No matter how much your business does or doesn’t rely on computers, pretty much all businesses with an internet connection are at risk of digital threats every day. Cybercriminals and hackers can target your employees’ or customers’ private data and sell it to third parties, or worse. That’s why it’s so crucial to have the right cyber liability insurance.

Fortunately, a Florida independent insurance agent can help you get set up with all the cyber liability insurance your business needs to operate safely. Even better, they’ll get you equipped with this coverage long before you need to use it. But first, here’s a deep dive into this critical coverage.

What Is Cyber Liability Insurance?

Cyber liability insurance is a crucial coverage add-on to Florida business insurance. Though many standard business insurance policies are starting to include cyber coverage, that’s not always the case. Cyber liability insurance is designed to protect businesses of all kinds against cybercriminals, hackers, and digital threats.

Having a cyber liability insurance policy in place can help your business stay afloat after a data compromise or cyberattack. In the event of a data breach, you wouldn’t want your business to be left without protection. Be sure to ask your Florida independent insurance agent about getting set up with cyber liability insurance ASAP.

Who Needs Cyber Liability Insurance?

It might sound like an exaggeration, but virtually every modern business could benefit from having cyber liability insurance. If you use computers or the internet at all for work-related activities, you’re putting your business at risk of losing sensitive information that could really end up hurting you, financially and otherwise. A Florida independent insurance agent can further explain why your business needs cyber liability coverage.

What Does Cyber Liability Insurance Cover in Florida?

Cyber liability insurance provides a lot of important protection for businesses in Florida, as well as across the map. Though your policy may vary, a handful of common coverages are offered by many cyber liability insurance policies in Florida, including:

- Loss of income: Covers you if your business’s operations get suspended or are limited after a data breach or cyberattack by helping to replace lost revenue.

- Legal expenses: Covers you against lawsuits if customers sue you after their personal information gets stolen, or if a bank sues you for having to cancel their customers’ stolen credit card information. This coverage pays for attorney, court, and settlement fees.

- Hired professionals: Covers professional programmers or other experts to help your business repair damage to its computer systems after an incident, including removing malware and patching up other holes in security.

- Costs due to damaged reputation: Provides public relations protections for your business to help keep the media as quiet as possible following an incident like a data breach.

Cyber liability policies are not standard, so depending on which insurance company you choose, you may be offered different coverage options to pick and choose from. Your Florida independent insurance agent can help you assemble the right policy for your business.

What Doesn’t Cyber Liability Insurance Cover in Florida?

Unfortunately, cyber liability insurance can’t cover just anything. According to insurance expert Paul Martin, standard excluded perils under cyber liability insurance are:

- Intentionally malicious acts

- Employee dishonesty

- Regulatory/statutory penalties

Martin noted that specific exclusions can vary greatly by policy. Since cyber liability policies aren’t standard, neither are their exclusions. Ask your Florida independent insurance agent to review your policy with you in depth, including its coverage exclusions.

Why Do I Need Cyber Liability Insurance?

You might still not be convinced that your specific business could benefit from cyber liability insurance. Check out a list of alarming recent data breach stats below, and you may change your mind.

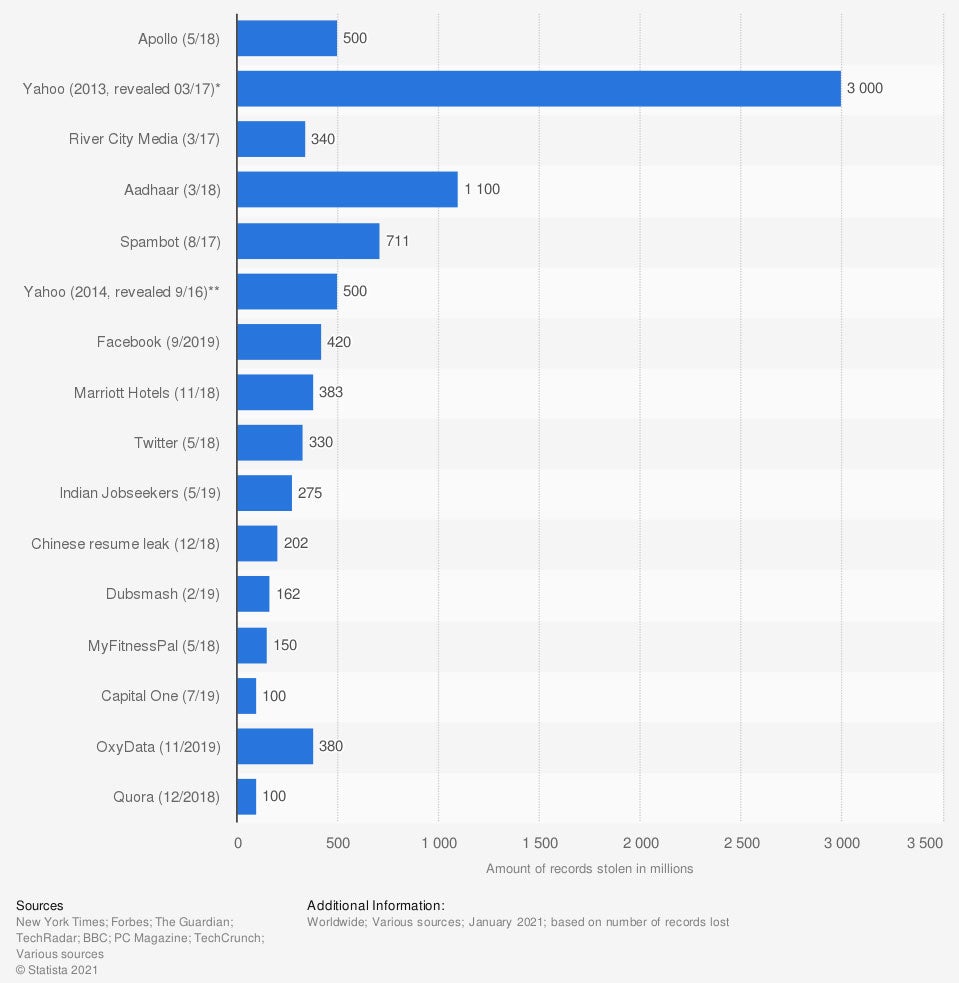

Number of compromised data records in selected data breaches as of January 2021 (in millions)

Over the past decade, there have been numerous data breaches that have each exposed millions of records belonging to the affected business. In 2017, Yahoo! finally revealed that it had exposed three billion data records in a breach back in 2013. Also in 2017, Spambot had an exposure of 711 million data records. More recently, in 2019, social media giant Facebook suffered a data breach that exposed 420 million records.

Given the prevalence and severity of data breaches affecting even household names like Facebook, it’s easy to see just how critical cyber liability protection is. Speak with your Florida independent insurance agent to get equipped with coverage before it’s too late.

How Much Does Cyber Liability Insurance Cost in Florida?

As with any other type of insurance, the cost of your cyber liability policy will depend on several factors. Martin said these factors commonly include:

- The size of your business

- Your business’s annual revenue

- The specific operations of your business

- Your business’s exact location

If your business is conducted primarily online, you might need more coverage than an older mom-and-pop shop that only uses computers to check email. Also, if your business is located in a larger city like Miami, your coverage might cost more due to the increased risk of storm damage and crimes like theft.

In 2019, the average cost of cyber liability insurance was $1,500 for a $1 million policy. Your Florida independent insurance agent can offer more specific pricing information for cyber liability policies in your area.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting business owners against cyber liability risks like data breaches and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in cyber liability insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/290525/cyber-crime-biggest-online-data-breaches-worldwide/

https://www.businessinsurance.com/article/20190919/NEWS06/912330752/Average-costs-of-cyber-liability-insurance-studied

https://www.iii.org/article/cyber-liability-risks

© 2024, Consumer Agent Portal, LLC. All rights reserved.