Clothing stores may not seem too inherently risky, but like all other businesses, there are many unforeseen hazards that need to be anticipated from the beginning. Owners of successful clothing stores need to keep the safety of their property, inventory, staff, and customers in mind at all times. That’s why having clothing store insurance is so important.

Luckily a Florida independent insurance agent can help you find the right kind of clothing store insurance for your needs. They’ll also get you equipped with this protection before you ever need to use it. But before we jump too far ahead, here’s a closer look at this important coverage.

What Is Clothing Store Insurance?

Clothing store insurance is one type of Florida business insurance catered to meet the niche needs of clothing stores. Coverage includes protection for business property and inventory, along with liability and more. Your specific clothing store’s needs may vary from others, which is why it’s a good idea to shop for coverage with the help of a Florida independent insurance agent.

What Does Clothing Store Insurance Cover in Florida?

Though your clothing store policy may vary, there are several basic protections required by most businesses. The core of your clothing store insurance policy is likely to include:

- Business income insurance: Protects your business against covered closures that could lead to lost employee wages or company revenue.

- Commercial general liability insurance: Protects your business against lawsuits filed by third parties for claims of personal property damage or bodily injury.

- Commercial property insurance: Protects your business’s structure and probably its inventory from disasters like storm damage, fire, and more.

- Workers’ comp: Protects your business against cases of employee injury, illness, or death due to work-related activities.

- Cyber liability insurance: Protects your business against data breaches and other cyberattacks that could lead to lost revenue, lawsuits, and more.

Your Florida independent insurance agent can help ensure that your clothing store gets set up with all the coverage it needs.

What Doesn’t Clothing Store Insurance Cover in Florida?

While clothing store insurance provides a ton of critical basic protection for your business, it also comes with listed non-covered events. According to insurance expert Paul Martin, many clothing store insurance policies are likely to exclude:

- Routine maintenance fees

- Nuclear or war damage/destruction

- Dishonesty by employees

- Earthquake and flood damage

Martin noted that it’s extra-important for clothing stores in Florida to consider adding a flood insurance policy to protect against natural flood damage, since the state is prone to hurricanes. Your regular clothing store insurance won’t cover damage caused by natural floodwaters.

Clothing Store Stats for the US

It might be helpful to know how the clothing industry overall performs before you start shopping for coverage. Check out these recent stats for clothing stores in the US and factor them in to your search.

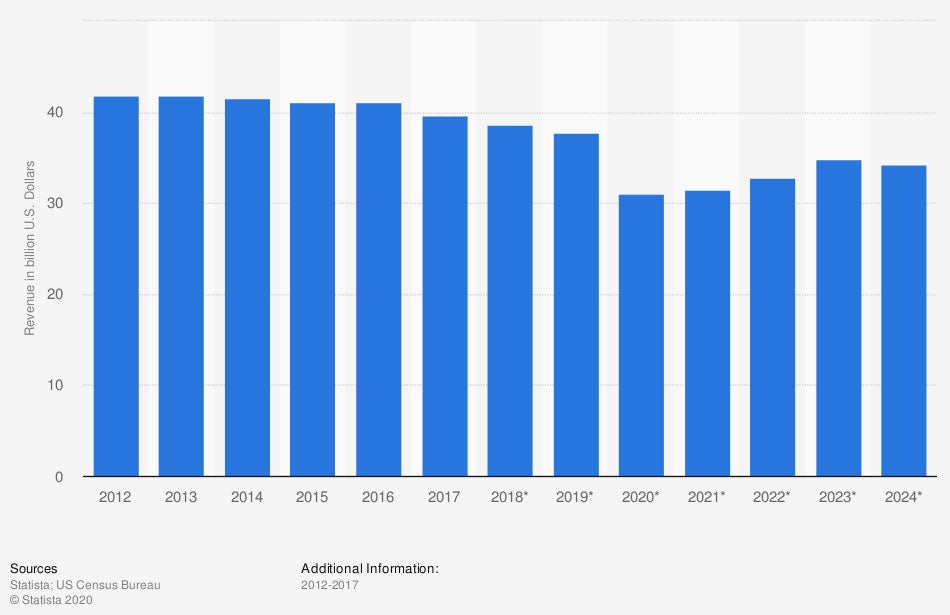

Industry revenue of “women’s clothing stores” in the US (in billion US dollars)

Clothing store revenue in the US has fallen a bit in recent years. At the beginning of the observed period, revenue of women’s clothing stores totaled $41.79 billion. In the coming years, industry revenue for US women’s clothing stores is projected to total $34.27 billion.

Since clothing stores remain a multibillion-dollar industry, it’s imperative that yours gets set up with the right Florida clothing store insurance, ASAP.

How Much Does Clothing Store Insurance Cost in Florida?

While it’s not easy to offer a ballpark figure for the cost of clothing store insurance in Florida, there are several factors that often go into calculating the cost of your premiums. It's important to be familiar with these factors before you buy your coverage.

Martin said that the following often influence the cost of clothing store insurance:

- Business’s size

- Business’s annual revenue

- Business’s property values

- Business’s number of employees

- Business’s operations and risks

Your Florida independent insurance agent can provide exact quotes and figures for the cost of clothing store insurance in your area.

Will My Location Impact My Rates?

Yes, like most coverages, the cost of your clothing store insurance will be affected by your exact location. Martin said that clothing stores located close to Florida coasts could pay 15% more than stores located further inland due to the increased risk of hurricanes and other storms.

If your clothing store is located in Miami or another big city, you’re also likely to pay quite a bit more than stores in smaller towns. Your Florida independent insurance agent can provide you with more information about how your location impacts your premium rates.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in clothing store insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/forecasts/311114/women-s-clothing-stores-revenue-in-the-us

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

https://www.iii.org/article/small-business-insurance-basics

© 2024, Consumer Agent Portal, LLC. All rights reserved.