Cost of Workers’ Compensation Insurance in Florida

In Florida, workers’ compensation rates are about 2% lower than the national average. The cost for coverage is based on the types of jobs your employees do. Florida is the only state that requires all insurance providers to use the same rate structure, which is established by the state according to recommendations by the NCCI. Therefore, there is little variance in cost between carriers. The only differences will be due to offered discounts, drug and safety discounts, and experience modifiers.

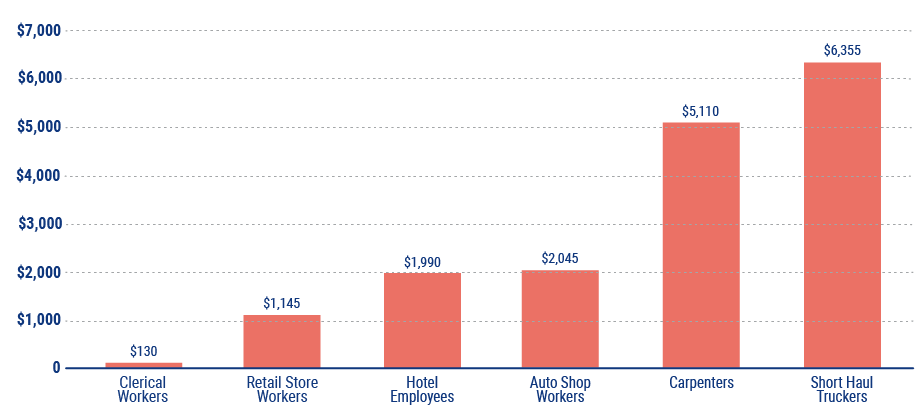

Florida Workers' Compensation (per $50,000 in payroll)