One of the greatest threats to businesses of any kind is a lawsuit. These days, customers and other third parties can sue you for just about anything. Whether you lose the case or not, it’s critical to be protected by general liability insurance.

Fortunately a Florida independent insurance agent can help you find the right type of general liability insurance to protect your business against many different lawsuits and their costs. They’ll even get you covered well in advance of you needing to file a claim. But first, here’s a deep dive into this imperative coverage.

What Is General Liability Insurance?

General liability insurance is one aspect of Florida business insurance that’s meant to protect your organization against various lawsuits. General liability coverage can provide important reimbursement for things like attorney, court, and settlement fees.

Without the right protection, your business could easily go bankrupt after just one lawsuit. A Florida independent insurance agent can help you get set up with enough coverage.

What Does General Liability Insurance Cover in Florida?

Without the right general liability insurance, your Florida business is vulnerable to costly lawsuits. General liability insurance protects you against:

- Bodily injury lawsuits: If a customer gets injured or becomes ill on your premises or otherwise as a result of your business, they could press charges against you.

- Property damage lawsuits: If a customer or other third party sues your business for claims of personal property damage, you’ll need the right general liability protection.

- Advertising injury lawsuits: General liability insurance also protects your business against lawsuits relating to claims of emotional or other injury caused by your advertisements.

- Medical payments: Your coverage can also help reimburse for the cost of medical treatment to third parties who claim to have been injured at or by your business.

A Florida independent insurance agent can help you get equipped with enough general liability insurance to help your business stay afloat for many years to come.

What Isn’t Covered General Liability Insurance in Florida?

According to insurance expert Paul Martin, general liability insurance in Florida comes with several exclusions in addition to its generous coverages. These exclusions are often as follows:

- Workers’ comp claims

- Product recall liability claims

- Contract disputes

- Back taxes claims

- Pollution liability claims

- Professional liability claims

Be sure to discuss any concerns you may have about your general liability coverage’s exclusions with your Florida independent insurance agent.

Liability Stats for Businesses in Florida

Before looking into general liability insurance, it can be helpful to know how vulnerable businesses are to lawsuits, not just in Florida, but across the country. Check out some stats below and see for yourself.

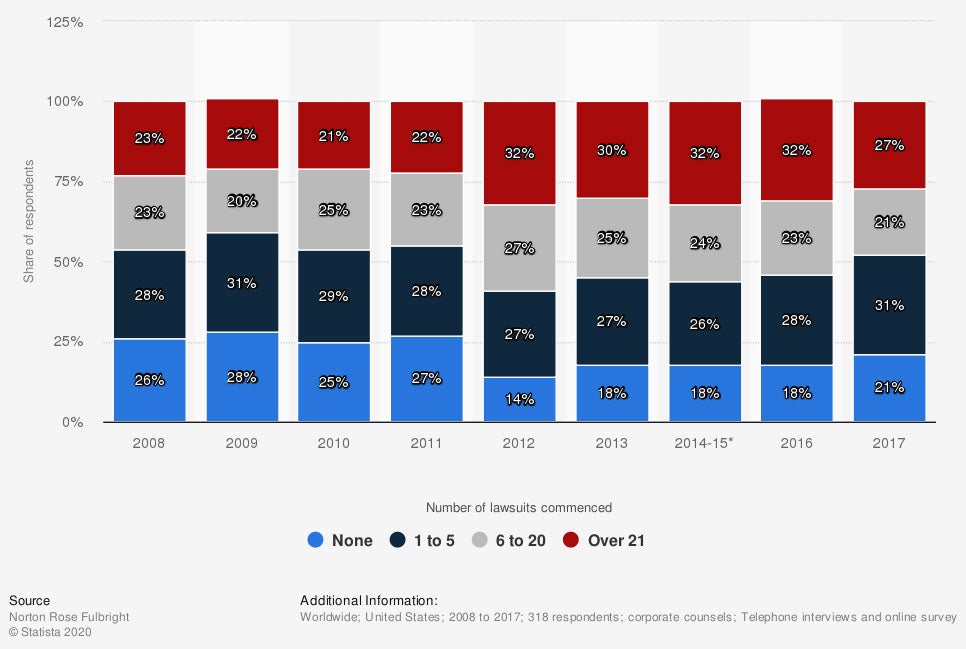

How many lawsuits were commenced against your company in the last 12 months?

It’s official, businesses are getting sued more and more commonly as time advances. More than a decade ago, 26% of participants reported they had not been sued at all. Just a few years later, this number had fallen to 21% of participants. On the flipside, at the beginning of the observed period, only 23% of surveyed businesses reported having been sued more than 21 times. Just a few years later, this number had grown to 27% of the surveyed businesses.

A Florida independent insurance agent can help you get set up with all the crucial general liability insurance it needs, especially in our increasingly litigious world.

What Is the Minimum Amount of Liability Coverage Required in Florida?

The amount of liability coverage required for your Florida business will depend on several factors. The first is the type of liability coverage in question. Commercial auto insurance has these minimum coverage requirements in Florida:

- $10,000 in property damage liability

- $10,000 in personal injury protection

To get your business equipped with the minimum liability requirements and more, work together with a Florida independent insurance agent. It’s recommended to bump up your liability coverage as much as possible to get the fullest picture of protection.

What Is Liability Coverage on Home Insurance in Florida?

The liability coverage provided by standard homeowners insurance policies in Florida comes with two major components:

- Bodily injury liability: Protects the homeowner against claims of bodily injury to a third party on their property, and sometimes even away from the home.

- Property damage liability: Protects the homeowner against claims of personal property damage to a third party at their home, and sometimes outside of the home.

The liability insurance portion of homeowners coverage protects homeowners against expensive lawsuits, similar to how general liability coverage protects business owners against lawsuits. A Florida independent insurance agent can help you find all the liability protection you need, whether you’re a business, homeowner, or anything else.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in general liability insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/892472/legal-services-number-of-lawsuits-per-company-worldwide/

https://www.iii.org/article/homeowners-insurance-basics

© 2024, Consumer Agent Portal, LLC. All rights reserved.