While technology, like computers and virtual storage, has allowed residents and business owners alike to cut corners and complete routine tasks more easily, unfortunately it’s also left them vulnerable to attacks by cybercriminals. Regardless of how dependent (or not) you or your specific business are on the Internet or electronic data storage, you’re not immune to holes in virtual security.

Fortunately, a Florida independent insurance agent can get you the right protection for you or your business. This means having adequate Florida cyber liability insurance. But for starters, here’s a guide to preventing cybercrime in the first place.

Steps to Preventing Cybercrime in Florida

Cybercrime can be costly and even traumatic depending on what exactly the cybercriminals manage to get their hands on. Fortunately, you don’t have to be a victim. There are tons of proactive steps you can start taking today to protect yourself and increase your peace of mind.

Take the following steps today to start protecting yourself against cybercrime:

- Update your software regularly: Though the seemingly constant notifications to update your software may be annoying, they really are trying to protect you. The longer a particular software has been out, the longer hackers have had to figure out a way to infiltrate the system’s defenses. Software updates contain patches to fix any discovered holes in security, so it’s important to stay current.

- Use spam filters: No one likes having to delete tons of electronic junk mail, but spam filters do much more than just sparing you this monotonous task. Good spam filters significantly cut down your chances of accidentally opening phishing emails. Phishing emails appear to be sent from a legit company, but really come from cybercriminals requesting sensitive data like personal logins or billing information.

- Use strong passwords: While it’s tempting to use simple passwords that are easy to remember (like your cat’s name, for example), you can seriously reduce your risk of cyberattacks by choosing stronger passwords. The longer, the better. Try for a password that’s at least 10 characters long and contains a combo of uppercase and lowercase letters, numbers, and special characters.

- Change your passwords: Since you’re already prepared to start using stronger passwords, you might as well change all of them now. It’s a good idea to update your passwords fairly often, so go ahead and upgrade the passwords to your computer’s login, email, online banking, social media, etc. to meet the requirements of strong, secure passwords.

- Study cybercrime trends: Another great line of defense against cybercrime is to stay on a good offense. Research current cybercrime trends to make sure you stay protected. If necessary, hire professionals to help you secure your network.

- Get the right coverage: No matter how many action steps you take to keep yourself safe, unfortunately you’ll never be 100% guarded against cyberattacks. Working with a Florida independent insurance agent to find the right cyber liability policy is the best way to protect yourself from harm caused by cybercriminals.

The more proactive you are about preventing cybercrime in the first place, the better chance you’ll have at maintaining that well-deserved sense of security.

What to Do if You’ve Been a Victim of Cybercrime

Sometimes even the most vigorous efforts towards keeping your system safe and protected from cyberattacks are eventually foiled. In such a case, don’t hesitate to take action. If you believe you’ve been a victim of cybercrime in Florida, take the following action steps ASAP:

- Report the crime: As soon as you notice evidence of a cybercrime, contact the Internet Crime Complaint Center or use the FBI’s tips form on their official website. Complaints are forwarded to local, state, federal, or international law enforcement.

- Contact your credit card company: If you believe your credit card number has been stolen, don’t hesitate to contact the company immediately. Have personal identification documents and bank records handy to be prepared to verify your identity.

- Collect the evidence: Any documentation you have that proves the cybercrime happened (e.g., credit card statements with charges you didn’t authorize) should be collected and safely stored in case of an official investigation.

- Change your passwords: You may be tempted to only change the password for whatever was specifically affected, such as your online bank account, but if your system’s already been compromised, it’s a good idea to go ahead and update all of your passwords following the incident.

- Consider changing email addresses or other login information: If a hacker was able to get into one of your online accounts through use of an email address, you might want to just change your email address entirely, especially if you use the same one for multiple logins.

- File insurance claims if necessary: Depending on the type of cybercrime committed and the extent of the damage, you may be eligible to receive reimbursement through your cyber liability policy. Reach out to your insurance company soon after the incident to begin the process. Have all the evidence you collected ready.

Perhaps the only upside to the frequency in which cybercrimes occur is the availability of professional resources in Florida to help you deal with them. In the event of an incident, don’t hesitate to reach out to the appropriate professionals to help you.

Cybercrime Statistics for Florida

Not only is cybercrime a problem for Florida residents, it’s a ginormous problem on a global scale. As technology continues to get smarter, unfortunately hackers and other cybercriminals do as well. Take a look at a handful of cybercrime stats for both the US and the state of Florida.

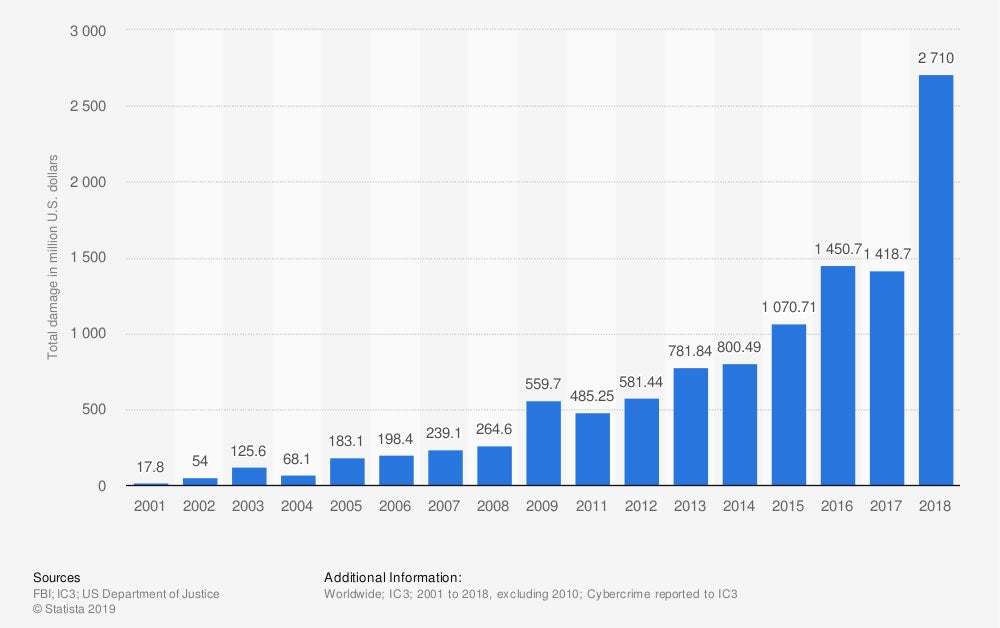

Amount of monetary damage caused by reported cybercrime to the Internet Crime Complaint Center from 2001-2018 (in million US dollars)

Back in 2001, reported cybercrime damages totaled a mere $17.8 million dollars. Less than two decades later, in 2018, losses due to cybercrime shot up to $2.71 billion dollars.

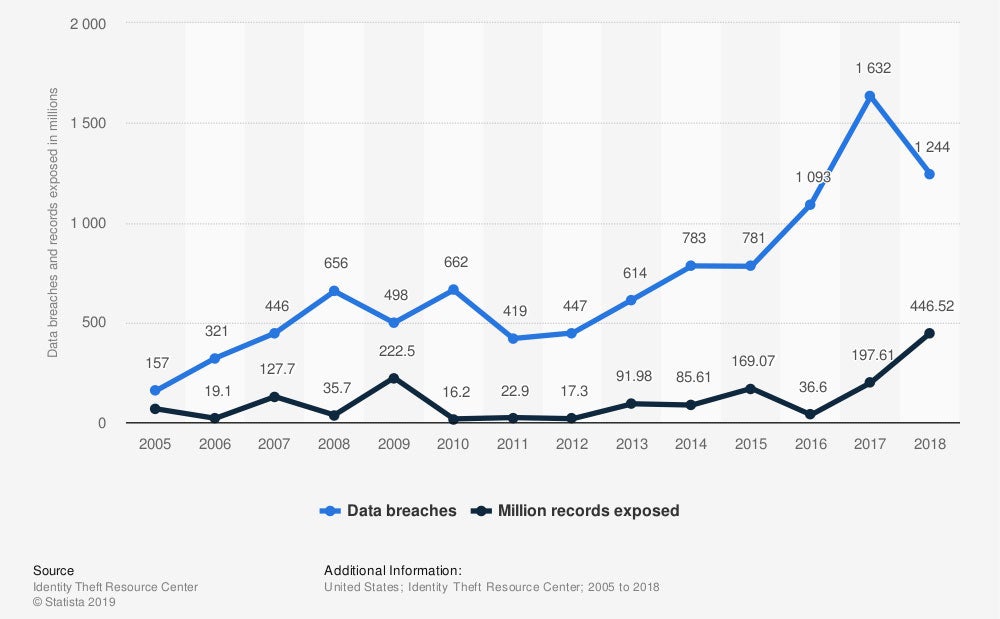

Annual number of data breaches and exposed records in the US from 2005-2018 (in millions)

In 2005, the Identity Theft Resource Center reported a total of 157 data breaches in the US, causing 66.9 million records to be exposed. In 2018, the reported number of data breaches climbed to 1,244, with 446.52 million records exposed as a result. Though the number of data breaches dropped from 2017 (when 1,632 were reported), the number of records exposed more than doubled from the 197.61 million reported the previous year.

Viruses, worms, Trojans, and malware were the most commonly reported cyberattacks in the US. More than half of the affected US businesses reported that it took an average of 68.9 days to fully resolve the incidents.

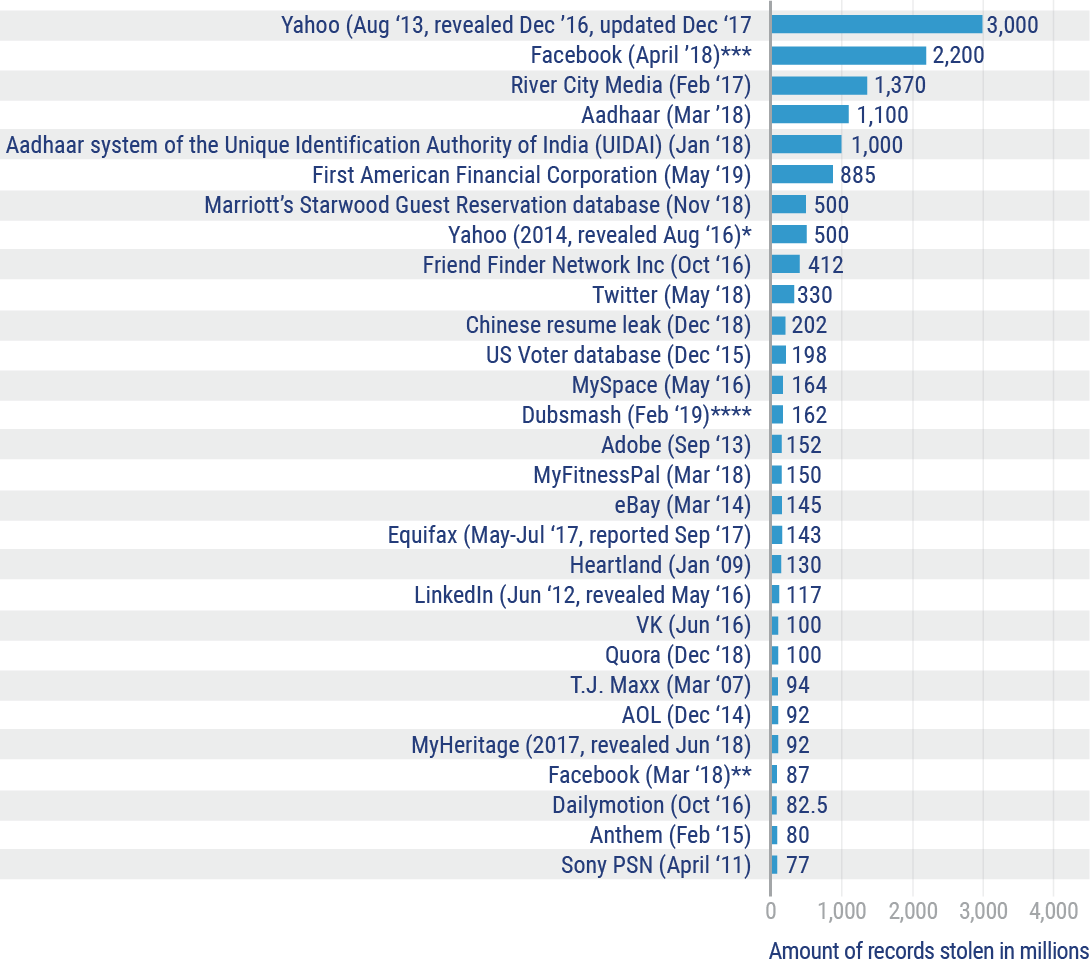

Number of compromised data records in selected data breaches as of May 2019

One of the biggest online data breaches of the past decade affected Sony’s PlayStation Network, which resulted in 77 million data records stolen and the server being offline for longer than 43 days. The largest recorded data breach in history, however, affected the online platform Yahoo. In 2017, the company reported that 3 billion accounts had been compromised by hackers.

Now for some cybercrime stats specific to Florida:

- 21,887 Florida residents have reportedly been victims of cybercrime.

- Florida comes second only to California when it comes to cybercrime frequency.

- $47.3 million has been actually reaped by cybercriminals in Florida.

- Florida ranks third in the US for total revenue lost to cybercrime.

- $110.6 million total has been lost by Florida residents to cybercriminals.

- The top three most common cybercrimes in Florida are non-payment/non-delivery, personal data breach, and identity theft.

With alarming stats like these, it’s all the more important for Florida residents to have the proper protection against cyberattacks and data breaches. Read on to find out more.

Does Insurance Cover Cybercrime?

You bet it does. Cyber liability insurance is specifically designed to protect against the harm cyberattacks can cause. In the event your system is compromised, sensitive data may be stolen and possibly sold to third parties. This can lead to ugly (and costly) lawsuits, not to mention embarrassment or trauma depending on the nature of the attack. Cyber liability coverage is becoming more necessary as time goes on, especially for those who run online businesses.

Florida cyber liability policies may provide a combination of the following types of coverage:

- Loss of income: If you run an online business or otherwise use computers for an aspect of work, you really need cyber liability coverage. If your business’s operations become suspended or slowed due to a cyberattack and you suffer a hit in profits because of it, cyber liability coverage can help replace lost revenue.

- Costs due to damaged reputation: Whether a cyberattack happens to a business or an individual, there’s always a risk of embarrassment or an otherwise damaged reputation, especially if sensitive, personal information is made public. Cyber liability insurance may help provide public relations protections to help keep the media as quiet as possible.

- Legal expenses: For business owners who experience a cyberattack that results in their customers’ personal information getting stolen, they’re likely to get slapped with an ugly lawsuit on top of everything else. Customers may sue the business, or the affected bank may sue for having to cancel their customers’ stolen credit cards. Coverage can pay for things like attorney, court, and settlement fees.

- Hired professionals: Often following a cyberattack, professional programmers or other computer experts have to be called in to help repair damage to the computer system, including removing malware and patching up other holes in security.

Depending on which Florida insurance company you go through, you may be offered different coverage options to pick and choose from, since cyber liability policies aren’t standard across the board. Cyber liability policies are generally so flexible you can choose your coverage limits and deductible amounts, as well.

How Much Does Cyber Liability Insurance Cost in Florida?

Just like any other type of insurance, the cost of your policy will depend on a number of different factors, including the size of your business and its annual gross revenue, or if the policy is for you personally. However, the smaller and less risky your business is to insure, the lower the cost of your premium will be. This basic formula is pretty standard across all types of insurance coverages out there. That being said, it’s sometimes possible to predict a basic range estimate.

For example, residents or smaller companies in Florida with relatively basic computer operations might pay less than $1,000 annually, while large tech giant businesses with all kinds of security needs might pay closer to $10,000 per year or even more. Your Florida independent insurance agent will be able to give you more specific pricing information for cyber liability policies that work for you.

Why Work with a Florida Independent Insurance Agent?

In order to get the protection you need and deserve, you’ll want to work with a trusted expert. And who could be better for the job than a local agent who shares your area code? Independent insurance agents act as your own personal insurance shoppers, offering you tons more options than one-policy companies. With just one call, they’ll hook you up with multiple quotes.

Florida independent insurance agents are armed with knowledge on what coverage is needed in your area, and they’ll get you set up with just enough of it — not too little, not too much. They’ll handle all the heavy lifting so you can rest assured you’ll be set up with the right coverage at the right price.

They’re not just there at the beginning either. If disaster strikes, your Florida agent will be there to help walk you through the claims process and make sure you’re getting the benefits you're entitled to. Now that’s thinking ahead.

Article Reviewed by | Paul Martin

Statista

usa.gov

staysafeonline.org

floridatrend.com

patch.com

business.gov

us.norton.com

businessknowhow.com

itproportal.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.