Donut shops are notorious for bringing joy to the public. But in order to provide customers with those tasty treats, the business’s operations, staff, property, and more have to be protected behind the scenes. That’s why having the right donut shop insurance is so important.

Luckily a Florida independent insurance agent can help your donut shop get equipped with all the coverage it needs to keep its doors open for many years to come. They’ll also get you set up with coverage way before you need to file a claim. But until then, here’s a deep dive into donut shop insurance.

What Is Donut Shop Insurance?

Donut shop insurance is basically a specialized form of Florida business insurance designed to protect the owners of donut shops. A convenient and affordable insurance package, donut shop coverage protects your business against numerous disasters, including fire damage, lost income, and much more. A Florida independent insurance agent can help you get equipped with the right protection for you.

What Does Donut Shop Insurance Cover in Florida?

While your policy may vary, there are several basic coverages commonly found in donut shop insurance packages. You’ll want to work together with a Florida independent insurance agent to get set up with all the protection you need, but here are some of the core coverages you should look for.

- Commercial property insurance: This coverage protects your donut shop against physical property damage caused by fire, lightning strikes, and more.

- Commercial liability insurance: This coverage protects your donut shop against lawsuits filed against you by third parties for claims of personal property damage or bodily injury caused by your business, or on the premises.

- Workers’ compensation: This coverage protects your employees from injury, illness, and death on the job.

- Cyber liability: This coverage protects your business against data breaches and other cyber security issues.

- Employment practices liability: This coverage reimburses costs relating to employee lawsuits if they sue your business for claims of harassment, etc.

- Product liability coverage: This coverage reimburses fees relating to any ingredients your donut shop uses that may be recalled.

Your Florida independent insurance agent will work together with you to build the donut shop insurance package that provides the right blend of coverages for your needs.

What Doesn’t Donut Shop Insurance in Florida?

Though donut shop insurance provides a ton of critical protection for your business, it doesn’t cover just anything. According to insurance expert Paul Martin, these are some of the most common exclusions:

- Inexplicably lost inventory

- Robbery

- Pollution

- Routine maintenance fees

- Nuclear reaction and war

- Earthquake or flood damage*

*Because Florida is commonly prone to flood-related disasters like hurricanes, it’s critical to talk to your Florida independent insurance agent about adding separate commercial flood coverage for your business.

Donut Shop Stats

Ever wondered how much of an impact donut shops make on the US economy? Check out the stats below and see for yourself.

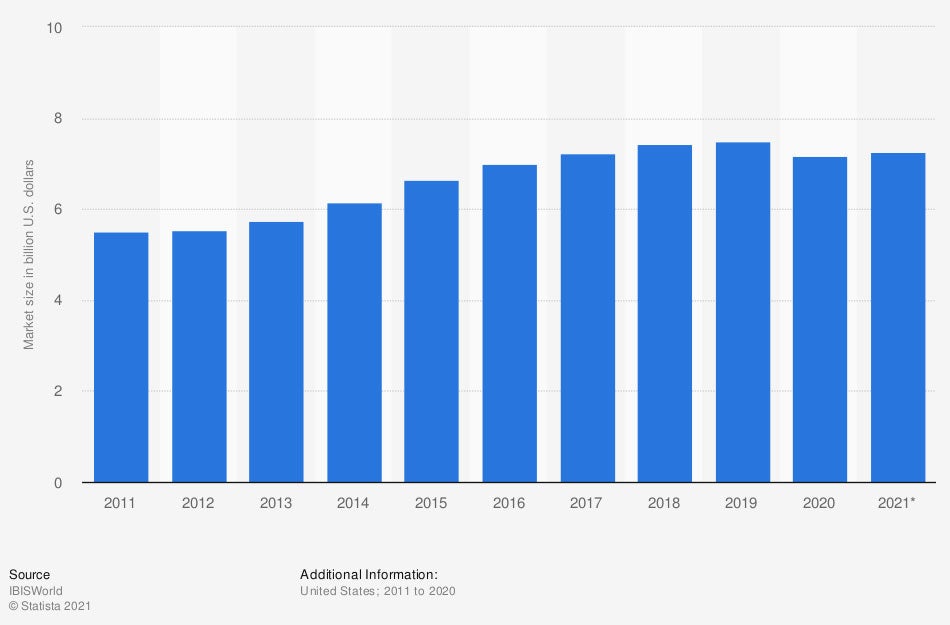

Market size of the donut store sector in the United States (in billion US dollars)

The market size of donut shops across the US has grown quite a bit over the years. At the start of the last decade, donut shops produced $5.51 billion in annual revenue. Just 10 years later, donut shops accounted for $7.16 billion in annual revenue. The market size of the donut shop industry is projected to increase considerably in coming years.

How Much Is Donut Shop Insurance in Florida?

The cost of your donut shop insurance in Florida will depend on several different factors, including your exact location. Here are just a few of the common aspects that affect the cost of your coverage.

- The size of your business

- Your business’s annual revenue

- The number of employees you have

- Your business’s risk level

- Your business’s history of claims

A Florida independent insurance agent can help you find exact quotes for donut shop insurance near you.

Will My Location Impact My Rates?

Yes, your specific location will impact your donut shop insurance rates. Premiums can be influenced by the size of your town, since bigger cities like Miami tend to be more prone to crime, and also have higher property values than other towns. Also, if you’re located along one of the coasts of Florida, you might also pay up to 15% more for your coverage due to the increased risk of hurricane damage to your business.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in donut shop insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

stats - https://www.statista.com/statistics/962392/doughnut-store-market-size-in-the-us/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

© 2024, Consumer Agent Portal, LLC. All rights reserved.