Average Cost of Business Insurance in Florida

The cost to carry commercial insurance can vary significantly from one business to the next. Rates are influenced by factors such as your business type, number of employees, liability risks, and the value of your business assets. Insurance rates in Florida tend to be higher than throughout most of the country due to the severe weather risks, but comparison shopping can help you find the best price for your coverage.

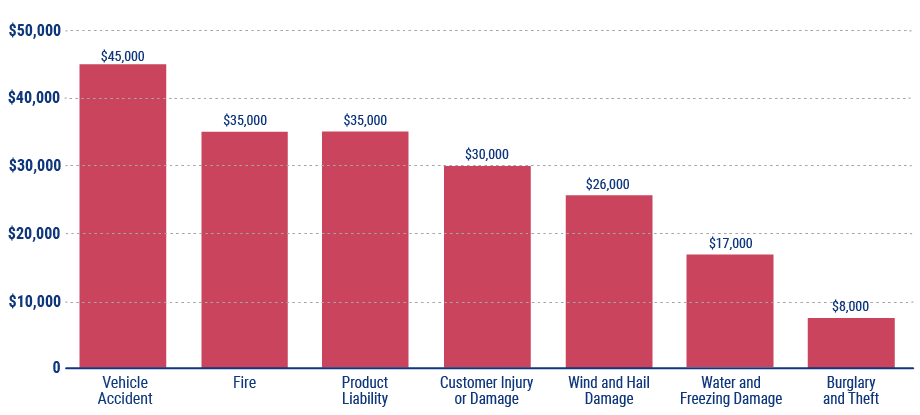

Average Cost for the Top Business Insurance Claims