When you're purchasing a home, there are a lot of steps. One of the most critical is how you'll be insuring your property. Mortgage insurance can be confusing, but a Florida homeowners insurance agent can help.

A Florida independent insurance agent will know the policies and coverages necessary to protect your assets. They'll even do the shopping for you at no cost. Get connected with a local expert for quick quotes.

What Does Your Homeowners Insurance Cover in Florida?

First, you'll want to know how your homeowners insurance will protect your property in Florida. Then you can determine what mortgage insurance will cover if needed.

How your home coverages are broken down:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home uninhabitable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

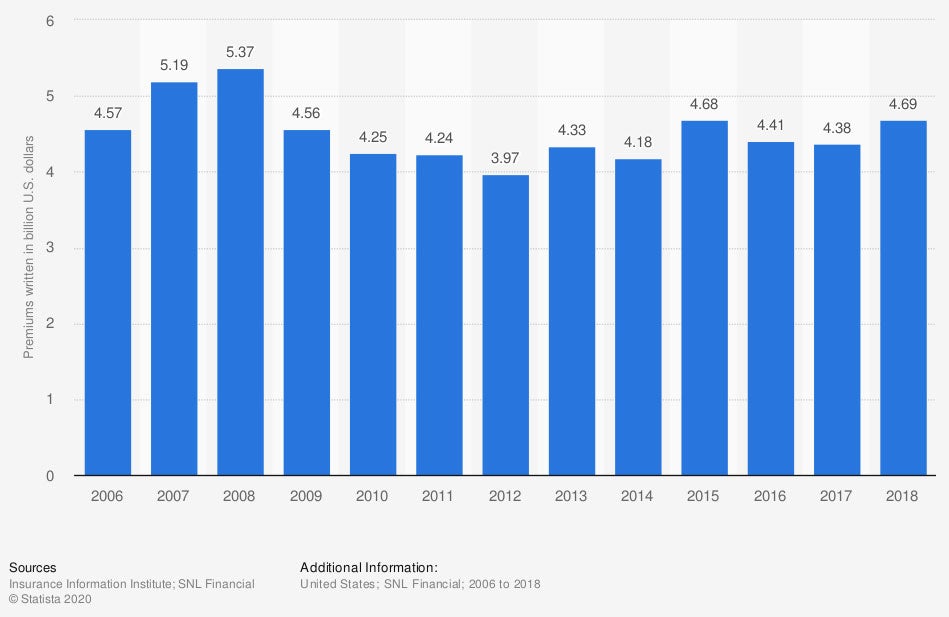

Value of net premiums written by mortgage guaranty insurance in the US from 2006 to 2018(in billion US dollars)

Mortgage insurance is a whole other ballgame separate from your primary homeowners policy. You may be required to carry mortgage insurance depending on your lender.

What Is Florida Mortgage Insurance?

Mortgage insurance is not something that protects you as the homeowner, but instead protects the lender. If the lender thinks you are at a higher risk for defaulting, mortgage insurance, or PMI, pays part of the loan balance back to the lender.

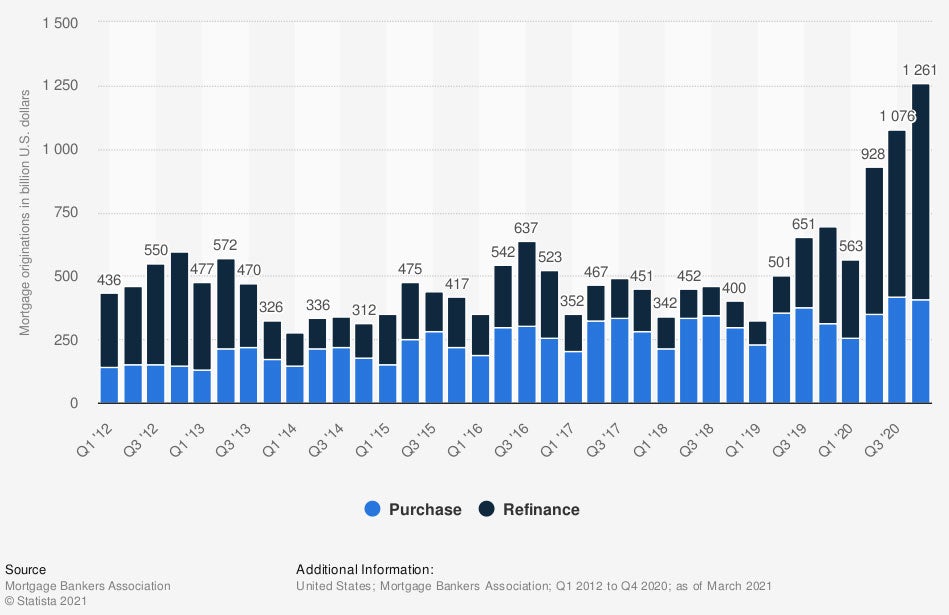

Mortgage originations in the US from 1st quarter 2012 to 4th quarter 2020, by type (in billion US dollars)

If you're getting a mortgage, you're not the only one. There are billions of dollars in mortgages that originated in the US alone.

Who Needs Florida Mortgage Insurance?

How to determine whether you need mortgage insurance is more up to the lender. The mortgage company decides how much of a risk you are and what they are willing to allow. Check out the risk factors lenders use to determine if your home needs mortgage insurance:

- Loan to value: If your loan to value is higher than 80%, the lender will usually require mortgage insurance.

- Credit score: If your credit score is low, the lender may require mortgage insurance.

- Down payment: If your down payment is less than 20% of the purchase price.

How Mortgage Insurance Is Calculated in Florida

If you need mortgage insurance due to not having enough down payment or the lender requiring it, then you may want to know how it's calculated.

Your mortgage insurance costs can fall anywhere from 0.22% to 2.25% of the loan value. This is how the lender decides what you'll pay:

- Loan size: If you have a larger loan, you can expect to be charged a higher percentage of mortgage insurance.

- Credit score: If you have a less than satisfactory credit score, then your mortgage insurance will likely be higher.

How a Florida Independent Agent Can Help

Mortgage insurance in Florida may be necessary if you fall into any of the above categories. However, it can be confusing if you're not a licensed professional. When you have some help identifying how your PMI is calculated, it can make things more straightforward in the home buying process.

A Florida independent insurance agent will review your policies for free. They have a network of carriers and lenders that they recommend, so you're only working with the best. Connect with a local expert to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffery Green

https://www.statista.com/statistics/429053/net-premiums-written-by-mortgage-guaranty-insurance-usa/

https://www.statista.com/statistics/275722/mortgage-originations-in-the-united-states/

http://www.city-data.com/city/Florida.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.