For many businesses, equipment is necessary for operating properly. Should your equipment break down, it could cause financial turmoil. That's why Florida business owners need the proper business insurance for their equipment.

Business equipment insurance can protect you from a variety of risks. To find this insurance, it's best to work with a Florida independent insurance agent, as they understand where to find the best business insurance in the state. To start, here's what you should know about business equipment insurance.

Florida is home to 2,500,000 small businesses.

What Is Commercial Equipment Insurance?

Commercial equipment insurance is a type of business insurance specifically designed to cover equipment that is used to operate your business.

"This is usually referred to as equipment breakdown insurance," explained insurance expert Jeffrey Green. "Equipment breakdown covers repair and replacement of both the machinery and other property damaged as a result of the breakdown."

What Does Florida Business Equipment Insurance Cover?

Business equipment can range from forklifts to printing machines, so every piece of machinery will have different coverage.

Business equipment insurance will cover:

- Repairs

- Lost income due to broken-down equipment

- Labor and time costs to repair equipment

- Loss of goods or spoiled food

Business equipment insurance protects from:

- Mechanical breakdowns

- Power surges

- Motor burnouts

- Short circuits

- Damage to someone else's property

- Stolen equipment

- Vandalized equipment

Green explained that every machinery policy will be different, so it's best to check with your Florida independent insurance agent to understand the covered perils in your policy.

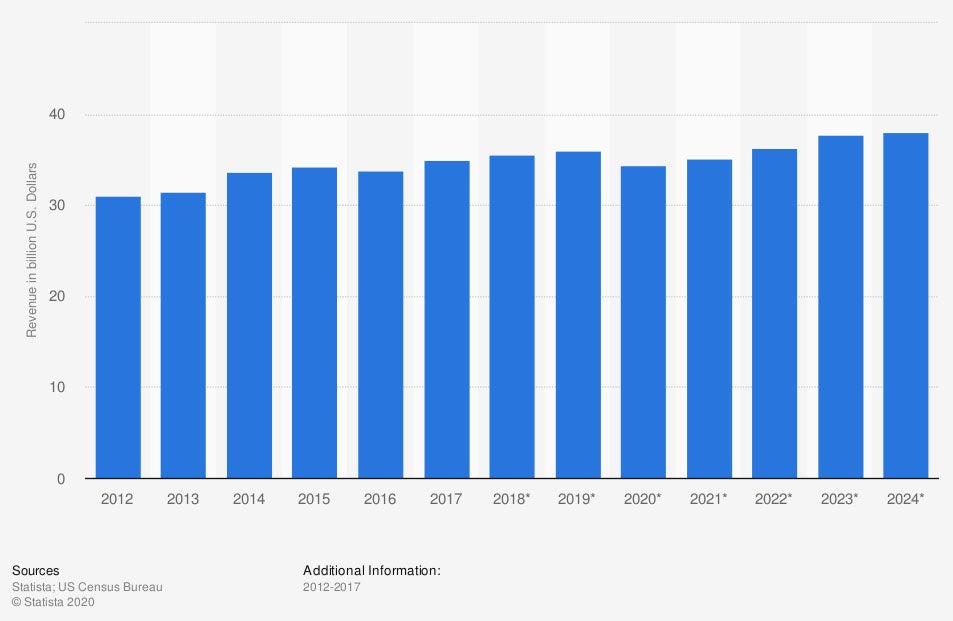

Industry revenue of “commercial and industrial machinery repair“ in the US

Maintaining and repairing commercial equipment is a multibillion dollar industry in the US.

What Isn't Covered by Florida Business Equipment Insurance?

Insurance companies only want to cover your equipment if you take good care of it. If you're negligent with your machinery, it could be excluded in a claim.

Business equipment insurance will not cover:

- Damage from general wear and tear

- Intentional damage

- Breakdown from poor maintenance

- Damage from pests, deterioration, mold, rust, or the like

When purchasing your business equipment insurance, you'll want to consider your policy limits. Your insurance will only pay for repairs up to your limit so it's important to consider the replacement value of your equipment before insuring it.

What Is Commercial Equipment Warranty Insurance?

Most equipment will come with a warranty from the manufacturer. Warranties can be valuable, but according to Green, they are short-term and do not cover property damage as a result of breakdowns.

Other considerations to keep in mind about warranty insurance include:

- Exclusions: A big exclusion from warranty insurance is covering any damage as a result of operator error.

- No reimbursements: Warranties never cover any lost income or cash flow.

- Limited coverage: Warranties will only cover specific types of damage.

Warranties can add extra protection for your equipment, but business equipment insurance provides more comprehensive coverage for your machinery.

Do I Need Commercial HVAC Equipment Insurance in Florida?

A Florida business equipment insurance policy will include coverage for any damage to your heating and air conditioning systems.

For this reason, you do not need to purchase a different type of insurance for proper coverage. You will want to work with your Florida independent insurance agent to make sure your policy limits are sufficient should you have an HVAC issue.

How Can a Florida Independent Insurance Agent Help?

Every business has different insurance needs. Purchasing the wrong coverage or not enough coverage can be permanently damaging to your company. A Florida independent insurance agent is there to help.

They'll chat with you, free of charge, to learn more about your business and the equipment you use to run it. Not only are they experts in business insurance, but they also understand the insurance market in Florida. They'll shop multiple carriers and provide you with several quotes to choose from. Work with a TrustedChoice independent insurance agent today.

Author | Sara East

Article Reviewed by | Jeffery Green

Statista image: https://www.statista.com/forecasts/311234/commercial-and-industrial-machinery-repair-revenue-in-the-us

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

https://www.dms.myflorida.com/business_operations/state_purchasing/insurance_contracts/equipment_breakdown_insurance_boiler_and_machinery

© 2024, Consumer Agent Portal, LLC. All rights reserved.