If you're a landscaping company in Florida, there's a chance you're busy all year round. When the weather participates, it can be good for business. Florida commercial insurance is the key to protecting your livelihood and running a smooth operation.

Fortunately, a Florida independent insurance agent can help you find coverage that's affordable and sufficient. They'll even do the shopping for you for free. Get connected with a local expert for tailored quotes today.

What Is Landscaping Business Insurance?

Your Florida landscaping business will need a variety of coverages for full protection. Check out standard insurance options for landscapers below:

- General liability: This pays for bodily injury and property damage claims filed against your business.

- Business umbrella: When a liability claim exhausts your underlying limits, this policy will kick in with more coverage.

- Workers' compensation: If an employee gets injured or becomes ill while on the job, this policy pays for any medical expenses and lost wages.

- Commercial auto: When an accident or damage occurs to a company vehicle, this policy will foot the bill.

- Business property: This policy pays for the replacement or repair of any property owned by the business.

- Business equipment breakdown: This pays for your business-owned equipment when it breaks down and needs repair or replacement.

What Does Landscapers Insurance Cover in Florida?

Fire, theft, vandalism, and severe weather are all standard policy coverages included in your landscaping insurance. While every operation will need limits specific to them, all companies will have foundational policies.

Common losses that your Florida landscapers insurance will cover:

- Coverage for claims of bodily injury or property damage

- Coverage for business property and equipment in transit

- Coverage for hazardous chemicals used

- Coverage for your business inventory such as products

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

What Doesn't Landscapers Insurance Cover in Florida?

All landscaping policies will have some exclusions that could apply. Below are a few coverages that may not be in your policies at all:

- Drive other car insurance: This can generally be added to your commercial auto policy but is not automatic. It would give a dollar amount of coverage towards another vehicle that the owner or the owner's family members rented or used that isn't already on their policy.

- Employment practices liability insurance: This coverage is not included but can usually be added. It would help pay for a discrimination lawsuit filed by an employee.

- Employee vehicles: If you allow your employees to use their cars when going from job site to job site, there isn't usually coverage under your policy. It can be added, and should if this is a practice.

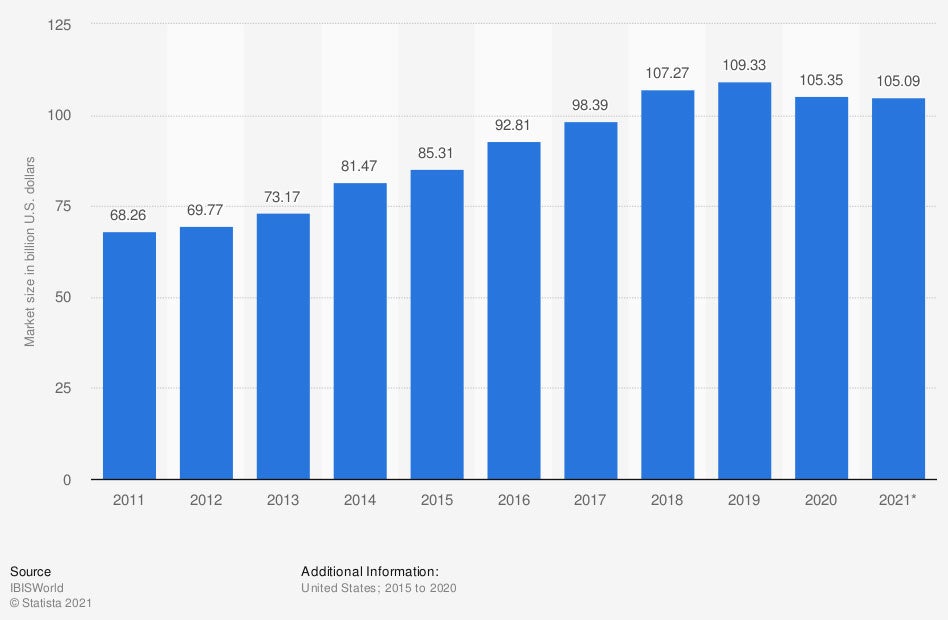

Market size of landscaping services in the US from 2015 to 2020 with a forecast for 2021 (in billion U.S. dollars)

If you're not adequately insured as a business owner, you could open yourself up to a whole lot of financial trouble. To better protect your landscaping business, be sure to review coverage so you're not left in the dark.

What Does Insurance for a Landscaping Business Cost in Florida?

Your Florida landscaping business will have premiums unique to your daily operations. Carriers calculate your costs off of several risk factors. Take a look at what companies consider when quoting:

- Loss history

- If you use chemicals

- If you have employees

- Equipment you own

- Local crime rate

Does My Florida Business Location Impact My Rates?

When your business is mobile, like landscapers, your physical location may not be a factor. The radius in which you travel will be, however. Take a look at what could affect your rates based on your Florida territory:

- Local crime rate

- Local natural disasters reported

- Local claims reported by other insureds

- Flood zone assigned

- Property in-transit

- Radius traveled

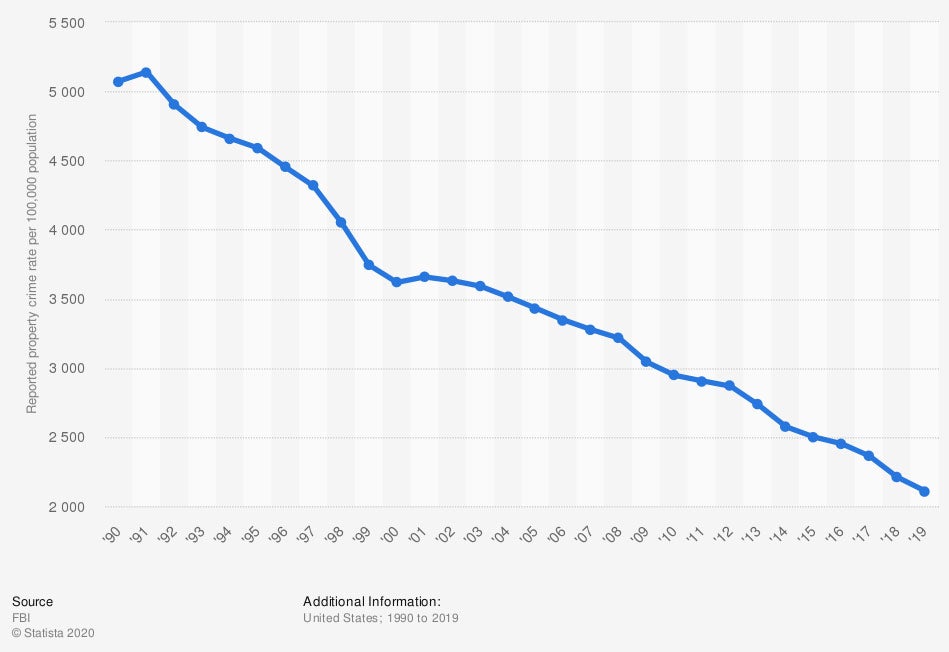

Reported property crime rate in the US from 1990 to 2019

The rate of crime in your area will affect your insurance costs. The safer the city, the better your premiums will be for landscaping insurance.

How an Independent Insurance Agent Can Help in Florida

When you're looking for the best landscaping business insurance in Florida, you're not alone. There are multiple options when it comes to finding coverage and rates that work. Fortunately, a trusted adviser can help you review policy and premium choices for free.

A Florida independent insurance agent works on your behalf at no additional cost to you, making it a no-brainer. Since they have numerous carriers, they have you covered. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/294212/revenue-of-landscaping-services-in-the-us/

https://www.statista.com/statistics/191237/reported-property-crime-rate-in-the-us-since-1990/

http://www.city-data.com/city/Florida.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.