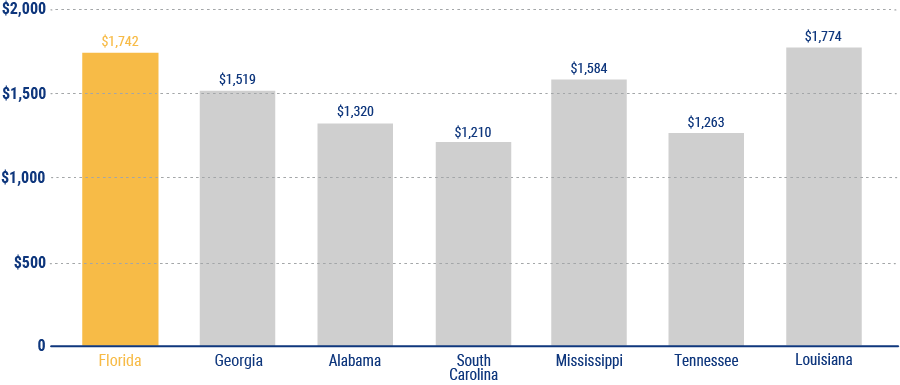

Average Cost of Car Insurance in Florida

The average American driver pays $1,311 per year for car insurance. In Florida, drivers pay an average of $1,742 each year. Take time to compare quotes to make sure you get the best deal on auto insurance in your area. Florida's drivers may pay more for car insurance than drivers in many other places, but independent insurance agents can help you score lower rates than you might pay if you shop on your own.

Florida's Average Cost of Car Insurance Per Year