When you’re working on a construction project, whatever its size or scale, there are always several possible catastrophes that could occur. Just one storm could set your project back weeks, or even wipe it out entirely. That’s why it’s so important to get the right builders risk insurance in advance.

Florida independent insurance agents can help you find the builders risk insurance policy that works best for your crew. They’ll get you set up with the coverage you need, long before you ever actually need to use it. But before we get too far ahead of ourselves, here’s a deep dive into this crucial coverage.

What Is Builders Risk Insurance?

Builders risk insurance is a type of Florida property insurance specifically designed to cover construction projects currently in progress. Builders risk coverage reimburses for the current value of that construction project if it’s damaged or destroyed by numerous perils, like fire or natural disasters. This coverage can save you thousands of dollars or even more in the long run, and a Florida independent insurance agent can help you get equipped.

Builders risk insurance is designed to be a short-term coverage that only exists for the lifetime of a construction project. Once the project is complete, the coverage term is, too. Policies are often available for increments of 3, 6, 9, or 12 months. These time frames can vary, though.

What Does Builders Risk Insurance Cover in Florida?

Builders risk insurance is crucial for builders and building owners alike to protect construction projects in the works. Some of the major coverages provided by builders risk policies in Florida are:

- Equipment breakdown coverage: This coverage protects builders’ property and equipment from mechanical breakdowns. It can can cover steam boiler explosions and more.

- Identity restoration coverage: This coverage protects against identity theft of the policyholder.

- Building coverage: This coverage protects the actual building being constructed, as well as structures already completed for the project. Personal property used to maintain the project is also covered.

- Ordinance and law coverage: This coverage protects against increased rebuilding costs due to ordinances or laws that regulate construction of damaged structures.

- Commercial general liability (CGL) coverage: This coverage protects builders against lawsuits filed by third parties for claims of bodily injury, property damage, or advertising injury. CGL insurance is not always included in builders risk policies, though.

A Florida independent insurance agent can further explain the core coverages included in typical builders risk policies.

What Doesn’t Builders Risk Insurance Cover in Florida?

Though builders insurance provides a ton of important protection, it does also come with its own set of exclusions, just like all other coverages. According to insurance expert Paul Martin, some of the main exclusions in builders risk policies are:

- Wear and tear damage

- Acts of terrorism and war

- Employee theft and dishonesty

- Rust and corrosion

- Damage due to faulty design

- Disasters that occur during planning

A Florida independent insurance agent can help you address any concerns you may have about coverage exclusions under builders risk insurance.

What Are the Biggest Risks to Builders and Contractors?

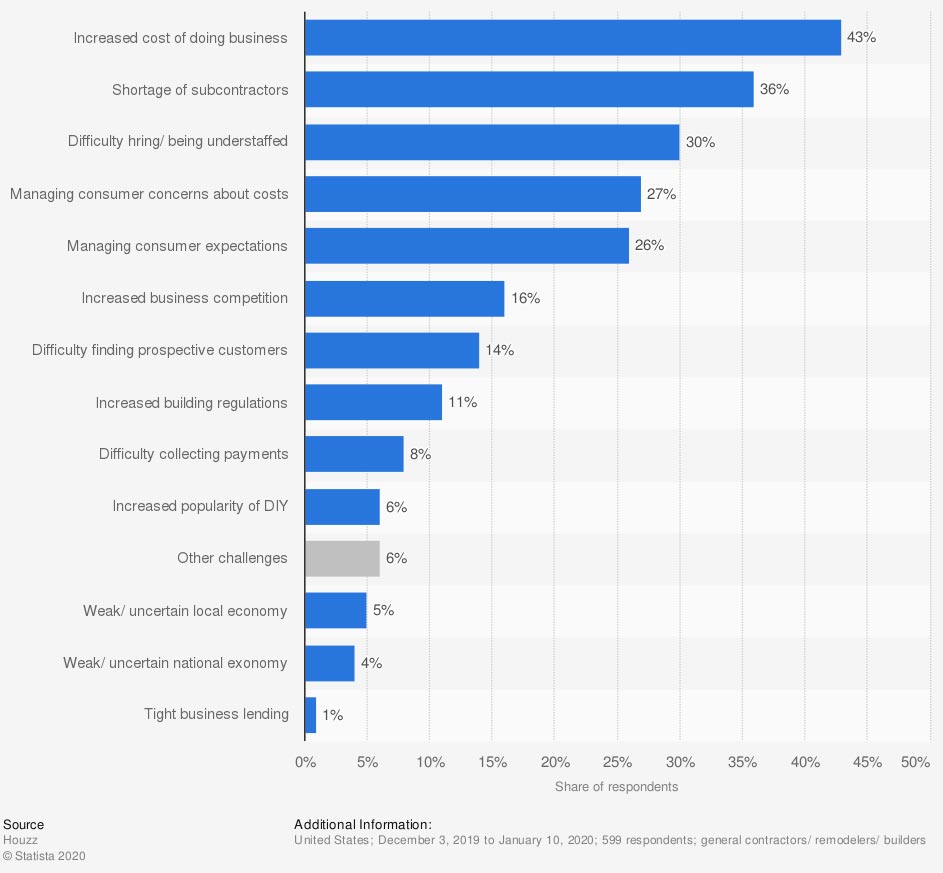

Top business challenges experienced by remodelers, builders and general contractors in the United States in 2019

In 2019, the biggest challenges reported by builders, remodelers, and general contractors in the US were increased costs of doing business, shortages of subcontractors, difficulty hiring, and managing consumer concerns and expectations. Of the surveyed group, 11% said increased building regulations were a top challenge. Fortunately, part of builders risk insurance is designed to cover this risk.

While builders risk insurance can’t cover every major challenge faced by builders of all kinds, it does still offer tons of important protection. Speak to your Florida independent insurance agent about any remaining concerns for your current projects, and they might be able to help you find additional coverage.

How Much Is Builders Risk Insurance in Florida?

According to Martin, the cost of your builders risk policy will vary depending on several factors, one being your exact location. The end value of the project and its specific risk level will also influence your premium rates. The cost of coverage can be lower than other policies, since builders risk insurance is designed to be short-term. Your Florida independent insurance agent can help you find exact quotes and figures for your city.

Do I Need Builders Risk Insurance?

Most likely, if you’re a contractor or other builder working on a construction project. Pretty much any time financing is involved in a building project, the lender will actually require workers to have a builders risk policy before work begins. An exception would be if the builder or building owner funded the entire project themselves. Regardless of the technicalities, though, having a builders risk policy is always a smart choice before construction work starts.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting builders of all kinds against losing projects in progress and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in builders risk insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/918573/remodelers-builders-us-top-business-challenges/

iii.org

irmi.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.