When you own a property, there are numerous exposures that could create big losses. It can be challenging to know if your policy has the right coverage. While you won't be able to predict the future, you can prepare for it.

A Florida independent insurance agent has access to several carriers so that you have options on your Florida homeowners insurance. They even do the shopping for you at no additional cost. Connect with a local expert for custom quotes to start.

What Does Homeowners Insurance Cover in Florida?

Let's start with some of the most common losses that could befall your Florida home. Fire, wind, hail, lightning, and theft are all major concerns and are typically covered under your insurance. The majority of homeowners policies have the following coverages:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home uninhabitable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

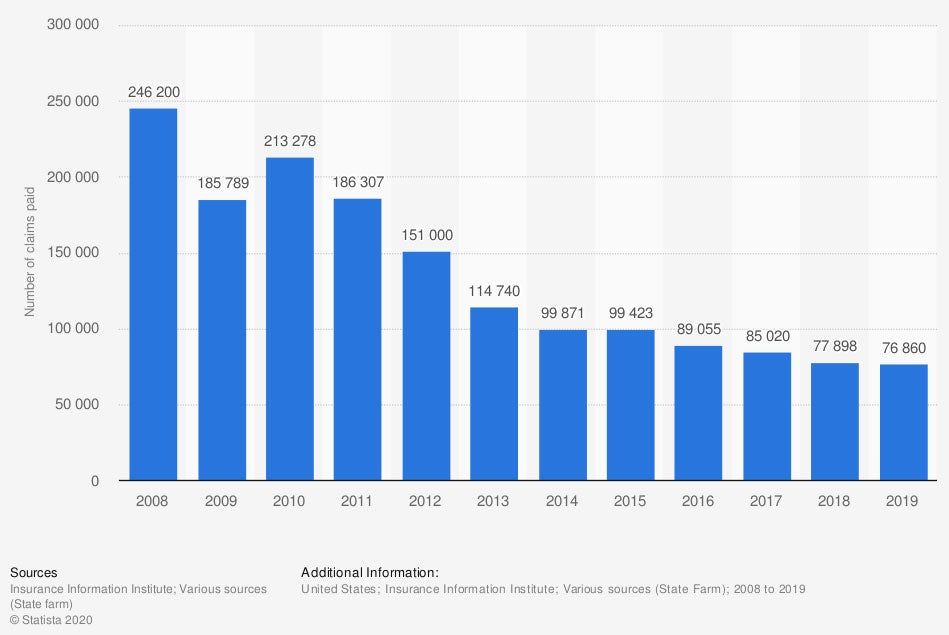

Number of homeowner insurance claims paid due to lightning losses in the US from 2008 to 2019

Severe storms and lightning can often occur at any home. Therefore, it's important to understand how your area is affected by loss for proper coverage.

Catastrophes That Occur in Florida

Every state has a list of natural disasters that occur most often. In 2020, Florida had $3,456,451,000 in homeowners claims paid. Some of the common ones you'll want protection for are:

- Wildfires and residential fires

- Hurricanes and tropical storms

- Severe storms and lightning

- Flooding and water damage

- Burglary and other property crimes

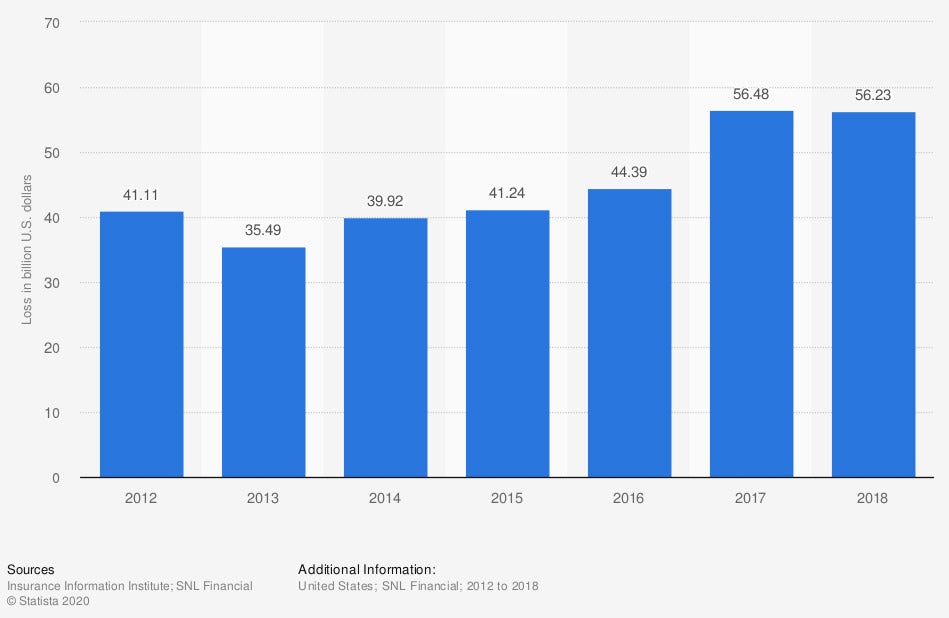

Incurred losses for homeowner insurance in the US from 2012 to 2018 (in billion US dollars)

A home loss can be costly if you're not properly insured. Your policy can come in handy when a claim has to be filed due to a catastrophe.

How Are Homeowners Insurance Claims Paid in Florida?

Carriers will pay out claims according to your policy coverage selection. Most homeowners insurance limits are insured the same way. Check out the different values your property could be replaced or repaired as:

- Replacement cost: Pays to replace your property to its like kind and quality when a claim occurs. This typically applies to your home structure itself and belongings.

- Actual cash value: Pays to replace or repair your property to the current market value. This usually applies to your belongings and roof after a certain age.

Some carriers will pay for the loss with the company replacing or repairing the item without you getting too involved. Other companies will ask you to provide receipts for belongings and reimburse you once they have proof you've replaced said items.

How a Florida Independent Insurance Agent Can Help

When you're shopping for homeowners insurance, the cost is important. If you have any past claims on your record already, then your premiums could be more expensive. In addition, there are numerous carriers you can shop through, making it challenging to know what's best.

Fortunately, a Florida independent insurance agent can help with policy and premium options that fit your budget. They will do the comparing at zero cost to you, making it easy. Connect with a local expert on TrustedChoice.com to get started in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffery Green

https://www.statista.com/statistics/217232/paid-claims-by-us-homeowners-insurers-due-to-lightning-losses/

https://www.statista.com/statistics/428998/incurred-losses-for-homeowners-insurance-usa/

http://www.city-data.com/city/Florida.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.