida auto insurance can be expanded to provide more protection.

Fortunately, a Florida independent insurance agent can help explain the difference in limits. They have access to several carriers so that you get the best choices in town. Get connected with a local expert for tailored quotes.

What Is Theft Insurance?

Insurance for a Florida theft can be added to or included on any of your primary policies. Your auto insurance coverage will have a specific limit that will have to be purchased to protect against a theft or vandalism claim. Take a look at the theft rates per 1,000 people below:

- National theft rate: 2.289

- Florida theft rate: 1.933

What Does Theft Insurance Cover in Florida?

When a theft loss occurs, you'll want to be prepared with adequate protection. The necessary coverage should be obtained and reviewed when discussing solutions with your adviser. Check out what your Florida auto policy will cover:

- Personal belongings in your vehicle

- Your vehicle itself

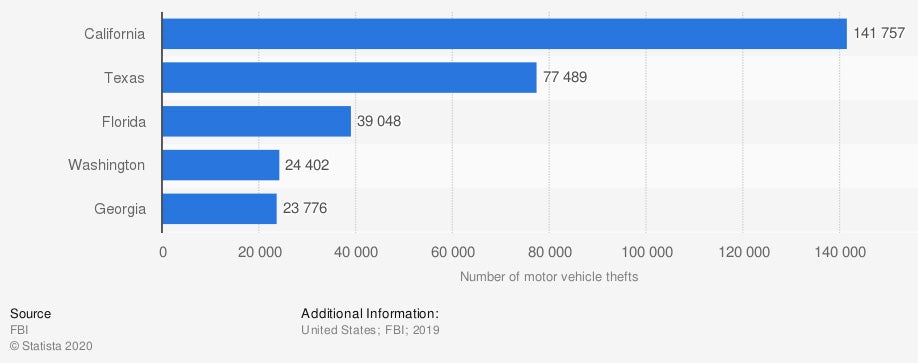

The number of vehicle thefts reported in the US

If you have proper protection for a theft loss, you won't have to pay out of pocket. There are numerous coverage types on your auto policy that can be added for additional support.

What Doesn't Theft Insurance Cover in Florida?

While it's essential to know what's covered under your auto policy, it's equally important to understand what's not. Losses that are generally excluded under your theft coverage on your auto policy:

- Scheduled property: This will be specifically insured under your personal articles floater, not your auto policy.

- Permissive use: If you permit someone to borrow your vehicle, theft usually would have to be proven.

- No comprehensive coverage: If you have not added comprehensive protection to your auto policy, you won't have insurance for theft or vandalism.

Does Car Insurance Cover Theft in Florida?

When it comes to belongings in your vehicle or your car itself being stolen, your policy may respond. You will only have coverage if you obtain comprehensive insurance on your current auto policy. This coverage will have a deductible, usually $500 to $1,000, and you'll have insurance for a theft loss as long as you've added this coverage.

How to File a Claim for Theft in Florida

When you are the victim of a crime, it can be hard to think straight. If you understand how to file a theft claim on your auto policy beforehand, it can save you some time and worry.

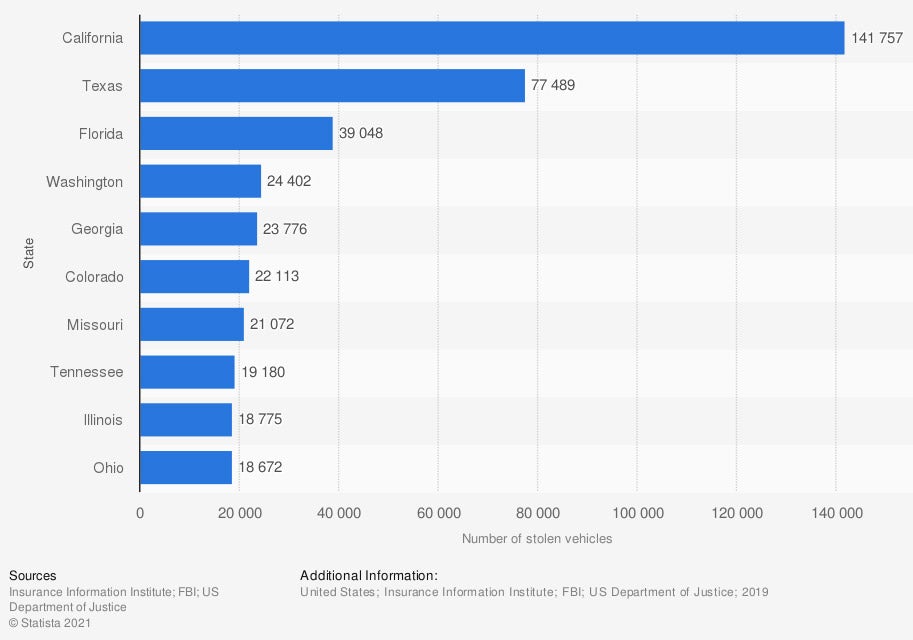

Leading US states with the most auto thefts

Florida is in the top three on this list, which means you'll want adequate protection for a loss. Here are four easy steps for filing a theft claim on your auto insurance:

- Step 1: Get to a safe place.

- Step 2: Call your independent insurance agent.

- Step 3: Ask your agent how to get a temporary vehicle through insurance.

- Step 4: Set up a meeting with your assigned adjuster.

How an Independent Insurance Agent Can Help in Florida

The right coverage for your personal auto policy is necessary to avoid paying out of pocket. There are several options to choose from, and not all insurance is created equal. When shopping for Florida auto protection, consider using a licensed professional.

A Florida independent insurance agent can help find a policy and premium for an affordable price. Since they do the comparing at no additional cost, you'll save time. Connect with a local expert on TrustedChoice for quotes today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/232559/motor-vehicle-thefts-reported-in-the-us-by-state/

Graphic #2: https://www.statista.com/statistics/424892/us-top-ten-states-with-the-most-number-of-motor-vehicle-thefts/

http://www.city-data.com/city/Florida.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.