When you run a hobby store, you’ve got to be aware of numerous potential dangers on a daily basis, including threats to your customers and your business alike. Fortunately having the right coverage can seriously help cushion the blow of many disasters. That means having adequate hobby store insurance.

Florida independent insurance agents can help you find the right kind of hobby store insurance for your unique business. Even better, they’ll get you equipped with the proper coverage long before you ever need to actually use it. But before that, let’s take a deep dive into this important coverage.

What Is Hobby Store Insurance?

Hobby store insurance is just one special kind of Florida business insurance, tailored to meet the needs of hobby store owners. Coverage comes with the basics of a business insurance package, and then gets topped off with several protections unique to hobby stores. Because of this, policies may vary slightly between each hobby store. When hunting for coverage, a Florida independent insurance agent is your greatest ally to get the job done right.

What Does Hobby Store Insurance Cover in Florida?

Your hobby store insurance policy will vary depending on your specific business’s operations and needs. However, there are many common core coverages included in most business insurance packages. You can expect to see the following coverages in your hobby store insurance for starters:

- Commercial property: Your hobby store’s office or other buildings need coverage as well as the contents inside, such as products and inventory, against disasters like theft, fire, etc.

- Workers’ compensation: Your hobby store’s staff also need coverage against job-related injury, illness, or death.

- Commercial general liability: Your hobby store is vulnerable to lawsuits from third parties for claims of bodily injury or personal property damage. This coverage reimburses for legal fees in the event of a lawsuit.

- Business income: Hobby stores also need coverage for lost income and wages during temporary closures due to covered perils like certain natural disasters, falling objects, etc.

A Florida independent insurance agent can further explain the basic coverages offered in most hobby store insurance packages, and how they benefit your business.

Extra Coverages Necessary for Hobby Stores in Florida

According to insurance expert Paul Martin, once you’ve got the basics of business insurance squared away in your hobby store policy, you’ll then add the unique protections needed for your company. These extra coverages often can include:

- Cyber liability insurance: Your hobby store probably stores a lot of important data electronically, leaving it vulnerable to hackers and data breaches. That’s why cyber liability insurance is so important for all businesses today.

- Commercial umbrella insurance: If your hobby store faces a hefty lawsuit, you might blow through the liability coverage limits provided by your general liability insurance. Commercial umbrella insurance can increase these limits up to $1 million or more.

- Commercial auto insurance: Your hobby store’s vehicle fleet needs its own protection against theft, vandalism, storm damage and more. Your personal Florida auto insurance will not cover business vehicles.

- Crime insurance: Your hobby store also needs this critical protection against employee or third-party theft of its income.

With the help of your Florida independent insurance agent, you’ll assemble a complete hobby store insurance package that meets all your business’s needs.

Hobby Store Business Stats

It’s helpful to know which types of stores benefit from having the most business insurance coverage, due to their risk level. Check out some stats for hobby stores in the US to better gauge the level of protection your unique business requires.

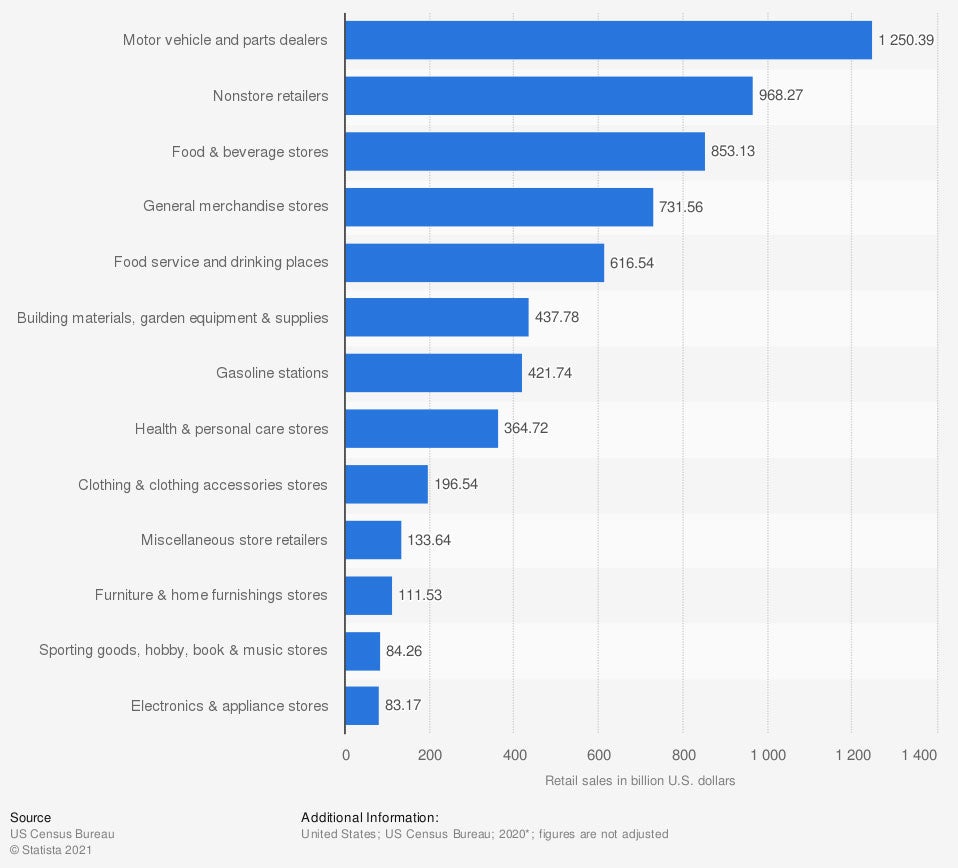

Annual retail sales in the United States in 2020, by store type (in billion US dollars)

In 2020, motor vehicle and parts detailers generated $1.25 trillion in revenue. Food and beverage stores brought in $853.13 billion, and general merchandise stores brought in $731.56 billion. Hobby stores, along with sporting goods stores and music stores, came in near the bottom of the list, raking in $84.26 million in revenue.

A Florida independent insurance agent can help your hobby store get equipped with the appropriate amount of coverage for its specific risk level.

What Doesn’t Hobby Store Insurance Cover in Florida?

Like any other type of insurance, hobby store coverage comes with its own set of excluded perils. Martin said the most common coverage exclusions for hobby store insurance are:

- Nuclear or war damage

- Employee dishonesty

- Routine maintenance

- Flood damage

- Earthquake damage

For hobby stores in the coastal state of Florida, it’s important to consider adding a separate flood insurance policy to cover against related damage. Your Florida independent insurance agent can help you find the coverage you need, since regular business insurance does not cover natural flood damage.

How Much Does Hobby Store Insurance Cost in Florida?

Though some hobby stores could pay only a couple hundred dollars each year for their coverage, others could pay several thousand or even more. The price of your policy will depend on several factors, such as:

- The size of your business

- The number of employees you have

- Your business’s unique risks

- Your business’s annual revenue

- Your specific location

Your Florida independent insurance agent can further list the factors that influence the cost of your hobby store's insurance, and even find exact quotes for your area.

Will My Location Affect My Hobby Store Insurance Rates?

Yes, as is true with most types of insurance, your exact location influences your hobby store coverage rates. If your hobby store is along one of the Florida coasts, coverage could be up to 15% more expensive than for stores further inland, due to increased risk of damage from hurricanes, etc.

Also, hobby stores in bigger, more expensive, and more dangerous cities, such as Miami, could pay quite a bit more for coverage. Big cities often have higher costs for property coverage and increased threats of crimes like theft and vandalism. Your Florida independent insurance agent will help find rates for your specific location.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting hobby store owners against liability risks, property damage, and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in hobby store insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/289776/us-retail-annual-sales-store-type/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/small-retail-stores

https://www.irmi.com/term/insurance-definitions/retail-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.