Before you ever start your engine, you’ve got to be aware of the numerous threats lurking around every turn on the road. But your vehicle is actually at risk before it ever leaves the driveway. That’s why it’s so important to have enough car insurance at all times.

Luckily a Florida independent insurance agent can help you find the right car insurance for your needs. They’ll even get you set up with this important coverage long before you ever need to file a claim. But first, here’s a closer look at how much car insurance you really need in Florida.

How Much Car Insurance Do I Need?

No matter where you live, you always need to be equipped with at least your state’s bare minimum legal requirements for car insurance. In Florida, the mandatory types of car insurance are:

- Property damage liability: Protects you in case you damage property belonging to another with your vehicle.

- Personal injury protection: Protects you and any passengers in your vehicle in case of injury after an accident.

A Florida independent insurance agent can help ensure that you get equipped with at least the minimum car insurance requirements in your area.

Do I Need Full Coverage Car Insurance in Florida?

According to insurance expert Paul Martin, “full coverage” car insurance isn’t a standard industry term. Rather, folks who ask for “full coverage” are typically referring to a car insurance package that contains the following:

- Liability insurance: Covers you in the event of a lawsuit filed by a third party for claims of bodily injury or personal property damage caused by your vehicle.

- Collision insurance: Reimburses you for damage to your own vehicle in the event of a collision with another vehicle or object.

- Comprehensive insurance: Covers you against numerous other threats, including theft, windshield damage, explosions, and more.

Though bodily injury liability insurance isn’t legally required in Florida, it’s a crucial coverage to consider. Collision coverage and comprehensive coverage are also critical options you may want to add to your policy.

How Much Does Full Coverage Car Insurance Cost?

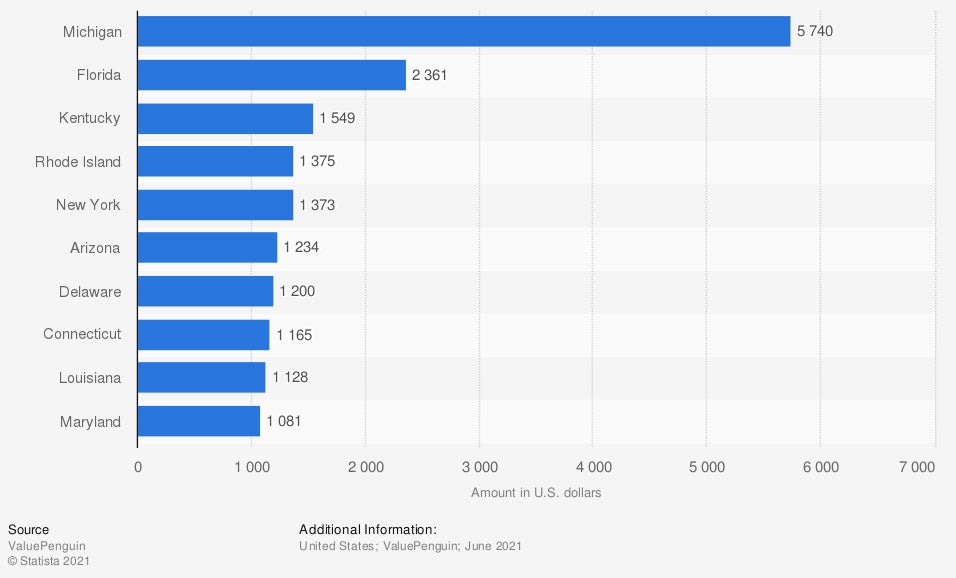

Before shopping for coverage, it’s a good idea to have some cost figures in mind. Though full coverage isn’t a standard type of car insurance, the average annual car insurance premium for drivers in Florida can be seen in the graph below.

Estimated annual car insurance premiums in the United States, by state (in US dollars)

Florida comes in second place overall for the highest cost of car insurance in the nation. This year, annual car insurance premiums for Florida residents are estimated to be $2,361. Only Michigan’s car insurance premiums are more expensive, at an estimated $5,740 annually.

A Florida independent insurance agent can help you find exact quotes for car insurance in your area.

When Is the Best Time to Buy Car Insurance?

While you need to have car insurance in place before you ever drive a new vehicle off the lot or old vehicle out of the garage, there are various times when it’s important to shop around for new, potentially cheaper coverage. The most common time to find savings on another auto insurance policy is after a major life event, such as:

- A traffic violation clearing from your record

- Certain major birthdays (e.g., 25, 40, etc.)

- Getting married

- Moving

- Buying a home

- Earning a degree

Your Florida independent insurance agent can help recommend ideal times to shop around for the cheapest car insurance in your area, and compare new policies and rates for you.

How Does My Driving Record Affect My Car Insurance Rate?

One of the biggest influencing factors in your car insurance rate is your history of traffic violations. If you have a more colorful record full of accidents or traffic violations, your rates are likely to skyrocket compared to individuals with squeaky-clean records.

If you have accidents or other violations on your record, the insurance company will see you as riskier to insure. When insurance companies perceive a greater risk, they charge heftier premiums. This fact just creates all the more incentive to be safe and responsible while on the road.

What Are the Risks of Driving Uninsured?

If you drive while uninsured, you can risk a whole lot of things, including your license. Your driver’s license can be suspended if you’re caught driving without the state’s minimum coverage requirements for car insurance.

Without car insurance, you also risk costly tickets and the lack of financial reimbursement after an accident or other disaster. Just one lawsuit against you could be financially devastating without the liability coverage provided by standard car insurance policies. It’s always a safe bet to just be insured from the very start.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect vehicle owners against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in car insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/675367/annual-auto-insurance-premiums-usa-by-state/

https://www.investopedia.com/terms/p/personal-injury-protection-pip.asp

https://www.caranddriver.com/car-insurance/a36190599/best-day-to-buy-car-insurance/

© 2024, Consumer Agent Portal, LLC. All rights reserved.