Many churches aren’t just open on Sundays, they’re open every day of the week, and they’ve got numerous activities going on at all times. Without the proper coverage, many different hazards could impact your church’s functions. That’s why it’s so important to be equipped with church insurance.

Fortunately a Florida independent insurance agent can get you set up with the right church insurance for your needs. They’ll also get you set up with all the coverage required long before you need to file a claim. But first, here’s a deep dive into this crucial insurance.

What Is Church Insurance?

Church insurance is just one special form of Florida business insurance that’s designed to protect churches and their unique operations. Church insurance often includes a combination of property coverage and liability coverage. Policies also come with exclusions. A Florida independent insurance agent can help you find the best church insurance for your business’s needs.

What Does Church Insurance Cover in Florida?

Church insurance provides several components of important protection. The coverages in your policy may vary, but according to insurance expert Jeffery Green, these are some of the most common elements found in church insurance:

- General liability insurance: Protects you against claims made against your church by members, volunteers, and other third parties.

- Property insurance: Protects your church’s physical building and contents from disasters like fire, lightning, and more.

- Church-sponsored activities liability insurance: Protects off-site activities your church sponsors, like picnics and sporting events. These are one-off policies and must be purchased separately before each event.

- Daycare and preschool liability insurance: Many churches provide daycare or preschool options. Coverage protects you against lawsuits filed by disgruntled parents.

A Florida independent insurance agent can further explain what’s included in church insurance and why it’s so important to have coverage.

What Other Coverages Does My Church Need in Florida?

Depending on your policy, your church insurance may or may not include these important coverages. However, they are highly recommended to provide additional protection for your institution.

- Religious freedom insurance: Protects your church from discrimination suits.

- Ministers and pastors liability insurance: This coverage is essential for every religious organization and offers spiritual counseling liability protection. Coverage often extends to clergy, church leadership, and paid or non-paid sanctioned volunteers.

- Employee practices liability insurance: If an employee sues your church for sexual harassment, discrimination, or wrongful termination, this coverage will reimburse for the financial ramifications.

- Ordinance or law insurance: Coverage is important for churches more than 20 years old, to help bring your building up to current code if necessary.

An independent insurance agent will help your church get equipped with all the additional protections it requires to maintain smooth operations.

Church Stats for Florida

When considering the importance of church insurance, it’s helpful to know just how high of a percentage of the public belongs to a church. Check out some stats for church membership in the US overall and see for yourself.

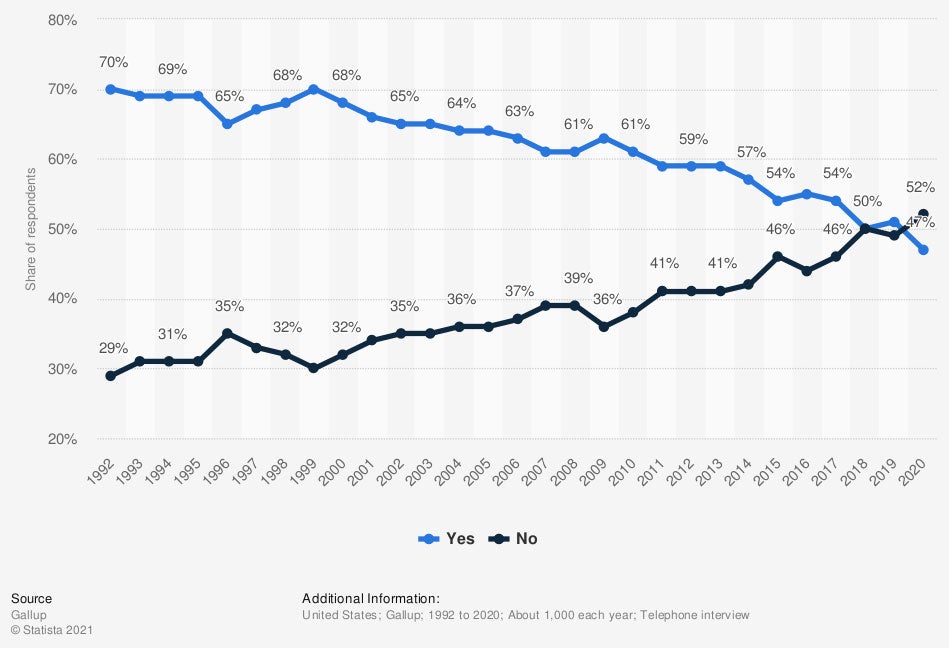

Do you happen to be a member of a church or a synagogue?

Church membership has declined quite noticeably over the past couple of decades, from 70% of the US population at its highest point, to just 47% in recent years. However, that’s still nearly half of the US population that reports belonging to a church or synagogue.

With church membership still so common, it’s crucial to make sure your institution, and its members, are adequately protected.

How Much Is Church Insurance in Florida?

The cost of your church insurance will vary based on several factors. You’ll want to review these with your independent insurance agent to determine how your premiums will be impacted.

- Your church’s location

- Your church’s size

- Your church's exposures

- Your church’s property age and value

- Your church’s staff size

The general liability coverage portion of church insurance’s cost can range from $500 to $1,500 annually. But that’s just one aspect of the entire policy. An independent insurance agent can help you find exact church insurance quotes for your area, as well as find any applicable discounts for you.

Where Can I Buy Church Insurance?

The availability of church insurance may depend on the specific town you live in. However, these are some of our top picks for church insurance carriers:

- Famers Insurance

- Progressive

- Nationwide

- Brotherhood Mutual

- GuideOne

An independent insurance agent can help you decide if the church insurance provided by any of these insurance companies is right for you.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in church insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

https://www.statista.com/statistics/245485/church-membership-among-americans/

https://www.irmi.com/whats-new/product-update/churches-and-religious-institutions-exposures-and-risk-management-discussions-pli

© 2024, Consumer Agent Portal, LLC. All rights reserved.