All modern businesses need protection against cyberattacks and other digital threats, no matter how often their computer systems are used. Hackers don’t discriminate between entirely online businesses and those that only use computers to make sales. That’s why it’s so important to have the right cyber liability insurance.

Fortunately a Florida independent insurance agent can help your business get equipped with enough protection through cyber liability insurance. Even better, they’ll get you set up with this coverage long before you need to use it. But before we get too far ahead of ourselves, here’s a closer look at this crucial coverage.

What Is Cyber Liability Insurance?

Cyber liability insurance, sometimes called cyber security insurance, is an important piece of a complete Florida business insurance package. This coverage is not always included in business insurance policies, but it is becoming more common as modern businesses become more digitally based over time.

Cyber liability insurance provides crucial protection against cyberattacks and data breaches and their associated costs and damages. Your business could be sued after a data breach, which could have devastating consequences without the right coverage. A Florida independent insurance agent can help you find the right cyber liability insurance for your business.

What Are the Different Types of Cyber Security?

When getting coverage for your business, it’s critical to know what aspects of it need the most protection. Start by reviewing some of the different types of cyber security before hunting for the right insurance.

Types of cyber security:

- Information security: Protects a business’s data that’s in transit or in storage.

- Operational security: Refers to permissions that allow users to access your business’s network, as well as the processes determining when and how this data is shared or stored.

- Application security: Protects your business’s software and devices from various threats.

- Network security: Protects your business’s computer system from intrusions by hackers, etc.

A Florida independent insurance agent can help you find the right type of protection for your business that considers all forms of cyber security.

Where Can I Find Cyber Security Insurance?

There are many insurance companies that could offer cyber liability or cyber security insurance for you. Here are just a few of the current top cyber liability insurance providers.

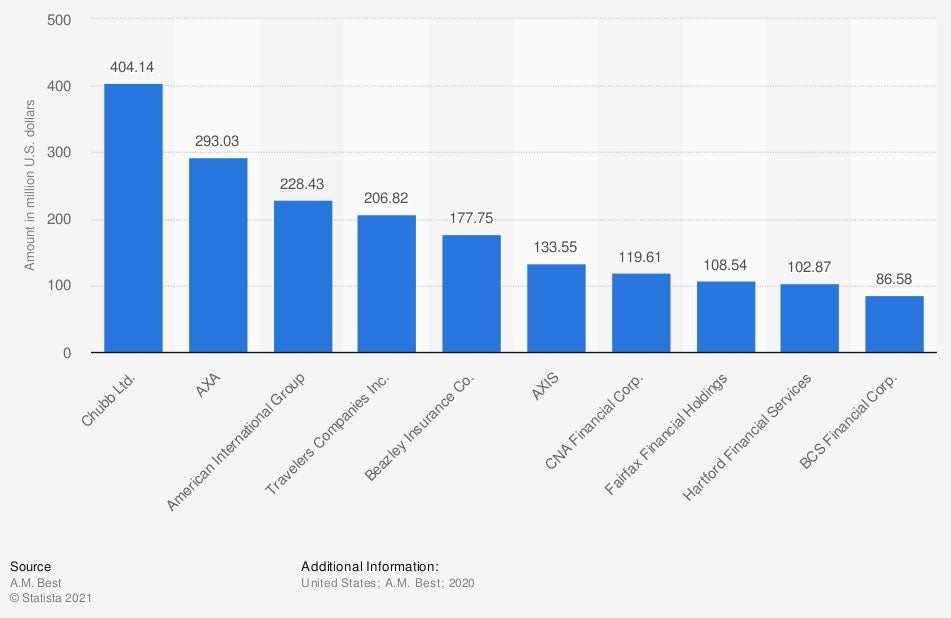

Leading insurance companies in the United States, by value of direct cyber security premiums written (in million US dollars)

The current top cyber liability insurance company is Chubb, with a total of $404.14 million in premiums written. Next highest is AXA ($293.03 million), and then American International Group ($228.43 million). Travelers Insurance ranks fourth, at $203.82 million in premiums written.

A Florida independent insurance agent can help you find cyber liability insurance from one of these companies, if their policies best meet your needs.

Are My Employees a Cyber Breach Risk?

Yes, your employees are at risk of a cyber breach any time they use your business’s computer system or internet. Even something as simple as swiping a customer’s credit card when taking payment can place your business, customers, and employees at risk.

One of the biggest concerns, however, involves your employees’ company email. If an employee clicks on a bad link or opens a phishing email, it could compromise not only their information, but also your entire business’s security. That’s why having cyber liability insurance is critical.

What Can I Do to Improve the Security of My Company?

Fortunately there are several proactive steps you can take to protect your business from cyberattacks and data breaches, and many of them are relatively simple. Follow this checklist today to start protecting your business from cyber threats.

- Train your employees: It’s important to train your employees to practice safe browsing when using the company network, to know how to spot phishing emails, and to create strong passwords in order to keep your business and entire team safe.

- Use a secure network: Make sure your business has a firewall and uses an encrypted, secure Wi-Fi network.

- Use multi-factor authentication: If possible, set up your company’s system to require multi-factor authorization for various logins, such as having a code sent to staff email.

- Update your antivirus software: It’s not enough to just have antivirus software installed, it’s imperative to ensure you also update it on a regular basis.

The more proactive you are in safeguarding your company against cyberattacks and other digital threats, the less chance you’ll have to actually use your cyber liability insurance.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in cyber liability insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/729614/leading-insurers-usa-by-direct-cyber-security-premiums-written/

https://www.kaspersky.com/resource-center/definitions/what-is-cyber-security

https://www.sba.gov/business-guide/manage-your-business/stay-safe-cybersecurity-threats

© 2024, Consumer Agent Portal, LLC. All rights reserved.