Jewelry stores are some of the riskier retailers on the market. With such high-value products for sale and on display, jewelry stores are tempting targets for thieves and more. It’s imperative to keep your inventory, along with the rest of your business, protected at all times. That means having jewelry store insurance.

Fortunately a Florida independent insurance agent can help your jewelry store get equipped with all the coverage it needs to maintain smooth operations. They’ll also get you set up with this protection long before you ever have to file a claim. But first, here’s a deep dive into this important coverage.

What Is Jewelry Store Insurance?

A specific type of Florida business insurance, jewelry store insurance exists to protect jewelry stores and their owners against numerous risks, including property damage, theft, and more. Coverage includes the basics of business insurance, and is then customized to meet the needs of your specific store. A Florida independent insurance agent can help your business get set up with the right combination of coverages for you.

What Does Jewelry Store Insurance Cover in Florida?

The thing about jewelry store insurance is that it’s highly customizable, so your policy may vary slightly from the coverages listed below. But according to insurance expert Paul Martin, you can often expect to find the following protections under Florida jewelry store insurance:

- Crime insurance: Protects your business against fraud, forgery, counterfeiting, and other crimes that could serious harm your profits and reputation.

- Commercial property insurance: Covers your business’s physical property from many disasters like fire, lightning, etc.

- Cyber liability insurance: Covers your business for costs associated with cyberattacks and data breaches.

- Business income insurance: Covers your business for various closures that could otherwise lead to gaps in revenue and employee wages.

- Commercial general liability insurance: Covers your business against costly third-party lawsuits.

- Workers’ comp: Covers your business against suits related to employee injury, illness, or death caused by the business.

With the help of a Florida independent insurance agent, your jewelry store can get equipped with all the protection it deserves.

What Doesn’t Jewelry Store Insurance Cover in Florida?

Martin said that the coverage exclusions in your jewelry store insurance policy may vary, but in general, there are a few perils not covered by many types of business insurance in Florida.

Your jewelry store insurance will probably exclude:

- Earthquake damage

- Flood damage

- Dishonest acts by staff

- Nuclear damage

- War damage

You might want to work together with your Florida independent insurance agent to add a separate flood insurance policy to your jewelry store insurance. Business insurance does not cover damage caused by natural water sources like hurricanes, which Florida is prone to.

Jewelry Store Stats for the US

Before you start shopping around for jewelry store insurance, it’s a good idea to become familiar with your industry as a whole. Check out some stats for jewelry store sales in the US below.

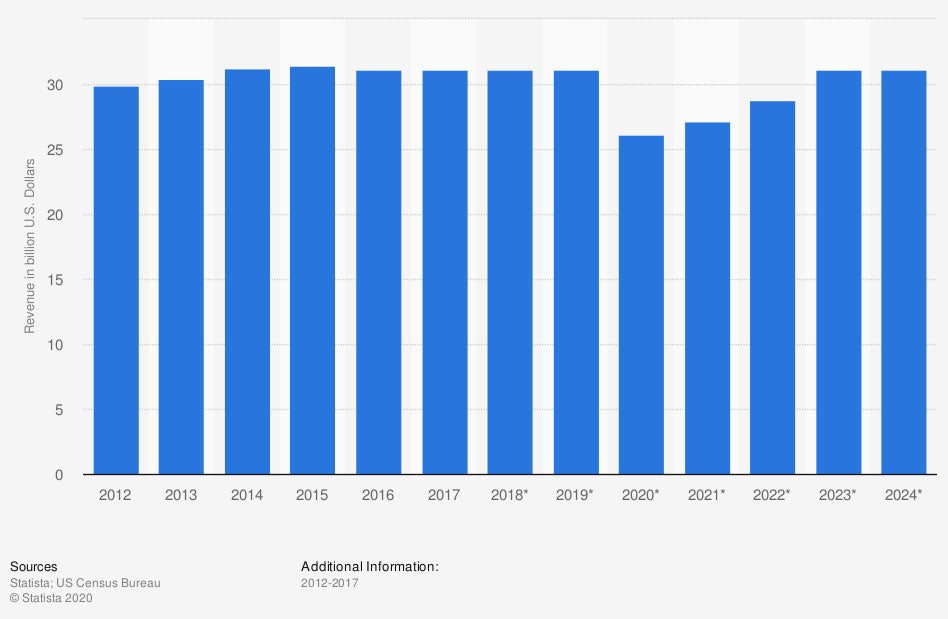

Industry revenue of “jewelry stores” in the US (in billion US dollars)

The industry revenue of jewelry stores in the US is actually projected to grow in the coming years. In the beginning of the observed period, annual revenue from jewelry stores totaled $29.86 billion. Within the coming years, this total is projected to increase, to $31.11 billion.

With jewelry store sales on the rise, it’s all the more important to make sure yours is protected by adequate coverage now.

How Much Is Jewelry Store Insurance in Florida?

Martin said that price ranges for jewelry store insurance in Florida can be difficult to predict. However, there are a handful of factors that tend to always influence the cost of your premiums. These include:

- The size of your jewelry store

- The number of employees your jewelry store has

- The value of your jewelry store’s property and inventory

- Your jewelry store’s annual revenue

- Your jewelry store’s risks and operations

Quotes for jewelry store insurance in your area can be provided by a Florida independent insurance agent.

Do I Need Valuable Items Coverage?

Since jewelry stores stock and handle particularly costly products, it’s imperative they have special protection, which is not provided by basic business insurance. Jewelers block insurance is basically a form of inland marine insurance tailored to protect against damage to or loss of the jewelry in jewelry stores.

This coverage is crucial for all Florida jewelry stores. A Florida independent insurance agent can help you get covered.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in jewelry store insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/forecasts/311117/jewellery-stores-revenue-in-the-us

https://www.irmi.com/term/insurance-definitions/jewelers-block-insurance

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/small-retail-stores

© 2024, Consumer Agent Portal, LLC. All rights reserved.