Even when you work for yourself, there are still a few risks you’ve got to keep in mind on a daily basis. One of the most important things to consider is your health. It’s crucial to be equipped with adequate self-employed health insurance if you’re not with a traditional employer.

Fortunately a Florida independent insurance agent can get you set up with the right self-employed insurance for you. They’ll even get you equipped with coverage long before you need to use it. But until then, here’s a deep dive into this critical coverage.

What Is Self-Employed Insurance?

Insurance expert Jeffery Green explained that self-employed insurance almost always refers to the health insurance needed by those who work for themselves. Without a traditional employer, self-employed individuals are responsible for providing their own health coverage. One benefit of this, however, is that self-employed workers can deduct 100% of these premiums from their taxable income.

What Does Self-Employed Insurance Cover in Florida?

Self-employed insurance in Florida protects individuals who work for themselves against many types of healthcare costs that could otherwise be extremely expensive out of pocket. Self-employed insurance often covers:

- Various medical bills

- Various routine treatments

- Various hospital bills

Make sure to work with a Florida independent insurance agent to be certain of what your specific self-employed health insurance policy covers.

Self-Employed Industry Stats for Florida

When considering the coverage needed by self-employed individuals in Florida and the US overall, it’s helpful to know which industries have the most of these workers. Check out some stats below.

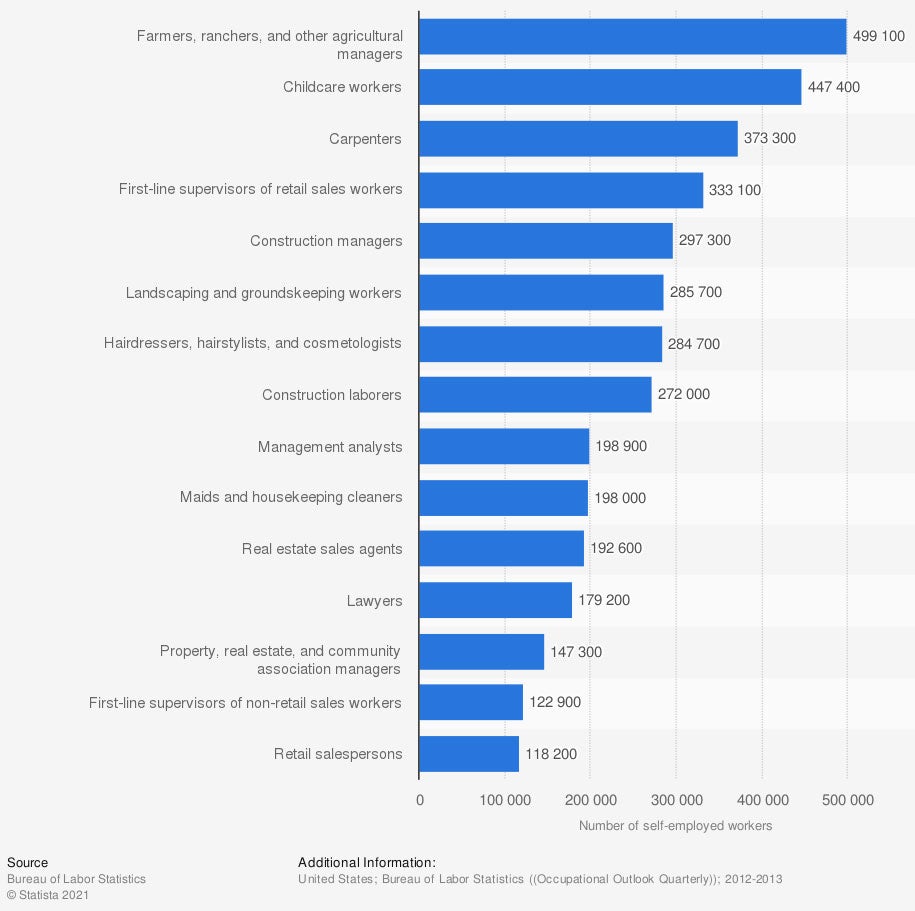

Projection of the occupations with the most self-employed workers in the US

In the near future, farmers, ranchers, and other agricultural workers are expected to make up the vast majority of the self-employed market, at 499,100 employees total. Childcare workers (447,400) and carpenters (373,300) are projected to be second-highest.

With hundreds of thousands of self-employed workers in several different US industries, self-employed insurance is absolutely critical in all areas.

What’s Not Covered by Self-Employed Insurance in Florida?

To determine what your self-employed insurance doesn’t cover or specifically excludes, it’s important to review your policy along with your Florida independent insurance agent. Because self-employed health insurance plans vary so widely in their exclusions and coverages, it’s crucial to be familiar with your own policy’s details. That’s also why it’s so important to review the finer details of each plan before you make your selection.

Florida Self-Employed Health Insurance Cost

Costs of self-employed health insurance in Florida tend to vary depending on a few different factors. Self-employed insurance is often priced based on the following:

- Policyholder occupation

- Policyholder age

- Policyholder health history

- Policyholder location

- Policyholder lifestyle and hobbies*

*Smokers often pay more for coverage than non-smokers. Self-employed health insurance often ranges from $200 to $500 monthly, but these numbers can vary widely. A Florida independent insurance agent can help you find exact quotes for self-employed insurance in your town.

Do Florida Self-Employed Workers Need Workers’ Compensation?

Workers’ comp is sometimes required for self-employed workers, depending on location and occupation. Self-employed contractors are often required to have workers’ comp because customers can request to see proof of coverage before a job is completed. But since certain health insurance plans exclude work injuries, workers’ comp is crucial for many self-employed workers.

Another important type of self-employed worker to consider getting workers’ comp is anyone who currently relies on a spouse’s health coverage. Your job-related injuries or illnesses may not be covered under their employer-provided health insurance. However, a Florida independent insurance agent can help you get set up with enough self-employed insurance to cover you.

Florida Disability Insurance for Being Self-Employed

Disability coverage in Florida will have different requirements based on occupation. Self-employed roofers need different disability insurance than self-employed lawyers, and so on. The underwriting process for disability insurance for self-employed individuals tends to be more complex and extensive than for traditionally employed individuals.

Self-employed workers might be required to provide tax returns and proof of employment to insurance companies before being approved for disability coverage. Luckily a Florida independent insurance agent can help by telling you which documents will be necessary when hunting for self-employed disability insurance.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in self-employed insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

stats - https://www.statista.com/statistics/207331/forecast-of-the-number-of-self-employed-us-workers-by-occupation/

https://www.iii.org/article/can-i-deduct-my-health-insurance-premiums-my-income-tax-return

https://www.irmi.com/articles/expert-commentary/the-workers-compensation-self-insurance-decision

© 2024, Consumer Agent Portal, LLC. All rights reserved.