Of all the places to own a property, a large body of water can be tranquil. However, if you're going to live by the ocean, you should account for the risks associated with the open seas. Florida homeowners insurance will include coverage for your property, but not flooding.

Fortunately, a Florida independent insurance agent can help you find the right flood policy for your budget. They work with FEMA-approved carriers so that you can relax. Connect with a local expert to get started today.

What Is Flood Insurance?

When you live in Florida, flood insurance is a must. First, you should understand how it works. Take a look at how flood insurance can help:

- Flood insurance: This type of property insurance covers a structure for losses due to a flood. This is caused by snow melting, storm surges, heavy rainfall, storm drainage system failures, and even levee dam system failures.

What Does Flood Insurance Cover in Florida?

It's essential to know what your flood insurance policy will replace or repair in the event of a loss. Check out what your Florida flood policy will cover:

- Electrical and plumbing systems

- Furnaces and water heaters

- Appliances

- Flooring

- Detached garages

- Personal belongings

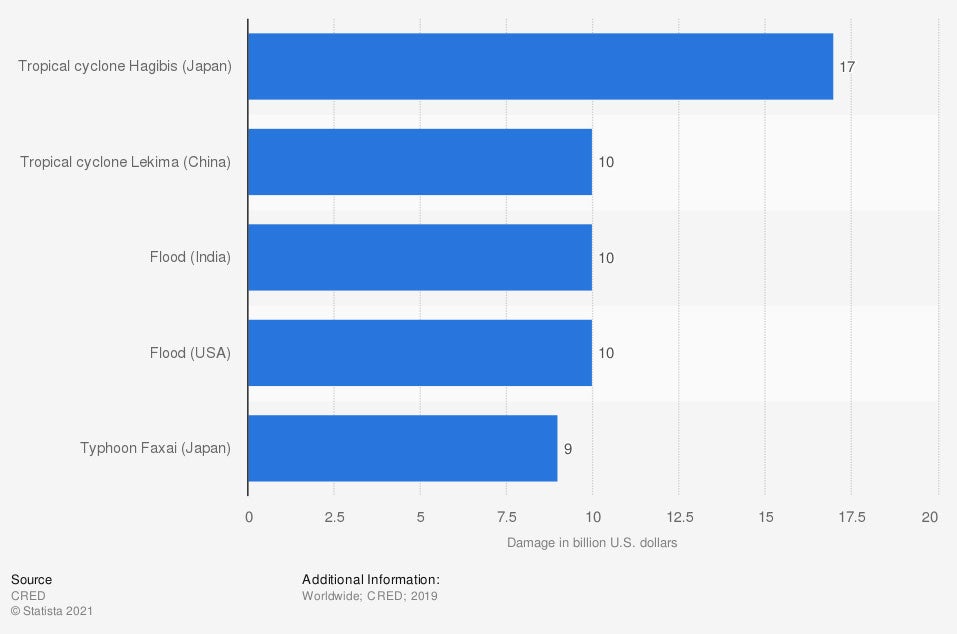

Natural disasters with the most economic damage worldwide in 2019 (in billion US dollars)

Floods are among the top five natural disasters that caused the most economic damage in 2019. A flood could occur at any moment and with little warning.

What Doesn't Flood Insurance Cover in Florida?

Your Florida flood insurance will have losses that it won't insure. It's essential to understand what a flood is:

- What is considered a flood: A flood is an excess of water on land that is usually dry. This typically is classified as affecting two or more acres of land or two or more properties.

Losses that are generally excluded from your flood policy:

- Water/sewer back-ups

- Burst pipes

- Waterline malfunctions

- Roof leaks

How Is Flood Insurance Calculated in Florida?

Carriers look at your individual risk factors when calculating your flood insurance costs. Pricing depends on personal and outside elements, but the average annual flood insurance premium in Florida is $592. Items that may affect your Florida flood policy rates are:

- The location of your property

- The flood zone of your property

- Whether the property is residential or commercial

- Your insurance score

- Your loss history

- Prior coverage history

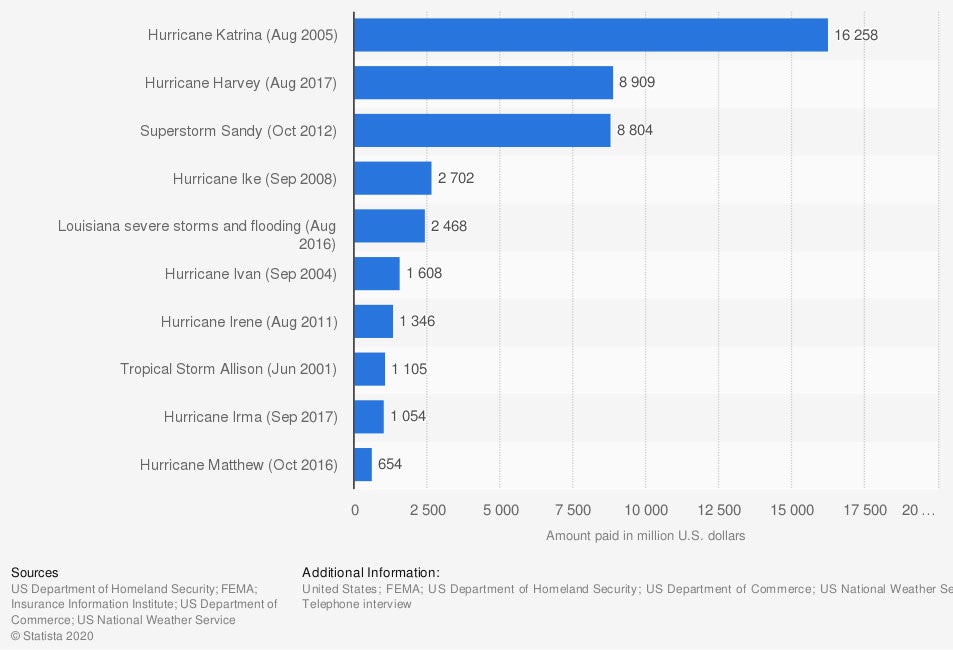

Most expensive flood disasters in the US from 1978 to 2019, by National Flood Insurance Program (NFIP) payouts (in million US dollars)

While flood insurance is not always a requirement for every property, it is usually necessary. You never know when a flood will strike, and it's better to be prepared for the worst.

How Much Flood Insurance Is Necessary in Florida?

FEMA offers a maximum coverage amount per structure depending on the property type. While you'll need to review your policy with a trained professional, it's good to understand what's out there. Limits are as follows:

- Flood insurance for your home: Flood carriers usually offer $250,000 for the building and $100,000 for the building contents.

- Flood insurance for your business: Flood carriers usually allow $500,000 for the building and $500,000 for the building contents.

- Flood insurance as a renter: Flood carriers typically offer $100,000 for contents-only coverage.

How a Florida Independent Insurance Agent Can Help

In Florida, the chances of a flood affecting your property are greater than most. When you live by a body of water, you're more at risk for a flood loss to occur. Fortunately, a trusted adviser can review your policies for free and help you find flood coverage fast.

A Florida independent insurance agent will have access to several markets so that you don't have to do the searching alone. They'll even do the shopping for you at no additional cost, making it a no-brainer. Connect with a local expert on TrustedChoice.com to get started in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/273895/natural-disasters-with-the-most-damage/

https://www.statista.com/statistics/216501/most-expensive-us-flood-disasters/

http://www.city-data.com/city/Florida.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.