All drivers on the road must be aware of various threats to themselves, their passengers, and their vehicles at all times. Drivers in Florida, however, have to be extra careful about natural disasters like hurricanes. It’s important to understand whether your regular car insurance policy protects against hurricane damage.

Fortunately a Florida independent insurance agent can help get your vehicle protected against hurricane damage and more. They’ll also get you set up with the right car insurance policy long before you need to file a claim. But first, here’s a closer look at car insurance and what it covers.

What Is Hurricane Insurance?

Your standard Florida homeowners insurance policy includes protection for windstorms like hurricanes. However, Florida is required to have a separate windstorm deductible in their homeowners insurance policies, along with 18 other states.

Windstorm coverage under a homeowners insurance policy protects against the high winds from hurricanes and other natural disasters. However, to protect your home against natural flood damage, you’ll need to ask your Florida independent insurance agent about flood insurance.

What Does Hurricane Insurance Cover?

Hurricane coverage is built into standard homeowners insurance policies, but the additional windstorm coverage amplifies your home’s protection. Technically this extra coverage is not referred to as “hurricane insurance,” but rather “wind and hail coverage.”

These policies protect your home against two major components of hurricanes and other damaging disasters, the heavy winds and possible hail. A Florida independent insurance agent can help your home get all the protection it needs against every natural disaster.

What’s Not Covered by Hurricane Insurance?

While hurricane insurance, or wind and hail coverage, provides crucial additional protection for your home, it also has an important exclusion. Hurricane or wind and hail insurance will not cover your home against water damage after a natural flooding event, such as from a hurricane.

If your home gets damaged by a natural water source like heavy rain from a storm, your homeowners insurance and wind and hail coverage won’t reimburse you for the damage. The only way to protect your home against natural flooding is with a separate flood insurance policy.

How Costly Is Hurricane Damage?

When considering additional hurricane protection for your home or vehicle, it’s helpful to know just how damaging and costly these storms really are. Check out some recent hurricane stats for the US below.

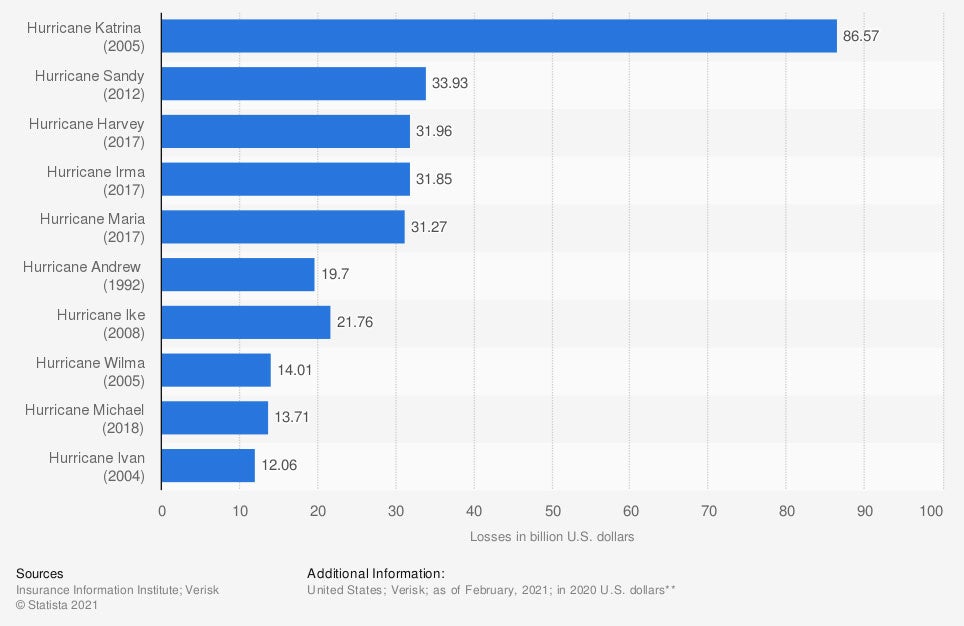

Most expensive hurricanes in the United States, by insured property losses (in billion US dollars)

The costliest hurricane to date was Hurricane Katrina, which cost the US $86.57 billion in total property losses, including homes and vehicles. Second-costliest was Hurricane Sandy, which cost the nation $33.93 billion in total property losses.

Just one hurricane can cost the entire country billions of dollars in property damage losses. That’s why it’s so important to make sure all of your property, including your home and vehicle, is protected from these devastating disasters.

Does Car Insurance Cover Hurricane Damage in Florida?

According to insurance expert Paul Martin, your car insurance will cover hurricane damage if you purchased comprehensive, or “other than collision,” insurance. Comprehensive car insurance covers vehicle damage from hurricanes, as well as the following disasters:

- Windshield damage

- Fire

- Falling objects

- Missiles and explosions

- Collisions with large animals

- Vandalism and riots

Your Florida independent insurance agent can help your vehicle get protected with the right comprehensive car insurance policy to guard against hurricane damage and much more.

Common Insurance Claims for Hurricane Damage

Unfortunately, hurricane claims can be a fairly frequent occurrence in Florida. Review the following common hurricane damage claims to better prepare yourself against unexpected disaster.

The top four hurricane property damage claims are:

- Roof damage: Hurricane claims are often for homeowners’ roofs that were damaged by wind, rain, or hail.

- Utility damage: Hurricane claims also often stem from damaged power lines, plumbing systems, and amenities such as telephone and Wi-Fi.

- Equipment damage: AC units and other equipment in the home are also vulnerable to hurricane damage, and account for a large portion of all hurricane claims.

- Interior damage: Finally, the interior of the home, such as the floors, ceilings, and any personal belongings, commonly get damaged by hurricanes’ wind, rain, hail, or resulting mold.

A Florida independent insurance agent can help you get protected against the top hurricane damage claims for your home and other property.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in car insurance and homeowners insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/428934/most-costly-hurricanes-usa-by-property-losses/

https://www.iii.org/article/hurricane-season-insurance-guide

https://hurricanepropertydamageclaims.com/types-of-hurricane-property-damage-claims/

© 2024, Consumer Agent Portal, LLC. All rights reserved.