When you run an auto shop with a garage and care for customers’ vehicles, you’ve got to make sure you’re protected in case of accidents or other disasters. The first step is getting set up with the right coverage. That means having adequate garage keepers insurance.

Florida independent insurance agents can help you get set up with the right kind of garage keepers insurance for your needs. Even better, they’ll get you equipped with the proper coverage long before you need it. But until then, let’s take a closer look at this important coverage.

What Is Garage Keepers Insurance?

Garage keepers insurance is a special form of Florida business insurance designed to protect the owners of auto garages and repair shops. Garage keepers insurance covers damage to vehicles that are in the care and/or custody of the policyholder while they’re attending, servicing, repairing, parking, or storing them during garage operations. A Florida independent insurance agent can help you find garage keepers insurance that works for your specific business.

Garage Keepers Insurance vs. Garage Liability Insurance

When hunting for the right coverage for your garage, you may be confused by two common forms of coverage that have similar names. Here’s how to tell them apart.

- Garage keepers insurance protects garages and their owners if a customer’s vehicle gets damaged while in the care of the business. This coverage is broader than that of a garage liability policy.

- Garage liability insurance protects garages and their owners from liability claims filed by third parties for personal property damage or bodily injury caused by the business. This coverage also protects against damage to a customer’s vehicle caused by products sold by an auto shop.

A Florida independent insurance agent can further explain the differences between these two forms of coverage and help you decide which is right for you.

Auto Shop Stats for Florida

When shopping for coverage for your garage or auto repair shop, it’s helpful to know why coverage is so important for the industry. Check out some auto shop stats for the US below.

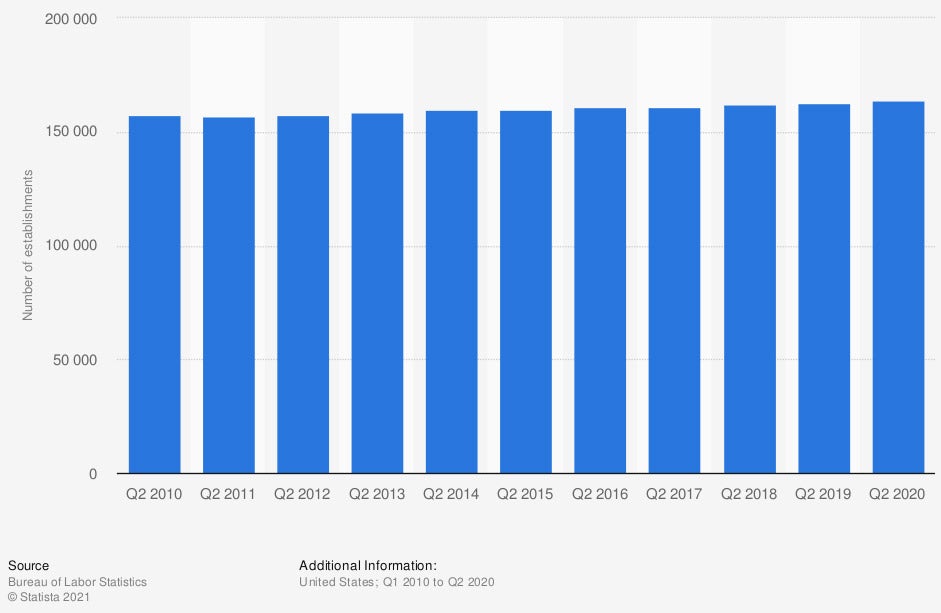

Number of auto repair and maintenance establishments in the US from 2nd quarter 2010 to 2020

Though the number of auto repair and maintenance shops remained quite stable over the past decade, it did continue to increase over the years. By 2020, the number of auto repair shops had grown to a total of 164,090 for the US, up from 157,529 businesses in 2010.

Top Services Performed at Auto Repair Shops by Spending

Customers are most likely to pay to have auto repair shops replace parts of their vehicles following a crash, and are second-most likely to pay for auto repair services for paint jobs.

While performing any of these services, or even those not on this list, having proper garage keepers insurance is crucial to protecting your shop’s reputation.

What’s Not Covered by Garage Liability Insurance?

Like all forms of coverage, garage liability insurance comes with its own set of exclusions. According to insurance expert Jeffery Green, garage liability insurance does not cover disasters like weather damage or theft to a vehicle when the garage is not legally liable for the disaster. Damage to a vehicle that has been properly locked and stored by an auto shop may not be considered the business’s liability, and would not be covered under these policies.

Direct Primary Garage Keepers Insurance in Florida

Green said that direct primary garage keepers insurance provides coverage for vehicles in a garage’s control and care, whether the business is legally liable for a disaster or not. Collisions and other disasters like weather damage while the vehicle is properly secured and locked on the business premises would be covered, even though they weren’t legally the fault of the auto shop. This coverage is much more comprehensive than garage liability insurance.

What’s Not Covered by Direct Primary Garage Keepers Insurance?

Though direct primary garage keepers insurance provides a much more complete picture of coverage for auto shops, garages, etc., it doesn’t cover just anything. Common exclusions under garage keepers insurance are:

- Theft or other loss of non-permanently installed stereo equipment

- Theft or other loss of CDs, DVDs, and other personal items

- Non-permanently installed phones, radios, and scanners

- Radar detectors

- Contractual obligations

- Defective parts and/or faulty work

A Florida independent insurance agent can address any concerns you may have about exclusions under garage keepers insurance.

Garage Keepers Insurance Limits in Florida

With the help of your Florida independent insurance agent, you’ll choose the coverage limits that make the most sense for your business. The two of you will calculate this by considering the average value of customer vehicles in your care at a given time, multiplied by the number of vehicles you’d be responsible for at once. If you often had five vehicles in your shop worth about $20,000 each, you’d want at least $100,000 in coverage.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting garage and auto repair shop owners against liability risks and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in garage keepers insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

https://www.irmi.com/term/insurance-definitions/garagekeepers-coverage

chart - https://www.statista.com/statistics/436416/number-of-auto-repair-and-maintenance-shops-in-us/

stats - https://brandongaille.com/29-auto-repair-industry-statistics-and-trends/

© 2024, Consumer Agent Portal, LLC. All rights reserved.