No homeowner wants to watch their property go up in flames. Worse yet is the thought of losing your property to a natural disaster and having no coverage to replace it afterwards. That's why being insured against wildfires is so important.

Fortunately a Florida independent insurance agent can help get you insured against wildfires in your area. They'll get you equipped with all the coverage you need long before wildfire season rolls around. But first, here's a simple secret to help get you insured against Florida wildfires.

What's the Secret to Getting Insured against Florida Wildfires?

Working with a Florida independent insurance agent is your greatest chance at getting all the protection you need against wildfires. Not only can these agents help you review your existing coverage, they can also get you equipped with any additional coverage you may require to protect your property fully.

Even better, Florida independent insurance agents can shop and compare quotes from many different carriers. Ultimately they can find you the most affordable wildfire coverage that gets the job done right. So, now the secret's out, but there's still plenty more to understand about wildfire coverage.

What Do You Need to Know to Obtain Florida Wildfire Insurance?

According to insurance expert Jeffery Green, wildfire coverage is not a separate add-on to your Florida homeowners insurance policy. Fire is already a covered peril under standard homeowners insurance. However, if you live in an area that's at high risk of wildfire damage, that might make homeowners insurance much more expensive.

How Do You Know How Much Wildfire Insurance You Need?

Green said that in some cases, insurance carriers will dictate how much coverage you need to have in different areas. But in other cases, you might have to decide coverage amounts yourself. Take these factors into consideration when shopping for your coverage:

- The total value of your property

- How much property you need to insure

- If you have any valuable items like electronics, artwork, or furs

- If you need additional coverage on your other policies, like Florida car insurance

Your Florida independent insurance agent can also help you decide how much fire and wildfire coverage you need to have under your homeowners insurance. If you're not properly equipped by your current policy, they can help you add more coverage.

How Destructive Are Wildfires in Florida?

When considering how much wildfire coverage you need in Florida, it's helpful to know just how destructive these disasters can be. Check out the stats below for wildfire damage across the US in general to get a better idea.

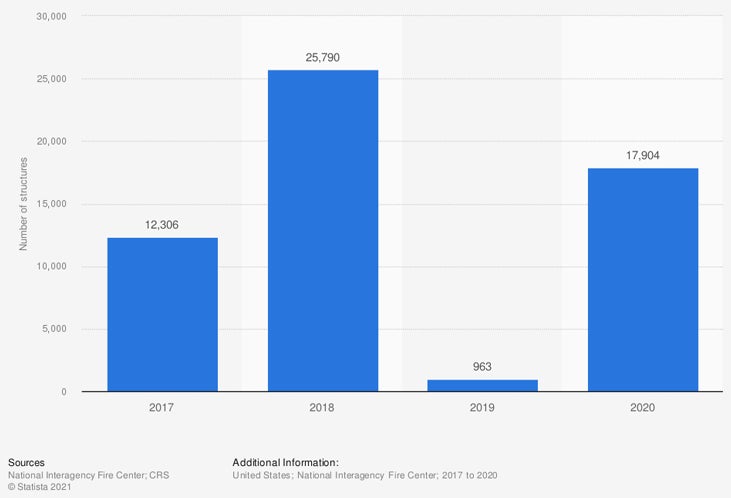

Number of structures burned by wildfires in the US

More than 50,000 structures have been burned by wildfires in the US over the past four years. Last year, wildfires damaged or destroyed nearly 18,000 structures across the country. This number jumped a huge amount from the previous year, when just under 1,000 structures were burned by wildfires.

Knowing just how common and destructive a threat wildfires continue to be in the US helps demonstrate the importance of securing enough coverage for your property. Make sure to review your homeowners insurance policy with the help of your Florida independent insurance agent.

What to Do after a Wildfire in Florida

Wildfires, like any natural disaster, are extremely stressful and you might find yourself wondering what to do next. If you've been a victim of wildfire damage, it's important to follow these steps ASAP to help get yourself back on track.

After a wildfire, take these simple actions:

- Get in touch with your insurance company: You'll need to have an adjuster visit your home to assess your property's damage from the fire, so make sure to reach out to your insurance company or Florida independent insurance agent ASAP after the disaster.

- Document damaged property: Take photos and videos and make a list of all damaged property after the wildfire, including the extent of damage or destruction to each item.

- Keep all damaged items: Make sure to not throw anything away, at least until after the insurance adjuster has visited your property to assess the damage from the wildfire and start your claim report.

- Stay updated on the claims process: Your Florida independent insurance agent will stay in touch with you through every step of the claims process after a wildfire and even keep you informed on ETAs for claim approval and reimbursement.

If you're still unsure of what to do after a wildfire, call your Florida independent insurance agent. They can advise you on the first steps to take before you can file a claim through your insurance company.

What Companies Can Get You the Best Insurance against Florida Wildfires?

When getting protected against Florida wildfires, you need an insurance company that offers reliable homeowners coverage. Just for you, we've assembled a list of some of our top picks in Florida for outstanding wildfire coverage through homeowners insurance.

Here's How a Florida Independent Insurance Agent Can Help You

Independent insurance agents are fully equipped to protect homeowners against commonly faced disasters. Florida independent insurance agents shop multiple carriers to find providers who specialize in homeowners insurance and wildfire coverage.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

iii.org/article/insurance-for-wildfires

chart - https://www.statista.com/statistics/1269895/structures-burned-by-us-wildfires/

© 2024, Consumer Agent Portal, LLC. All rights reserved.