When you run a bakery, you’ve got to keep lots of things in mind beyond the perfect temperature and cook time of the treats you sell. Just like any other business, bakeries have to be protected against risks like theft, fire, and more. That’s why having the right bakery insurance is so critical.

Luckily a Florida independent insurance agent can help your bakery get set up with all the coverage it needs to maintain smooth operations. They’ll also get you covered before you ever have to file a claim. But before we get too far ahead of ourselves, here’s a breakdown of this important coverage.

What Is Bakery Insurance?

Bakery insurance is basically one specific form of Florida business insurance, designed to cover the risks of bakeries. Bakery insurance combines the basics of business insurance, like liability coverage and property coverage, along with more niche protections needed by bakeries. A Florida independent insurance agent can help you find the right policy for your bakery.

What Does Bakery Insurance Cover in Florida?

Though bakery insurance provides a lot of business insurance basics, your policy may vary slightly. Here are some of the core coverages you can often expect to find in bakery insurance.

- Commercial liability insurance: Coverage is necessary to protect your business from third-party lawsuits.

- Workers’ compensation: Coverage is necessary to protect your business against employee illness or injury on the job.

- Spoilage: Coverage is necessary to protect your business against losses due to spoiled ingredients, such as from a power outage.

- Commercial property insurance: Coverage is necessary to protect your bakery’s physical property and inventory from disasters like fire and more.

- Cyber liability: Coverage is necessary to protect your business against data breaches and other digital threats that could compromise sensitive information, like credit card numbers.

With the help of a Florida independent insurance agent, your bakery can get equipped with all the important protection it deserves against numerous threats.

What Doesn’t Bakery Insurance Cover in Florida?

Though your bakery insurance policy provides a ton of critical protection, it also comes with a set of exclusions. According to insurance expert Paul Martin, common coverage exclusions under bakery insurance are:

- Routine maintenance

- Pollution

- Robbery

- Lost inventory

- Nuclear/war damage

- Flood/earthquake damage

For bakeries in Florida, it’s important to look into adding a separate flood insurance policy to protect your business against natural floodwater damage. Your Florida independent insurance agent can help you find coverage.

Bakery Industry Stats

Before embarking on your search for the proper coverage, it’s helpful to know a bit about your industry as a whole. Check out some stats for the bakery industry in the US below.

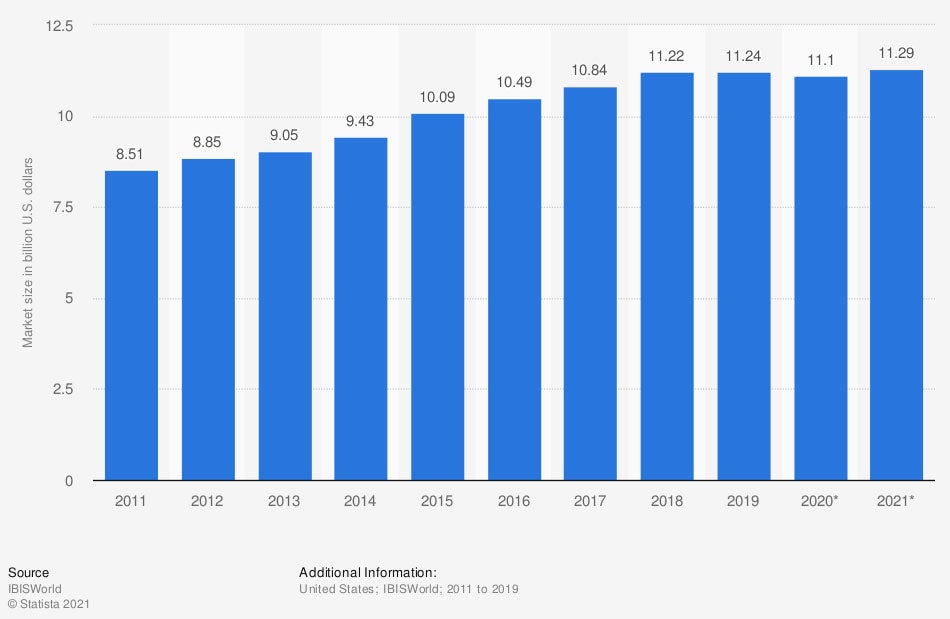

Market size of the bakery café sector in the US (in billion US dollars)

The market size of the bakery industry has grown considerably over the past decade, and is projected to grow even further in coming years. At the beginning of the observed period, the bakery industry amounted to $8.51 billion. In the next couple of years, this total is projected to rise to $11.29 billion.

With the bakery industry continuing to become more profitable over time, it’s all the more important to ensure that yours is adequately protected.

Do I Need Valuable Items Coverage?

For a bakery, no, you shouldn’t need valuable items coverage. Martin said that owners of jewelry stores and other retailers that handle expensive property might require additional protection.

But the ingredients and equipment used in your bakery should be adequately protected by the coverages in your bakery insurance package. A Florida independent insurance agent can further discuss any concerns you may have with you.

How Much Is Bakery Insurance in Florida?

The cost of your bakery insurance will depend on a number of different factors. Your specific location will influence the cost of your premiums, along with several other things, like:

- The size of your bakery

- Your bakery’s specific operations

- Your bakery’s risky equipment

- The number of employees you have

- The value of your bakery’s property

If your bakery is located along the coast of Florida, you might pay quite a bit more for your coverage than those located further inland, due to the higher risk of storms like hurricanes. A Florida independent insurance agent can help find exact quotes for bakery insurance near you.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in bakery insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/1175807/bakery-cafe-industry-market-size-us/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

https://www.iii.org/article/small-business-insurance-basics

© 2024, Consumer Agent Portal, LLC. All rights reserved.