Every property is at risk for loss, no matter where you live. Some claims are unavoidable and will need to be filed with insurance. Florida homeowners insurance could increase when you have a claim.

Fortunately, a Florida independent insurance agent can help you review your coverages and prepare for the worst. They'll make sure you know how your policy works and what you should claim. Connect with a local expert for tailored protection options.

What Does Homeowners Insurance Cover in Florida?

Your Florida homeowners insurance will have some risks that it will automatically insure. Fire, theft, wind, lightning, and severe weather are usually always covered. The majority of homeowners policies will be broken down like this:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home uninhabitable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

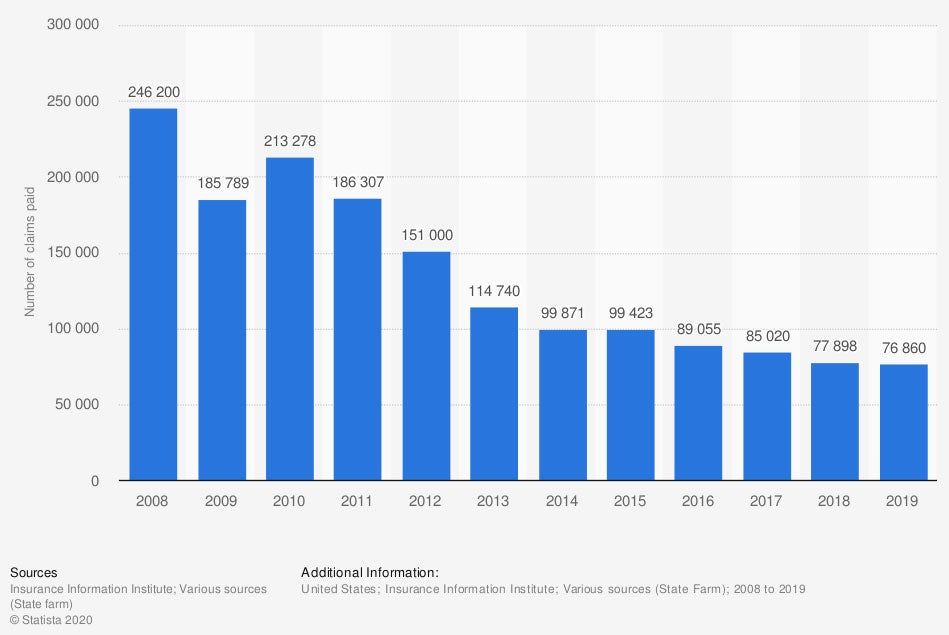

Number of homeowner insurance claims paid due to lightning losses in the US from 2008 to 2019

Lightning is a common occurrence for any property owner. Luckily, it's covered under your home policy.

Common Catastrophes in Florida

In 2020, Florida had $3,456,451,000 in home insurance claims paid. While you can't avoid every loss, you can be prepared for the most common for Florida. Check out the top catastrophes in Florida:

- Wildfires and residential fires

- Hurricanes and tropical storms

- Severe storms and lightning

- Flooding and water damage

- Burglary and other property crimes

Will Homeowners Insurance Costs Increase after a Claim?

One claim by itself won't usually impact your rates, unless you switch carriers. Your homeowners insurance premiums will usually increase after a claim. This is because carriers look at loss history as one of their rating factors. Check out the items insurance companies use when calculating your costs:

- Location

- Replacement value

- Coverage limits

- Insurance score

- Prior claims reported

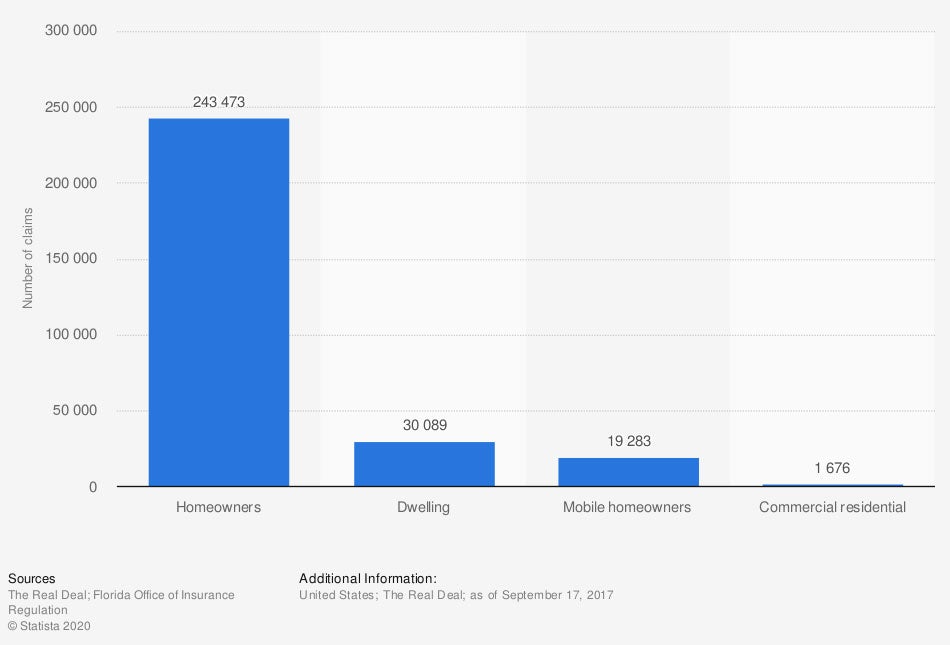

Number of residential property insurance claims filed after Hurricane Irma in Florida as of September 2017, by type

In Florida, you'll have a lot of hurricane activity, which could cause you to report a loss. Your homeowners policy will help cover your expense should you need to use it.

Additional Homeowners Insurance Options in Florida

When it comes to protecting your home, there are a couple more options in addition to your homeowners policy. Take a peek at some coverage choices you'll have in Florida:

- Flood insurance: Pays for damage due to flooding to your home.

- Umbrella insurance: Pays for a liability claim when your underlying home policy limits have been exhausted.

These two policies are crucial when obtaining insurance. Flood coverage alone is a must when you live in a coastal state, and every home has the risk of flooding.

How a Florida Independent Insurance Agent Can Help

When you're insuring your property, it takes some proactive thought. You'll need to prepare for the worst and hope for the best, since no one has a crystal ball to predict what could occur. If you're not a licensed professional, it may be challenging to know what's needed.

Fortunately, a Florida independent insurance agent can help with policy and premium options that won't break the bank. They'll even do the shopping for you for free, making it a no-brainer. Connect with a local expert on TrustedChoice.com for custom quotes today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/217232/paid-claims-by-us-homeowners-insurers-due-to-lightning-losses/

https://www.statista.com/statistics/752057/insurance-claims-filed-after-hurricane-irma-florida-by-type/

http://www.city-data.com/city/Florida.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.