Picture this. You’re sitting in your kitchen enjoying a cup of coffee, when all of a sudden you hear the sound of glass breaking. Now you’ve got a shattered window and a new golf ball you didn’t order. But who has to file the insurance claim if you weren’t at fault? Who’s responsible for this mess, anyway?

Fortunately a Florida independent insurance agent can not only answer this question for you, but also help you find the right homeowners insurance policy. They’ll also get you equipped with it before you have to file any claim, no matter how bizarre. For starters, here’s how home insurance would work if a golf ball came sailing through your window.

Who’s Responsible for Covering the Damages If a Golf Ball Smashes Your Window?

The coverage you have under your Florida homeowners insurance pays for a lot of things, from the common to the downright strange. Fortunately that means it would probably cover your smashed window in this scenario. Of course, if you found the guilty party you could sue them for the damage, but that probably wouldn’t be easy.

In an event like this one, it’s smart to be prepared to file a claim through your own insurance. Hopefully knowing that you have coverage even for incidents like these can help you rest easier in your home. Your Florida independent insurance agent can also further explain how your home insurance would cover you in many different scenarios.

Could I Be Held Responsible for the Golf Ball Smashing My Window?

Insurance expert Paul Martin said that you could very well be held responsible if you lived on a golf course. Since you assume this extra risk when purchasing a property on a golf course, the insurance company is likely to exclude coverage for any stray golf balls. So, if you buy a house on or near the putting green, just be prepared to cover any related damage yourself.

If I’m Responsible, How Much Do I Have to Pay?

Though your homeowners policy is likely to cover the golf ball incident, you might find that the amount of damage to your window doesn’t exceed your policy’s deductible. You’re responsible for paying your deductible out of pocket before your policy will start reimbursing you for covered disasters.

If the damage to your window was minor, it might not be worth filing a homeowners insurance claim. But if the golf ball broke a stained glass or otherwise valuable window, it’s a good idea to go ahead and file. Your Florida independent insurance agent can further advise you and help you review your policy’s deductible amount.

How Likely Is It That I’ll Get My Window Smashed by a Golf Ball in Florida?

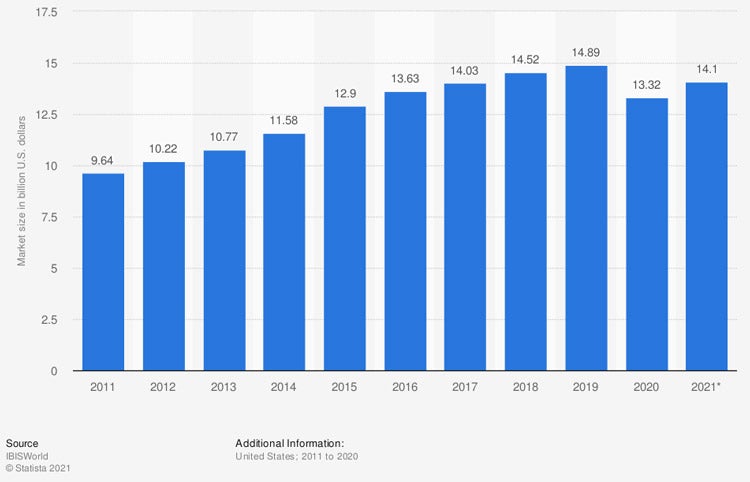

Florida is known for many things, one of them being golfing. But it’s not just Floridians that love to golf. The industry is growing in the US overall. Check out the chart below and see for yourself.

Market size of the golf driving ranges & family fun centers industry in the US

Golf driving ranges have continued to be an industry exceeding $10 billion for many years. The market size of this industry jumped from $9.64 billion in annual revenue to $14.1 billion within a decade.

Since the sport continues to grow in popularity, that means there are more and more golf balls on the loose. Unfortunately, one day you might just find a new one in your kitchen or living room. That’s why it’s so important to be prepared ahead of time.

What Else Does Homeowners Insurance Cover in Florida?

Your Florida homeowners insurance includes coverage for many threats beyond window-smashing golf balls. Basic coverages included in your policy are:

- Additional living expenses: Reimburses for additional living costs like hotel stays and takeout meals if you’re forced to live somewhere else while your home is being repaired.

- Structural coverage: Reimburses for covered causes to your home’s structure, such as natural disasters and more.

- Contents coverage: Reimburses for covered causes to your belongings like clothing and furniture for theft, fire, and more.

- Liability coverage: Reimburses for legal fees if you get sued by a third party.

A Florida independent insurance agent can review your homeowners policy with you, and even help you add coverages if you’re in need.

What Isn’t Covered by Florida Homeowners Insurance?

Fortunately your Florida homeowners insurance should protect you from stray golf balls and many other perils. However, it also comes with its own list of exclusions, like:

- Natural flood damage

- War or nuclear fallout

- Insect infestations

- Home-based business costs

- Earthquake damage

- Routine maintenance

For residents of Florida, it’s important to consider adding a separate flood insurance policy to protect your home from damage from natural floodwaters. Your Florida independent insurance agent can help.

Here’s How a Florida Independent Insurance Agent Would Help

Florida independent insurance agents are fully equipped to protect homeowners against commonly faced liabilities. Independent insurance agents shop multiple carriers to find providers who specialize in homeowners insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

https://www.statista.com/statistics/1174931/driving-ranges-family-fun-centers-market-size/

© 2024, Consumer Agent Portal, LLC. All rights reserved.