Some businesses have an employee or two that they just couldn’t function without. These workers can be referred to key people or a key men. If the key person were to become permanently disabled or die, it could hurt your company in multiple ways. That’s why it’s so important to have the right coverage in place.

Fortunately, a Florida independent insurance agent can help you find the right kind of key person insurance for your company. They’ll get you equipped with more than enough coverage, long before the time comes to use it. But before we jump too far ahead, here’s a closer look at key person insurance.

What Is Key Person Insurance?

According to insurance expert Paul Martin, key person insurance is designed to help businesses through the tragic loss of a key employee, whether that be by death or severe disability. It's an important addition to a Florida business insurance policy. Coverage can pay for the search for a new employee to fill the key person’s shoes, as well as to pay severance to the remaining employees, pay off investors, and fund the closing of the business if necessary.

With key person insurance, the business that the employee works for acts as the beneficiary of the benefits paid out by the policy in the event of that worker’s death or disability. A Florida independent insurance agent can help you determine which form of coverage is right for your business.

What Is Key Person Life Insurance?

There are two main forms of key person insurance, the first being key person life insurance. This coverage acts like a special life insurance policy designed only to protect crucial employees of a business, such as a CEO.

If this key employee dies, the business will receive the death benefit, no matter whether the employee died due to work-related causes or not. The amount of the death benefit will be based on the key person’s income and the portion of the business’s revenue they were deemed responsible for.

What Are the Benefits of Key Person Life Insurance?

Key person life insurance in Florida helps a business ensure that they can financially recover in the event of the loss of a top-performing employee. The death benefit received by the business from a key person life insurance policy can be used in the following ways:

- To compensate for lost revenue generated by the key person

- To pay off business debts

- To buy out remaining shareholders’ interest

- To fund the search and hiring process for a new employee

A Florida independent insurance agent can further explain the numerous benefits of key person life insurance, and which apply to your specific business.

Industries with the Highest Worker Fatality Rates

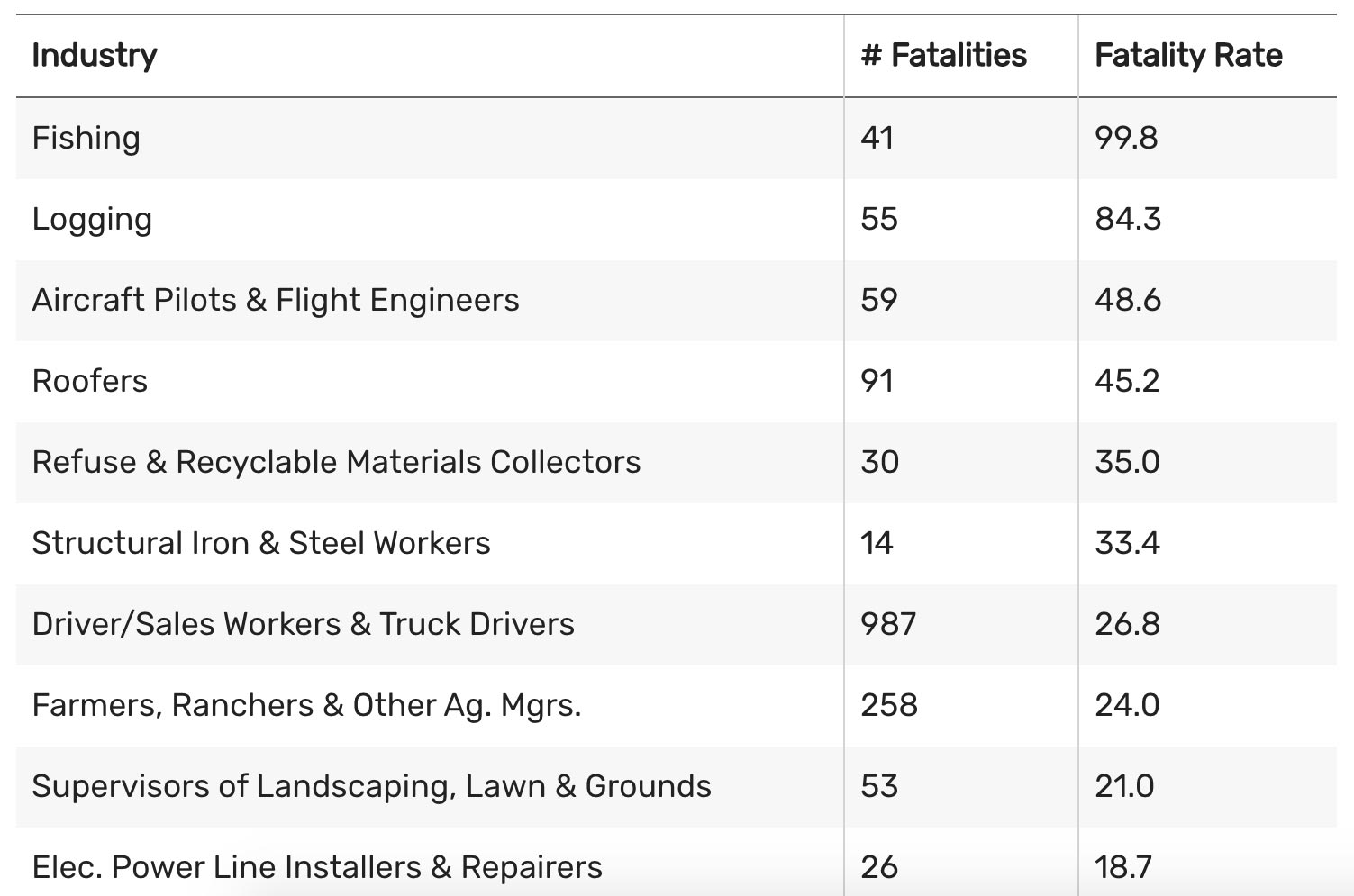

Occupations with High Fatal Injury Rates in 2017

In 2017, by far the highest fatality rate belonged to the fishing industry, with 41 reported fatalities that year and a 99.8 fatality rate. The logging industry was the second-highest, with a fatality rate of 84.3 and 55 reported fatalities. Runners-up included aircraft pilots and flight engineers, roofers, and refuse and recyclable materials collectors.

Even if your industry doesn’t make the list of the highest recorded employee fatalities annually, you may still have valuable employees that deserve protection regardless. Talk with a Florida independent insurance agent to determine whether key person life insurance is right for your company.

Is Key Person Life Insurance Permanent In Florida?

Both term and universal or whole life coverage options are available for key person life insurance. A business might decide to purchase a term life policy for their key person in increments of five or 10 years. A more permanent employee would benefit from universal or whole life coverage, which would cover them until the time of their death. A Florida independent insurance agent can help you decide which option is right for your business’s needs.

Are Key Person Life Insurance Premiums Tax Deductible in Florida?

No. According to the Internal Revenue Service, premiums on life insurance for key employees are not tax-deductible. That’s why it’s important to plan for the cost of your key person life insurance, since it will affect your business’s budget in advance. A Florida independent insurance agent can also help you by finding the most affordable coverage in your area, as well as scouting out any available discounts that your business may qualify for.

What Is Key Person Disability Insurance?

The other main form of key person insurance is a special type of disability coverage. If the key employee becomes disabled and is unable to perform their job duties, whether completely or partially, the business will receive funding from the policy. Funding from a key person disability insurance policy can help the business to search for and hire a replacement employee as well as recover from lost revenue due to the key person being unable to work.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting businesses from the devastating loss of a key employee and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in key person insurance and business insurance, deliver quotes from several sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.thebalancesmb.com/most-hazadous-occupations-462793

iii.org

irmi.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.