Currently, more than 3.5 million people in Florida are at risk of coastal flooding, and that number is only expected to increase as sea levels rise. Flood insurance can save you from financial devastation should an incident occur, but it's important to know exactly what you'll get with your flood insurance policy.

Flood insurance is a unique federally backed insurance option, so it's best to work with a Florida independent insurance agent to purchase coverage. Here's why Florida residents need this important insurance.

What Does Flood Insurance Cover in Florida?

Flood insurance is purchased from the National Flood Insurance Program and covers buildings up to $250,000 and contents up to $100,000, according to insurance expert Jeffrey Green. You can choose one or both types of coverage in order to protect your home and your belongings.

Flood insurance covers the following property

- Building foundation

- Built-in appliances and refrigerators

- Electrical and plumbing

- Permanently installed carpet

- Window blinds

- Detached garages

- Debris removal

Flood insurance covers the following personal possessions

- Furniture

- Clothing

- Washers and dryers

- Electronics

You can purchase additional flood insurance coverage through private insurers. A Florida independent insurance agent can help you determine if you need more protection.

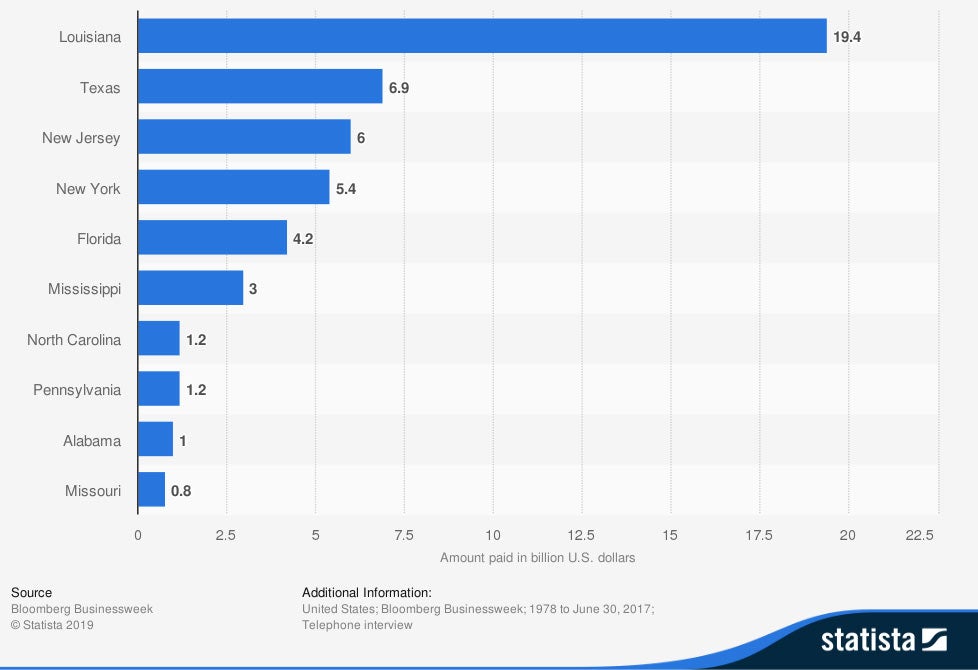

Value of National Flood Insurance Program payments in selected states in the US

In the last several decades, Florida has received the fifth highest amount of NFIP payments.

What Doesn't Flood Insurance Cover in Florida?

The National Flood Insurance Program has guidelines in place for what is considered a flood. According to the NFIP, flooding occurs when two or more acres of normally dry land area, or two or more properties, are inundated by natural waters.

Any flooding caused by non-natural waters would not be covered. This includes:

- Burst pipes

- Sewer backups

- Overflowing bathtubs

- Sprinkler system malfunctions

Florida flood insurance also has exclusions and restrictions for specific furniture and belongings that are in your basement. Your Florida independent insurance agent can provide you a complete list of what is and isn't covered.

How Much Does Flood Insurance Cost in Florida?

Florida has more flood insurance policies than any other state, but the premiums still remain around 19% lower than the national average. The average annual flood insurance premium in Florida is $592 a year.

Of course, this price will fluctuate based on a variety of factors including your location and the amount and type of coverage.

Is Flood Insurance Required in Florida?

Every state has a flood zone map and homes are categorized into low, moderate, or high-risk flood areas. For Florida homes that are located in a high-risk flood zone, mortgage lenders that are providing loans from a federally regulated bank will require flood insurance.

Even if flood insurance is not required, Green suggested that all Florida homeowners have it. "Every home and business owner should consider flood insurance, even if you are in a low-risk area."

Your Florida independent insurance agent can help you understand flood zones in your area.

Top 5 cities at risk of storm surge in Florida

| Cities with homes at risk of storm surge | Number of single-family homes at risk of storm surge |

|---|---|

| Miami, FL | 791,775 |

| Tampa,FL | 465,644 |

| Bradenton, FL | 262,745 |

| Naples, FL | 187,205 |

| Jacksonville, FL | 176,809 |

Does My Florida Car Insurance Cover Flood Damage?

Yes, it is possible to receive coverage for flood damage to your vehicle if you've purchased a Florida comprehensive car insurance policy.

Comprehensive coverage is an optional auto policy that is often referred to as "other than collision." Under this policy, events like hitting an animal or object, hail damage, a tree falling on your car, or damage from flooding would be covered.

Does My Florida Homeowners Insurance Cover Flood Damage?

Your Florida homeowners policy will cover specific types of flood damage. This includes flood damage caused by sudden, accidental events like burst pipes.

Your standard Florida homeowners insurance policy will not cover any flood damage caused by natural waters and severe weather events.

How a Florida Independent Insurance Agent Can Help You

Flood insurance can only be purchased through the NFIP, which partners with specific insurance carriers. A Florida independent insurance agent knows which insurance carriers in the state can write flood insurance policies.

They'll chat with you, free of charge, to determine your risk for flooding and help you determine the amount of coverage to purchase. They'll then secure the proper flood insurance policy for you, long before you need it.

Author | Sara East

Article Reviewed by | Jeffery Green

Top 5 cities: geo data sheet

https://www.floodsmart.gov/how/what-is-covered

https://www.floridadisaster.org/planprepare/flood-insurance/

https://statesatrisk.org/florida/coastal-flooding

© 2024, Consumer Agent Portal, LLC. All rights reserved.