Owners of coffee shops have to be even more alert than their caffeinated customers, in order to keep their business guarded from numerous risks. From theft to fire damage and beyond, coffee shops need unique protection designed just for them. That means having the right coffee shop insurance.

Luckily a Florida independent insurance agent can help your coffee shop get set up with enough coverage to get the job done right. You’ll walk away with all the protection you need to maintain smooth operations. But before we jump too far ahead, here’s a deep dive into this important coverage.

What Is Coffee Shop Insurance?

Essentially a special form of Florida business insurance, coffee shop insurance is set up to protect coffee shops and their owners from several specific risks. Coffee shop insurance is a convenient package that bundles the basics of business insurance, like property and liability coverage, with more niche-centered coverages needed by coffee shops. A Florida independent insurance agent can help you find the right package for your business.

What Does Coffee Shop Insurance Cover in Florida?

No two coffee shop insurance policies may be exactly the same, but you can expect to find several core coverages in your package, like:

- Product liability coverage: Protects your business from the cost of unexpected product recalls, such as ingredients used to make your drinks or snacks.

- Spoilage: Protects your coffee shop from ingredients that go bad due to covered losses like a power outage.

- Commercial property insurance: Protects your business’s property from accidental microwave fires, lightning strikes, and more.

- Commercial liability insurance: Protects you from lawsuits filed by customers or other third parties.

- Workers’ compensation: Protects you against suits relating to employee injury or illness on the job.

- Cyber liability: Protects your coffee shop from cyberattacks, breaches, etc. that compromise your electronic data like customer credit card numbers.

A Florida independent insurance agent will help you assemble a coffee shop insurance package that best meets your business’s unique needs.

What Doesn’t Coffee Shop Insurance Cover in Florida?

While your business gets a lot of important protection from coffee shop insurance, it’s not covered from absolutely everything under the sun. According to insurance expert Paul Martin, common coverage exclusions are:

- Flood and earthquake damage

- Pollution

- Robbery

- Nuclear or war damage

- Routine maintenance costs

- Lost inventory

You might want to ask your Florida independent insurance agent about adding a flood insurance policy to your coffee shop insurance. Regular business insurance does not protect against natural flood damage to your property.

Coffee Shop Stats

Before calling up your Florida independent insurance agent to shop for the right coffee shop insurance, it’s helpful to know a bit about your industry. Check out these stats for the coffee industry in the US.

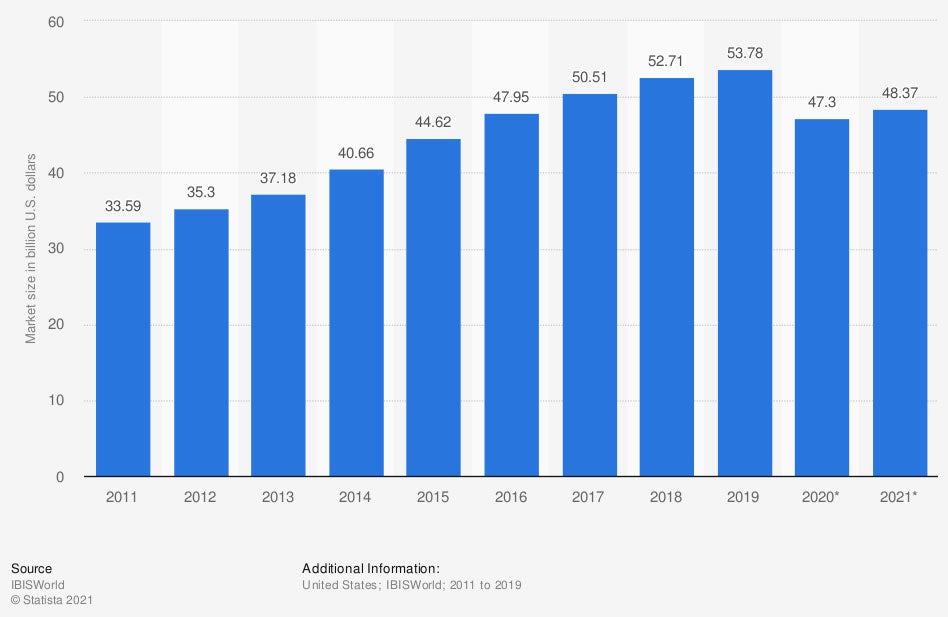

Market size of the coffee and snack shop sector in the US (in billion US dollars)

The market size of the coffee shop industry has grown over the years. At the beginning of the observed period, the coffee and snack shop sector had a reported $33.59 billion in revenue. In the coming years, this number is projected to grow substantially, to $48.37 billion.

Knowing that coffee shops are becoming more profitable over time, it’s all the more important to make sure yours is covered with the right protection.

Do I Need Valuable Items Coverage?

You shouldn’t need valuable items coverage for any of the equipment or inventory in your coffee shop. If you were running a jewelry store, you might need to add another type of special protection to your coverage.

But the ingredients used to make your coffee and other snacks most likely don’t need any additional coverage. A Florida independent insurance agent can provide you with more information.

Will My Location Impact My Rates?

As with many kinds of coverage, yes, your specific location will impact your coffee shop insurance rates. Martin said that you could pay quite a bit more for your coverage if your coffee shop is located close to one of the coasts of Florida, due to the increased threat of storm damage.

You might also pay more for your coverage if you’re located in a larger city. A Florida independent insurance agent can help find exact quotes for coffee shop insurance near you.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in coffee shop insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/1174179/coffee-and-snack-shop-market-size-us/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/specific-coverages/property-insurance

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

© 2024, Consumer Agent Portal, LLC. All rights reserved.